LIVE UPDATES: How new Trump tariffs will upend seafood trade : Intrafish

Doubt reigns in the market that consumers can absorb the inevitably higher prices of the United States’ vast quantities of imported seafood.

Tariff fatigue has investors and CEOs in limbo.Photo: Chip Somodevilla / Shutterstock.com : Intrafish

Trump announced tariffs of at least 10 percent on practically all goods coming into the United States, and higher rates on countries that have the highest trade deficits with the United States.

The US tariffs on China are set at 34 percent under Trump’s new plan. The European Union is subject to a 20 percent tariff.

Among others, a rate of 46 percent was applied to Vietnam, 32 percent to Taiwan and 24 percent to Japan.

Trump’s on-again, off-again tariffs have caused confusion and uncertainty across the seafood sector since they were first imposed.

—

‘I don’t have words’

The cumulative impact of the United States’ many tariffs on China over the last 5 years will add up to 79 percent duty on most seafood exported from China, said Norwegian Seafood Council China Director Sigmund Bjorgo.

In 2018, during Trump’s first term, most Chinese seafood got 25 percent tariffs. A few items, like frozen cod fillet and haddock were exempted, Bjorgo wrote in a LinkedIn post Friday.

Earlier this year, the Trump administration introduced additional 10 percent tariffs in two consecutive rounds. For many products, the additional 34 percent announced yesterday will bring total tariffs to 79 percent, with effect from April 9.

“The industry was already struggling, with 6 percent decline last year and 6 percent decline by February this year,” wrote Bjorgo.

The United States was China’s second largest seafood export market.

“I don’t have words to describe the difficult situation many Chinese seafood processing companies now must be experiencing.”

Vietnam’s largest pangasius exporter speaks out

Vietnam’s biggest pangasius exporter, Vinh Hoan, said Trump’s 46 percent Reciprocal Tariff on the country’s exports may negatively impact its net profit after tax by 15 percent to 30 percent this year.

In a statement, CEO Tam Nguyen said the situation “remains fluid” however, and the actual impact may vary depending on how the tariff is implemented and other factors “beyond out control”.

“For over two decades, we have been producing pangasius, a freshwater fish facing numerous market challenges in the United States, including labeling restrictions, antidumping duties, regulatory uncertainties, and misinformation campaigns,” said Nguyen.

“As always, our priority remains working closely with our customers, suppliers, and local communities, demonstrating the same resilience and determination that have guided us through past challenges.”

According to the National Fisheries Institute, pangasius is among the top five most consumed seafood products in the United States. The vast majority comes from Vietnam.

“It plays a vital role in providing healthy and delicious nutrition for millions of American families — just as it does for my own,” said Nguyen.

—

An eye on other players

Australian association Seafood Industry Australia pointed out in its regular newsletter Friday, that while Australia’s tariff of 10 percent is one of the gentlest in Trump’s barrage of economic barriers, members would do well to note that Mexico and Canada, both major suppliers of seafood to the United States, including lobster and tuna, were not subjected to reciprocal tariffs and have maintained preferential rates under the US-Mexico-Canada Trade Agreement (for now).

Australia exported around AUD 105 million (59.2/65.6 million) in seafood to the United States in 2024, including around AUD 30 million (€16.9 million/$18.7 million) in toothfish, AUD 20 million (€11.3 million/$12.5 million) in tuna, AUD 20 million in lobster, and AUD 10 million (€5.6 million/$6.2 million) in salmon.

Meanwhile, the Australian Government has pledged to make efforts to remove the tariffs, but has not indicated any willingness to retaliate.

Horses for courses

Each country and category will now have to re-examine the US market and assess what tariff their competitors have been hit with, said Shivram Warrior.

“This will result in either a favorable or unfavorable position emerging,” he said, adding that the lowest duty players will have an opportunity to fill market gaps that emerge.

“This will result in the flow of products changing into new markets, which I suspect will be more regional and to the EU,” he said.

—

Canada aquaculture group ‘cautiously optimistic’ Canada not likely to retaliate with food tariffs

Canada seafood has so far remained safe under the US–Mexico–Canada Agreement (USMCA) from Trump’s trade war tariffs. As of Thursday, the Canada government under Mark Carney has largely retaliated against Trump with tit-for-tat auto tariffs.

“Indications from a report in the Globe & Mail earlier this week is that the Canadian government, recognizing the importance and essential nature of food products and inputs to Canadian and American families, will also not tariff these products as counter-measures,” he said. “But the full response from the Canadian government is yet to be seen.”

Carney in a speech on Thursday said Canada would need to “reimagine” its economy when asked whether a US recession would also drag down Canada’s economy.

“Yesterday’s actions by the US administration, while not specifically targeting Canada, will rupture the global economy and adversely impact global economic growth,” he said.

