US-China seafood trade springs back to life – for now : Intrafish

The mutual reduction in import tariffs has allowed business to resume with immediate effect, but seafood traders remain wary of what might happen next.

Rachel Sapin and Rachel Mutter : Intrafish Published 13 May 2025, 23:30

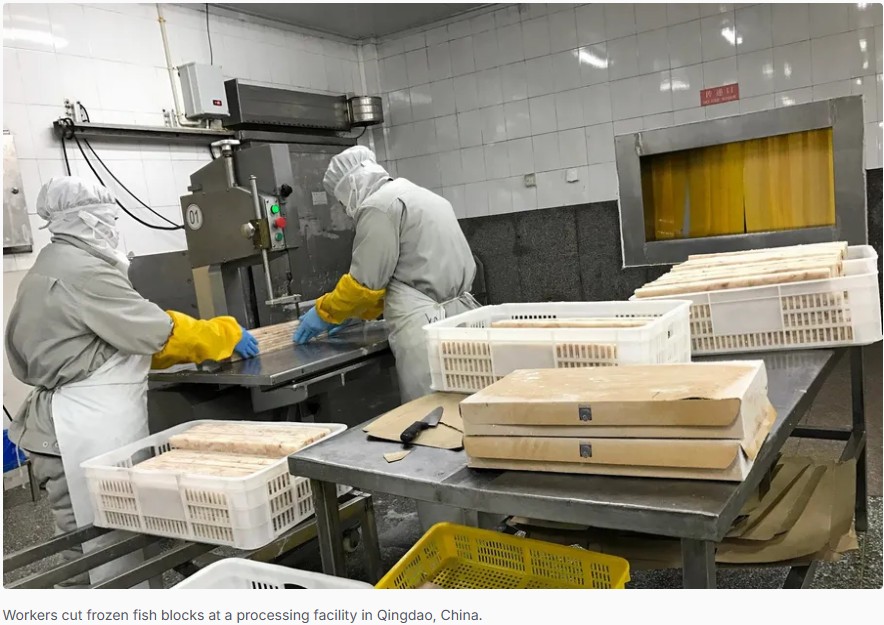

US seafood importers raced to resume business with China after the two countries agreed to a 90-day reduction of mutual tariffs that had effectively paralyzed two-way trade, several market sources told IntraFish.

Frustration remains, however, around the continued uncertainty about what might happen next.

“We’re back in business, to an extent,” said Mark Soderstrom, president of Southstream Seafoods, a leading US importer of frozen seafood. “We have reinstated our Atlantic cod production and a bit of our haddock production because of the [tariff] reduction.”

Soderstrom added, however, that it was hard to predict the longer term. Different species, he said, are subject to different rules.

The United States exported fish and seafood worth more than $1 billion (€898 million) to China in 2024, where it is largely processed and re-exported, according to figures from the US Department of Agriculture.

A tit-for-tat trade war, where both countries have repeatedly raised their respective import tariffs, had effectively paused trade until Monday, when both sides agreed to a temporary reduction.

The agreement lowers US President Donald Trump’s so-called “reciprocal” tariffs on imports from China under the International Emergency Economic Powers Act (IEEPA) to 10 percent from 125 percent.

China, in turn, has lowered its retaliatory tariffs on imports from the United States by the same amount. The temporary rates will take effect by May 14 and remain in place for at least 90 days – though Trump has also warned that rates could go “substantially higher” if the countries cannot reach a long-term agreement.

The picture is complicated by additional US tariffs that seafood traders say still apply. Under the previous plan, key Chinese seafood products had faced US tariffs of between 145 percent and 170 percent.

Tariffs imposed during Trump’s first term in office under Section 301 still apply to many seafood imports from China, amounting to 25 percent. A further 20 percent fentanyl-related tariff also remains in play.

‘Still very messy’

Matthew Fass, president of US importer Maritime Products International, has previously described the rates as an effective embargo on Chinese seafood imports to the United States.

On Monday, he told IntraFish that the latest tariff rates for major seafood species still added up to somewhere between 30 percent and 55 percent.

“It’s still very messy,” Fass said. “It’s a problem.

“Is it [an] embargo, [a] paralyzing level? No, but I think it’s going to take a little bit of time for people to unpack. For different species, some may be more workable than others,” he said.

Soderstrom, the president of Southstream, said the reduction in the tariff rates has enabled the company to reinstate some of the trading with China that had been halted under the higher rates.

Southstream, which imports most of the fish that it sells, has this year experienced a massive increase in the cost of cod loins. The species is caught either in the Pacific Ocean by US harvesters or in the North Atlantic Ocean by EU harvesters, before being reprocessed in China and sent to the United States.

Another issue at play is whether exclusions provided to key US seafood products, such as flounder and haddock that have so far been exempted from tariffs tied to Section 301 investigations, will remain in place. Those are set to expire at the end of this month.

“It’s not a solution to plan business for the next three to four years,” Soderstrom said of the ongoing uncertainty.

Restarting production

An executive from international seafood trader Siam Canadian agreed that the new tariffs were no longer embargo-level, but that the cumulative 55 percent made things “difficult”.

Marketing Manager Landy Chow said the lower tariff, combined with a weaker Chinese yuan and lower raw material prices, at least made it possible to ship to the US market.

Chow, who is based in Guangzhou, the heart of a key Chinese shrimp production region, said the reduced tariff would also likely enable seafood factories that had shuttered in April to resume production, albeit from a constrained financial position.

“At the 55 percent, Chinese factories will not make any profit,” Chow told IntraFish. “However, they at least could run their production at break-even or with limited loss.”

April was a quiet month for Siam Canadian in China, with no new enquiries for product. But Chow said Monday’s duty announcement sparked a couple of enquiries from the United States by the following day.

“That is good news,” he said. “I hope that business will improve in the coming months.”

The best-case scenario going forward, said Chow, would be that China and the United States reach an agreement on fentanyl, removing 20 percent of the tariff and lowering the overall rate to 35 percent.

“With such a duty, Chinese seafood exports to the USA will be fully recovered, especially tilapia,” said Chow, who added that a 25 percent tariff imposed specifically on tilapia in 2018 did nothing to hinder the growth of tilapia exports to the country.

“With a 35 percent duty, I would believe that situation will be the same.”

Another possible scenario could see China reduce its duty from 10 percent to zero, then request that the United States reduce its recent tariff from 30 percent to 20 percent.

Coupled with the fentanyl tariff, that would put the duty on Chinese seafood exports to the United States at 45 percent – “slightly better”, he said, than the current 55 percent.

‘Back to square one’

This, Chow thinks, is the most likely scenario and would put Chinese seafood exports back on their pre-2025 track, as the difference with competitors would be reset to its original position.

“If China seafood exports to the USA are subject to a 45 percent duty and Vietnam, Indonesia and Thailand are [subject to] 20 percent, the difference is 25 percent,” he said.

“As a result, that returns to the level we saw in 2019, when China’s seafood exports to USA were subject to 25 percent, whilst Vietnam, Indonesia and Thailand enjoyed zero percent.

“So, everything will come back to square one.”

The worst-case scenario, said Chow, would be that China and the United States fail to reach any agreement that both sides return to a policy of escalation. He said this appeared unlikely following the announcement on Monday.

“In general, the agreement made yesterday between the USA and China is good news for China seafood exporters,” he said. “Most seafood exporters expect a better tariff in the coming months.”