CAIA’s Kennedy emphasized the need for the Canada government to “very intentionally grow” the country’s aquaculture sector as one way to strengthen its economy in the face of uncertainty.

Inflation woes continue

An aggressive suite of tariffs announced Wednesday by President Donald Trump will significantly complicate the Federal Reserve’s job as it struggles to quash inflation and avoid an economic downturn, and could further stall seafood sales rebounding in the United States.

“They’re basically our worst-case scenario,” a chief economist at KPMG told Bloomberg.

UK eyeing new seafood tariffs

The UK government has begun compiling a list of US products, including salmon and Alaska pollock, that could face retaliatory tariffs after President Donald Trump imposed a 10 percent tariff on UK exports as part of his “Liberation Day” trade plan.

—

Tariff rate confusion abounds for some countries due to changing US executive order

Mowi: ‘A very demanding and unpredictable time’

Mowi, the world’s largest salmon producer, responded to the 15 percent import tariff on Norway by emphasizing the need to place no extra burden on the salmon industry at home.

“At the same time, it is crucial that the government does not impose new regulatory and financial burdens on the industry in a very demanding and unpredictable time,” he added.

—

SalMar: ‘Working to safeguard Norwegian interests’

“Our salmon finds its way to many markets all over the world, and how and in what way new customs tariffs will affect SalMar is currently difficult to say,” Sivertsen said.

“The aquaculture organizations and the authorities are now working to safeguard Norwegian interests. We support this work.”

Ecuador fears tariff impact on consumption

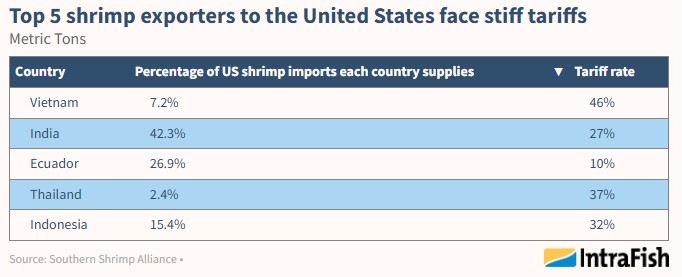

Jose Antonio Camposano, executive president of Ecuadorian trade body Camara Nacional de Acuacultura (CNA), said Ecuador had a “comparative advantage” at first glance over its competitors in the shrimp market.

“However,” he said, “work is needed to restore the previous conditions, as the tariffs could affect shrimp consumption in the United States.”

US importers will have to pay an additional 10 percent to bring in Ecuadorian shrimp to the US market. Other shrimp-producing countries face considerably higher tariffs: India received a 26 percent tariff, Indonesia 32 percent, Thailand 36 percent and Vietnam 46 percent.

Although the measure imposed on Ecuador is less severe, the country’s shrimp sector believes it is essential to continuously monitor how these tariffs could affect shrimp consumption in the US market, as well as the reaction of competitors who may shift their attention to other markets, Camposano said in a bulletin.

The shrimp sector plans to encourage the Ecuadorian government to maintain dialogue at the highest level with US authorities, said Camposano, while continuing to work in coordination with the private sector to restore the rates in place before this measure was announced.

In October, the US Department of Commerce (DOC) announced its final findings in antidumping and countervailing duty investigations, determining an average tariff of 3.78 percent on Ecuadorian shrimp.

The US shrimp market has become increasingly important to Ecuador. The country is now the second-largest shrimp supplier to the United States behind India. In 2024, Ecuador shipped more than 473 million pounds into the US market, more than double the level of 2019 and three times as much as two years earlier.

China vows retaliation against ‘bullying’ US tariffs

China vowed to retaliate against US import tariffs, dismissing the global volley of trade measures as “a typical unilateral bullying practice.”

In a strongly worded statement, the Ministry of Commerce said China “firmly opposes” the so-called “reciprocal tariffs” imposed by the United States “and will resolutely take countermeasures to safeguard its own rights and interests.”

The US has set a 34 percent tariff on imports of Chinese goods.

The Chinese ministry said the tariff policy “disregards the balance of interests achieved in multilateral trade negotiations over the years and ignores the fact that the US has long benefited greatly from international trade.”

In a statement published on its website, it added: “There are no winners in a trade war, and there is no way out for protectionism.

“China urges the United States to immediately cancel its unilateral tariff measures and properly resolve differences with its trading partners through equal dialogue.”

‘As bad as it gets’: tariffs to cause havoc in Norway

Norway’s salmon farmers are facing the “worst-case scenario” following the US announcement of a 15 percent tariff on imports from the country, according to Carnegie analyst Henrik Knutsen.

Norway will face a 15 percent tariff, while rival producer Chile and other salmon-producing nations received a base-line rate of 10 percent.

“With the US accounting for 25 percent of global consumption, this is as bad as it gets,” said Knutsen. “We expect salmon prices and thus sector earnings to be severely negatively impacted, and could easily see 40-50 percent downside to consensus operating profit (EBIT) estimates for 2025.”

Carnegie is expecting a sharp negative share price reaction for the different salmon farming stocks as a result of the tariff announcement.

Given the size of the US salmon market, implementation of the tariffs could essentially put global demand growth into negative territory for 2025 – at a time where global supply is set to increase 5 percent.

“The salmon farmers might therefore face a bleak outlook unless there are pullbacks from today’s statement,” Knutsen said.

He added that it is reasonable to assume that Chile would now take further market share in the US based on a lower tariff and higher volumes.

‘Wall of volumes’ likely to cause salmon prices to plunge

Lower US demand for Norwegian salmon as a result of the new tariffs, will shift more volumes into Europe and Asia, according Carnegie analyst Henrik Knutsen, however this is not without its challenges.

The EU market is growing less than the US, is a far more saturated market, and has lower willingness to pay. Meanwhile, volumes cannot easily be re-routed into Asia either, as this is primarily HORECA markets that favor larger sizes.

“The short term effects can thus be quite severe because volumes cannot easily be re-routed at the same price – it takes time to build new markets,” said Knutsen.

“With some simple assumptions on pass-through cost to US consumers and demand elasticity, we struggle to see less than 10 percent negative long term impact on salmon prices, even when factoring in increased demand from other regions,” he said.

The short term picture, however, looks more troubling, said Knutsen. Chilean volumes are set to rebound in the second half of the year, while in Norway, solid seawater growth has allowed for high volumes, and continued growth is also expected in the second half.

“Thus, the market could face a ‘wall of volumes’ without enough buyers,” said Knutsen. During the Fall when volumes are the highest, the EU is absorbing the lion’s share of volumes, which will now climb even further due to the slowing demand in the US.

Between 2017-2022, prices bottomed at €5.20 ($5.70) per kilogram on average during the fall. “We might be heading back to these levels,” warned Knutsen.

“If so, that would essentially wipe out all EBIT [earnings before interest and tax] from the majority of Norwegian salmon farmers, given the current cost level in the industry.

“As if that weren’t concerning enough, increased tariff barriers could also lead to higher input costs for feed, thus driving up feed cost longer term as well.”

‘Unjustified, illegal and disproportionate’

Chairman of the European Parliament’s International Trade Committee Bernard Lange reacted to the 20 percent tariff placed on EU exports announced by Trump, calling it “unjustified, illegal and disproportionate”.

“While President Trump might call today ‘Liberation Day’, from an ordinary citizen’s point of view this is ‘Inflation Day’,” said Lange.

“Because of this decision, US consumers will be forced to carry the heaviest burden in a trade war. These tariffs will only make processes and manufacturing more inefficient. They have prompted damaging uncertainty in the investment climate. Stock markets could hardly be clearer in their reactions.”

The EU is the world’s biggest single market, with 450 million consumers. “That is our safe harbor in tumultuous times,” added EU President Ursula von der Leyen in a separate statement.

“The EU will respond,” said Lange. “We are not backing down.”

‘I’m taking on a COVID mentality’

Taprobane has 17 processing facilities employing over 2,000 full-time employees, predominantly underprivileged women, throughout the northern and northwestern provinces of Sri Lanka.

The partnership was expected to reach over $20 million (€18.7 million) in annual sales by the end of this year, with plans to surpass $40 million (€37.4 million) by 2024.

“Shrimp we have options, but so do all other Asian countries, so I expect that EU/UK prices will come down as packers look to diversify,” said O’Reilly, adding that he understood that Indian shrimp prices had already come down.

“Crab unfortunately we don’t have many options outside of the USA, so right now I’m taking on a COVID mentality – let’s keep going – but unfortunately raw material prices will have to come down.

“No one can absorb 44 percent,” he said, although added that, while the tariff was incredibly high, most Asian packers were in the same boat after Trump’s announcement.

O’Reilly said Taprobane, along with other Sri Lankan export industries, would be lobbying the government.

Huge devastation in Asia

“And not only in the production but massive losses in the processing sector of the industry,” said Villanueva.

Vietnam, Indonesia, India and Thailand are among the world’s largest shrimp exporters. The United States is their biggest market.

Between them they have been hit with tariffs of 46 percent; 32 percent; 26 percent; and 36 percent, respectively.

Meanwhile the world’s biggest producer, Ecuador, has escaped with just 10 percent.

“These countries rely on small to medium growers for their production unlike the case in Ecuador where they have integrated huge companies operating the total shrimp value chain,” said Villanueva.

“It is also worthy to note that the US market is already the cheapest market for Asian shrimp in the attempt to fight with the cheaper Ecuadorian shrimp, so adding tariffs will result in massive financial losses,” he said.

Indian shrimp industry at a crossroads

The Indian shrimp industry, heavily reliant on exports to the United States, is “at a pivotal juncture due to recent trade dynamics,” Ravi Kumar Yellanki, president of the All India Shrimp Hatcheries Association wrote on LinkedIn Thursday morning.

Trump’s “Liberation Day” tariffs will add 26 percent to the country’s shrimp exports.

The executive said the industry now had to reflect on potential strategies that could shape the industry’s future: tapping into domestic demand; transitioning to black tiger shrimp from its mostly vannamei production which has a greater demand in local Asian markets; and/or negotiating customs duties on farm inputs with the Indian government to reduce production costs.

The imposition of countervailing duties by the U.S. Department of Commerce has already led to a decline in Indian shrimp farm-gate prices, “exacerbating challenges for farmers already facing a global oversupply situation,” said Yellanki.

“The Indian shrimp industry is at a crossroads, necessitating strategic shifts to navigate current challenges. Focusing on domestic market development, diversifying species cultivation, and advocating for favorable trade terms are pivotal steps. Collaborative efforts between the industry and government will be essential to ensure resilience and sustainable growth in this evolving landscape.”

“A bit of insulation”

The CEO of New Zealand’s biggest salmon farmer, New Zealand King Salmon, “will not be losing sleep” over the new 10 percent tariff that the United States just said would be imposed on the company’s exports to the country.

While Carrington said the company was still working through what the tariff would mean for customers, he said he didn’t expect New Zealand King Salmon’s margins to be impacted.

“Regrettably this is effectively an extra tax that will impact consumers and hopefully they will get some compensatory tax relief,” he said.

Trader : No-one can absorb these tariffs

Trump’s new tariffs will “seriously impact all seafood processors and exporters from Asia and importers in the United States,” the managing director of global seafood trader Siam Canadian, Jim Gulkin, told IntraFish Thursday morning Asia time.

Trump’s new tariffs will “seriously impact all seafood processor and exporters from Asia and importers in the United States,” said Jim Gulkin of Siam Canadian.Photo:Siam Canadian

The company exports seafood from Asia into North America and as such will be deeply impacted by the new tariffs, which include 36 percent on Thai exports; 32 percent on Indonesia, 26 percent on India; 34 percent on China; and 46 percent on Vietnam.

Gulkin said they he was still awaiting clarification on the effective date of the tariffs, but that there was no way around the impacts.

“Seafood is a business with very small margins,” he said. “No processor, exporter or importer has the wherewithal to absorb 25 percent or higher tariffs. The tariffs will have to be passed onto the consumer and consumption will drop markedly as a result of the substantially higher prices.”

A price rise for the end consumer

“The United States is an important market for Sealord orange roughy and toothfish and we think that the impacts will be slightly different for each species,” said Paulin.

For orange roughy, the fishing and aquaculture giant thinks the tariff will add about $0.50-$0.70 to the price for the importer.

“While this is not insignificant, it should flow into the market in the form of price rises for the end consumer and given all imported seafood will have this imposed, we are not expecting huge volume downside,” he said.

Chile salmon industry eyes further talks to reduce tariff impact

Importers of Chilean salmon will pay a 10 percent tariff versus 15 percent on Norwegian fish under the Trump tariff plan.

The Chilean salmon sector is analyzing the announcement in detail and its implications once it is implemented, Clement said.

“We also hope that we can reach agreements that minimize the negative effects for Chile and its export industry,” he said.

Chile and the United States have had a free-trade agreement in place since the beginning of 2004, exempting most things from tariffs except for items such as luxury goods.

“We trust in dialogue as a key tool to avoid impacts that harm both our sector and the national and international economy,” Clement added.

US wild shrimp producers cheer tariff hammer on imports

The Southern Shrimp Alliance (SSA), which represents producers of US wild shrimp caught in the Gulf of Mexico, applauded the Trump administration on Wednesday for imposing stiff tariffs on 96 percent of shrimp imports.

“We’ve watched as multi-generational family businesses tie up their boats, unable to compete with foreign producers who play by a completely different set of rules,” said John Williams, executive director of the Southern Shrimp Alliance.

“We are grateful for the Trump Administration’s actions today, which will preserve American jobs, food security, and our commitment to ethical production.”

America’s largest seafood trade group sounds the alarm

The National Fisheries Institute (NFI) said the Trump administration’s “Liberation Day” tariffs will hit the seafood industry and consumer hard.

“While we are encouraged by exemptions on reciprocal tariffs for some countries, like Canada and Mexico, tariffs will raise the cost of seafood, making the healthiest animal protein on the planet less available and more expensive,” NFI President Lisa Wallenda Picard said in a statement Wednesday afternoon.

“Meanwhile, the tariffs could threaten many of the 1.6 million American jobs that, according to the federal government, US commercial seafood companies support.”

Pangasius imports will feel tariff pain

The overwhelming majority of the farmed whitefish comes from Vietnam, which will be slapped with a 46 percent tariff on all of its exports to the US.

In 2024, 112,000 metric tons of frozen pangasius fillets were imported into the US market, worth $324.2 million (€297 million).

The fish is a major competitor in the US market with other value whitefish, potentially giving an opening for other species.

Assuming the newly announced tariff rates were applied evenly across last year’s imports, the per kilogram price of pangasius would have been over $4.20 (€3.85), as opposed to the actual value of $2.88 (€2.63) per kilo.

Overwhelming majority of US shrimp imports will be hit hard by tariffs

Nations supplying the United States with the majority of its shrimp are facing stiff tariffs, according to a plan announced Wednesday by President Donald Trump.

In his so-called “Liberation Day” speech from the White House, Trump announced tariffs of at least 10 percent on practically all goods coming into the United States, and higher rates on countries that have the highest trade deficits with the United States.

Among those countries with the higher rates are all of the major shrimp exporting nations, including Thailand, Vietnam, India, Ecuador, Indonesia and Bangladesh. Collectively these countries supplied more than 714,000 metric tons of the total 760,000 metric tons of shrimp the United States imported in 2024.

Tariffs of 46 percent will be placed on imports from Vietnam, India 26 percent, Thailand 36 percent, Indonesia 32 percent, Bangladesh 37 percent and 10 percent on Ecuador.

Chile gets an edge over Norway on tariff rates

The salmon landscape in the US is shifting.

Trump’s reciprocal tariff rates turned out to be a relief for Canadian seafood exporters to the US, which were previously threatened with 25 percent duties.

Instead, Trump said Wednesday goods that were covered under the pre-existing USMCA trade agreement — which includes seafood — would not face any additional tariffs.

That’s great news for Canada, which just a day ago was facing the prospect of being priced out of its most important market. Other salmon exporters to the US face a tougher hit, however. Norwegian seafood exports to the United States, for example, will face a 15 percent tariff, according to the new rates.

That puts the country at a disadvantage over Chile’s salmon exports to the US market, which will now face a 10 percent tariff. Salmon suppliers in the UK, New Zealand and Australia will all also face 10 percent rates.

Iceland and the Faroe Islands, which were not included on the table of reciprocal tariffs, will face 10 percent duties on their exports to the US, based on the Trump Administration’s announcement that all countries not listed would be hit with the 10 percent rate.

Peru fishmeal, fish oil producer relieved at 10% tariff

Importers of products from Peru, a leading supplier of raw material for fishmeal and fish oil, will pay an additional 10 percent tariff on goods brought into the United States under the Trump plan.

“There are countries that are much more affected,” the executive said.

Brazil tilapia producers want to see fine details

“We have to evaluate the tariffs applied by Trump, mainly to Colombia and China, then we can assess whether or not we will lose,” Francisco Medeiros, President of Brazilian aquaculture producer trade body Peixe BR.

Medeiros was speaking after US President Donald Trump announced an across the board 10 percent tariff on Brazilian products.

The United States is Brazil’s largest export market for tilapia.

Trump announces tariffs

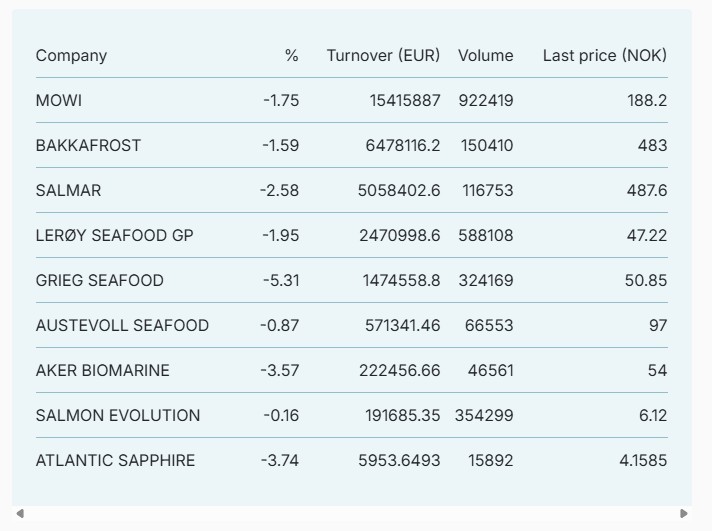

Are seafood investors ready for the ride?

There are only a limited number of publicly listed, broadly traded shares in the seafood sector. The majority of them trade on the Oslo Stock Exchange, so it serves as a good bellwether for investor sentiment.

Since the election of US President Donald Trump, and in particular his threats of tariffs, shares of several major public seafood companies have slid. For example: the Oslo Seafood Index, which includes major companies Mowi, Bakkafrost, Salmar and other majors (see below), has fallen dramatically since hitting a 2025 high on Jan. 30.

Investors have been increasingly nervous as April 2 nears. Individually, none of the shares in the index rose on Wednesday trading, ahead of Trump’s expected tariff announcements:

Stein Alexander Aukner, head of equity research at DNB, projected prior to Trump’s Wednesday announcement that investors appeared to understand how additional tariffs may impact seafood companies and their shares.

“The market is however well aware of the risk it seems.”

Mexico not planning tit-for-tat tariffs

—

Scale of damage the only question

Tariffs on salmon imports ‘wouldn’t really help anyone,” says Atlantic Sapphire founder

Johan Andreassen, the founder of land-based salmon pioneer Atlantic Sapphire in Miami, has warned US tariffs on salmon imports would just make food more expensive, and would not be beneficial to anyone.

“There’s a lot of noise right now about a new trade war and possible tariffs — and I get why people in seafood are nervous,” said Andreassen.

However, he said any tariffs placed on salmon imports would go against common sense, since the US does not produce nearly enough to cover its own needs, and would only result in higher food costs for consumers.

Andreassen drew parallels with comments made recently by United States Secretary of Commerce Howard Lutnick on the All-In DC podcast regarding mangoes.

“We can’t grow mangoes in America… If you put a tariff on a mango, that’s just a consumption tax… The idea is to choose things that are going to reshore,” said Lutnick.

Andreassen said it is the same situation with salmon.

“Yes, the US is producing some — and I know first-hand how hard that is. But we’re still far from producing enough to cover what the market needs,” he said.

“So putting tariffs on salmon imports wouldn’t really help anyone. It would just make food more expensive. Feels like common sense, honestly.”

A lot of inadvertent consequences

The biggest threat to Ireland’s seafood sector from potential US trade tariffs will largely come from the knock-on effects to the purchasing power of the country’s consumers, according to Bord Iascaigh Mhara (BIM), Ireland’s seafood development agency.

Total seafood exports from Ireland amounted to €683 million ($738.2 million) in 2024, according to BIM. But the vast majority of these head to European Union countries.

In comparison, total seafood exports from Ireland to the United States in 2024 amounted to just €7.6 million ($8.2 million), with the majority of this value associated with seaweed or algae.

However, the biggest effect of these tariff wars could be a reduction in consumer purchasing power and other indirect shifts in market dynamics, Donnelly said.

Vietnam, India offer concessions to appease Trump administration

Many of the countries most at risk of Trump’s threatened tariffs are in Asia.

Vietnam has the the third-largest trade surplus with the United States and is a major supplier of pangasius, shrimp and tuna to the market. On Tuesday, the Vietnamese government said it would cut import duties on a range of products including cars, food products, and liquefied natural gas in an attempt to appease the United States ahead of an announcement.

Canada and Mexico strengthen trade ties

Canada’s Prime Minister, Mark Carney, spoke with the President of Mexico, Claudia Sheinbaum on April 1 “discussing the importance of building upon the strong trading and investment relationship between the two countries, to benefit Canadians and Mexicans alike,” according to a press release from the Prime Minister’s office.

Carney also highlighted his plan to fight unjustified trade actions against Canada, protect Canadian workers and businesses, and build Canada’s economy, including through increased trade between Canada and Mexico.

The leaders agreed that ministers and senior officials will continue to work together to advance shared priorities and remain in close contact.

Canada focuses on domestic consumers as it awaits tariff results

Keith Sullivan, the executive director for the Newfoundland and Labrador Aquaculture Industry Association (NAIA) said Tuesday Newfoundland and Labrador and the rest of Canada are hopeful for a resolution to the trade disruptions.

In the meantime, the country’s seafood industry is focusing on diversifying its market, he said.

“All producers are focusing on the domestic Canadian market,” he explained. “there are increased opportunities to promote more of local seafood across the country.”

” Beyond that, it largely depends on individual species and logistical constraints. Some producers are investigating direct flights from Newfoundland and Labrador to Europe.”

Nova Scotia reaffirms opposition to tariffs

Last month, Smith told IntraFish that planning for his province’s seafood industry has been plunged into chaos by the helter-skelter nature of how the Trump administration is imposing and then suspending tariffs.

Canada’s Nova Scotia region exports just over CAD2.5 billion (€1.6 billion/$1.7 billion) worth of seafood worldwide annually, with half of that going to the US market. Lobster accounts for the lion’s share, but the province also exports crab, scallops, halibut and shrimp.

—

Barriers for US trade detailed in official report

The United States Trade Representative (USTR) has released its 2025 report on barriers to foreign trade.

The report details areas of concern to doing business in the largest export markets for the United States, covering nearly 60 trading partners.

It includes entries on important seafood supplying nations such as Chile, Canada, Ecuador, India and Norway.

The report broadly defines trade barriers as government laws, regulations, policies, or practices—including non-market policies and practices—that distort or undermine fair competition.

These include measures that protect domestic goods and services from foreign competition, artificially stimulate exports of particular domestic goods and services, or fail to provide adequate and effective protection of intellectual property rights.

Seafood makes several appearances in the document, with the USTR pointing out barriers in countries and blocs including the European Union, China, the United Kingdom and Japan, among others.

Tariffs will start immediately

Just a day away from the wide-ranging implementation of tariffs on products exported into the United States, the White House said Tuesday the tariffs take effect immediately once they are announced.

Salmon Scotland CEO: ‘Avoid the jumping around and gnashing of teeth’

“The US administration’s position does change very regularly,” he said. “Until we know what the tariffs are and if they will apply to Scottish salmon exports it is important not to overreact.”

Scott expressed confidence in both US consumers’ appetites for Scottish products and strong business relationships with exporters, adding: “The US market will remain important no matter what.”

“We take an optimistic view of the coming months and years,” he said. “It’s important to remember that US administrations come and go and policies may change. We should take a long term view and avoid the jumping around and gnashing of teeth.”

Salmon Scotland agrees with the UK Prime Minister’s “calm and collected” approach, Scott said: “This is not a time for panicking.”

‘We have a strong plan to retaliate,’ says EU

The European Union has a “strong plan to retaliate” against incoming US tariffs, President of the European Commission Ursula von der Leyen said in a speech to the European Parliament in Strasbourg on Tuesday, but added the bloc would prefer to negotiate a solution.

So far, the US administration has announced tariffs on imports of steel, aluminum, cars and car parts. The next sectors facing tariffs will be semiconductors, pharmaceuticals and timber. And on Wednesday the world is expecting an announcement on so-called ‘reciprocal’ tariffs that will immediately apply to almost all goods and many countries in the world.

While von der Leyen accepted there are “severe issues” in the world of trade, she warned tariffs “make things worse, not better” by fuelling inflation and costing jobs.

She said EU Member States would assess tomorrow’s announcements carefully to calibrate a response, while adding “all instruments are on the table.”

“Our objective is a negotiated solution,” she said. “But of course, if need be, we will protect our interests, our people and our companies.”

Noting that a trade war is in “no one’s interest”, von der Leyen said the EU was willing to work with the US on the trade balance of goods as well as services.

“We would all be better off if we could find a constructive solution,” she said. “At the same time, it also has to be clear: Europe has not started this confrontation. We do not necessarily want to retaliate, but we have a strong plan to retaliate if necessary.”

UK Prime Minister promises ‘calm and collected’ response to tariffs

He stressed his wish to avoid a trade war but promised to “act in the national interests,” and said that “all options remain on the table” in terms of a response.

Starmer also said ongoing trade negotiations with the US which seek to exempt the UK from tariffs are “well-advanced,” although it is unclear when businesses will see evidence of this.

“I do believe we can not only get to a place where we are avoiding tariffs on each other but we’re also actually strengthening that trade relationship, getting more access for UK businesses to the US market.”

New alliances forming

The countries are all important global customers for US seafood producers.

Trump says tariffs will be ‘very nice,’ lower than what is expected

In a news conference late Monday, Trump stated in reference to his reciprocal tariffs, he will be nicer to other countries than they are to the United States.

“We are going to be very nice by comparison,” he said, not referencing any specific country. “The numbers will be lower than what they are charging us, and in some cases, maybe substantially lower.”

“Relatively speaking, we’re going to be very kind,” he said.

“There are no tariffs if you build your product in the USA,’ he reiterated.

What seafood makes the ‘Dirty 15’ list?

US Treasury Secretary Scott Bessent helped clarify — somewhat — which countries could be targeted the most when Trump announces reciprocal tariffs on April 2.

The US trade balance in seafood is even more dramatic, given that the country imports upwards of 80 percent of the seafood it consumes in a given year.

Ecuador makes preemptive tariff strike

The Ecuadorian government removed tariffs on shrimp imports from the United States in an effort to prevent similar tariffs from being imposed on its shrimp exports to the United States in the latest round of the Trump Administration’s trade war.

Countries should look to Mexico for how to respond to Trump

“I still believe Trump will continue to use tariffs, and especially the threat of tariffs, as a negotiating weapon,” he said.

“I still think he will be shy in rolling out tariffs or, if he does, he will be quick to pull them back. He is using tariffs to get concessions … because he can. I suggest we are better off focusing on our businesses and not on all the noise.”

The seafood executive pointed out the US president is using tariffs as a means to level the playing field, saying the US has one of the “lowest tariff rates when applied as a weighted mean against all products” at 1.5 percent.

“Most countries have rates much higher with several countries into double-digit rates,” he said.

He said tariff threats are a way to open foreign markets to American manufacturers that have previously been closed out due to tariffs on American products.

“Foolish countries like Canada appear more interested in ‘jumping into the ring’ and going a few rounds with heavy talks of retaliation,” said O’Brien. “Mexico is showing far more smarts than Canada.”

Ecuador cuts tariffs on US shrimp imports, trying to avoid Trump retaliation

The Ecuadorian government removed tariffs on shrimp imports from the United States in an effort to prevent similar tariffs from being imposed on its shrimp exports to the United States in the latest round of the Trump Administration’s trade war.

Jose Antonio Camposano, executive director of Ecuadorian shrimp producers trade association CNA, told IntraFish Ecuador’s Foreign Trade Committee (COMEX) removed a 30 percent tariff on imports of shrimp from the United States on March 28 at the urging of CNA.

Tariff fatigue leaves stock market in limbo

The major US stock exchanges were mixed on Monday as investors prepared for the fallout of the Trump administration’s April 2 rollout of tariffs on leading US trading partners.

In midday trading, the Dow was up more than 130 points, or 0.32 percent. The S&P 500 was lower by 0.46 percent and the Nasdaq Composite slid 1.31 percent. Major stock markets in both Europe and Asia moved down on Monday.

‘Don’t shoot until you see the whites of their eyes’

California’s Southwind Foods is one of the largest suppliers of frozen value-added seafood to some of the biggest retail, foodservice and distribution companies in the United States.

Southwind Foods President Sam Galletti said the company is waiting and ready to adapt to what comes and will know what to do only when the tariffs are put in place.

“You know the old saying: don’t shoot until you see the whites of their eyes,” Galletti said.

Ultimately, the consumer will dictate what will happen, Galletti added.

Importers are reluctant

Read more

12 seafood trends you can bank on

“Whether that clarity happens on April 2 or we continue this back and forth with tariffs on, tariffs off, ad nauseum, is unsure,” the importer said.

Uncertainty is the nemesis of exporters and importers, and currently companies reliant on trade “are in a state of purgatory now and not sure which way to turn,” the importer said.

“Anything can happen, anything can change, there is simply no clear direction. Impossible to calculate risk if there are no rules.”

Europe looks for options

Holding pattern for Canada

Canada’s new prime minister, Mark Carney, said Friday on X (formerly known as Twitter) that he had a “productive” conversation with President Trump, though he gave few details. He did, however, warn that Canada would implement counter-tariffs onto US goods if the tariffs indeed go forward April 2.

—

The At-Sea Processors Association and the Pacific Seafood Processors Association, which represent major Alaska and US West Coast processors, warned the Trump administration that the state’s seafood exports are vulnerable to retaliatory trade tariffs that could greatly impact seafood businesses.

Read more

EU counter tariffs on US fish oil, soy would have limited impact for aquaculture

“While our industry is working hard to grow domestic demand, for the foreseeable future the viability of our industry will depend on our access to key export markets,” two leading seafood trade associations told the administration.

Approximately two-thirds of Alaska’s seafood production, by value, is exported, the associations said.

“Access to these consumers helps US harvesters remain competitive, promotes sustainability by utilizing the full catch, and reduces food waste,” the association said.

Read more

Alaska pollock industry asks Trump administration to tread carefully with tariffs

“US seafood is widely recognized as safe, sustainable, and of premium quality, allowing exporters to maximize value in key markets like Europe, China, and the Americas. This demand has historically helped stabilize US harvesters through economic downturns,” said NFI.

The NFI said it supported the Trump administration’s trade seafood strategy from 2020, and urged the administration to return to those policies.

The trade association said in recent years “a combination of longstanding and newly imposed trade restrictions—including tariff and non-tariff measures— has allowed competitors such as Canada and Chile to gain market share at the expense of US producers.”

“China’s retaliatory tariffs, for example, have made it far more difficult for US seafood to compete, while restrictive import measures in key markets such as the European Union, Japan, and Brazil have further eroded access for American producers. The result should surprise no one: US seafood exports have declined to their lowest levels in over a decade.”