Week 22 farm-gate shrimp roundup: Market slow-down as Asian shipping deadlines pass ahead of July US tariff decision : Undercurrent News

Asian shrimp exporters face market uncertainty as shipping deadlines for US-bound cargo have passed, while Ecuadorian small sizes have dropped, according to Undercurrent News’ latest global farm-gate price round-up

By Louis Harkell | May 27, 2025 11:45 BST

Additional reporting by María Feijóo, Tom Seaman and Lewis Hu.

Global shrimp markets have entered a standstill as shippingdeadlines for US-bound exports from major Asian producers have now passed, leaving the industry waiting for US president Donald Trump’s decision on reciprocal tariffs set to take effect July 9,according to Undercurrent News’ latest global farm-gate price round-up.

The market uncertainty has contributed to mixed price movements across regions, with Ecuadorian small-sized shrimp experiencing significant drops while Chinese prices accelerate their seasonal decline due to increased greenhouse production.

The shipping window closure affects all major Asian suppliers differently. Indian and Indonesian exporters, who had been racing to secure final shipments before the July 9 deadline, now face market uncertainty as the temporary reduction of reciprocal tariffs from 26% to the global baseline of 10% is set to expire.

“Everything that is destined or supposed to beat the July 9 deadline is gone, so orders are slowing,” Jim Gulkin, group managing director for Siam Canadian, told Undercurrent.” The deadline has passed for everybody… Everything’s in limbo, and that’s the problem. There’s just this uncertainty, which is the enemy

of any nuts and bolts business.”

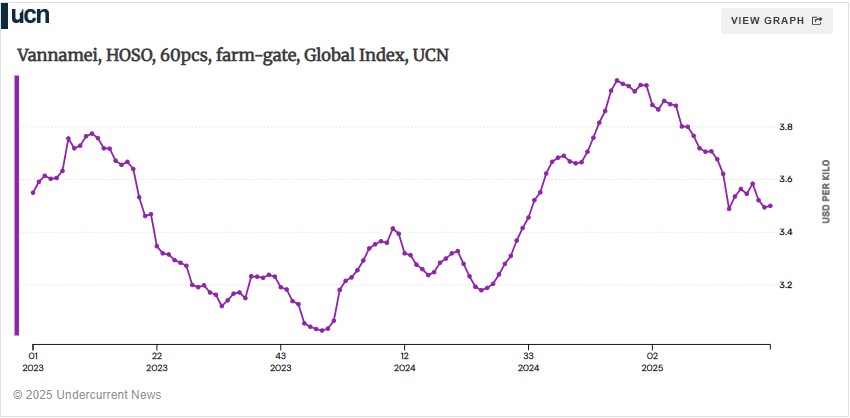

Undercurrent’s global shrimp index for benchmark 60-count vannamei stood at $3.65 per kilogram in week 22, remaining 8.2% higher than the same period last year despite ongoing tariff-induced market volatility.

The uncertainty extends beyond immediate shipping times, with Gulkin noting that shipping companies have become “very casual about being late by two to three weeks” since the COVID pandemic, creating additional risks for exporters trying to deliver before the tariff deadline.

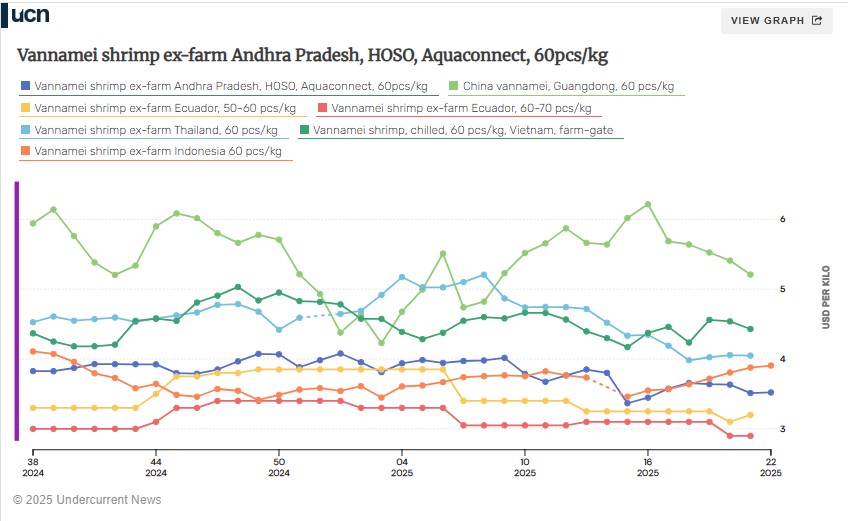

Among major export origins, Ecuador continues to offer the most competitive pricing at$2.90/kg for 60/70-count, while Vietnam remains the most expensive at $4.43/kg for 60-count. China’s Guangdong province is at $5.21/kg, though its production is mostly directed to domestic live shrimp markets.

Small shrimp prices drop significantly

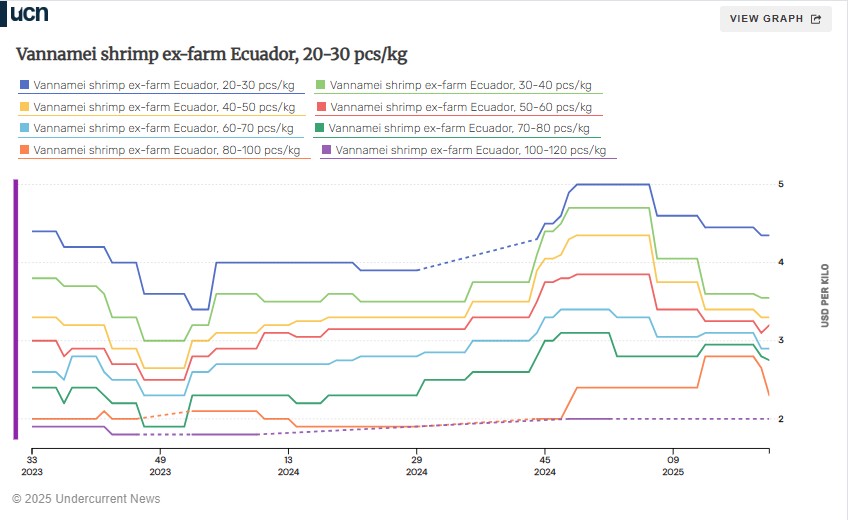

Ecuadorian shrimp prices diverged slightly in week 21, with smaller sizes seeing significant declines while medium and larger categories remained largely stable.

The most notable change came in the 80/100 count category, which dropped to $2.30/kg from $2.65/kg in week 20. The smallest size tracked, 100/120 count, was priced at$2.00/kg. Meanwhile, benchmark 20-30 count vannamei held steady at $4.35/kg, and most other medium sizes showed little to no movement.

Industry sources said the market is navigating between positive production trends and potential oversupply concerns.

“So far, 2025 has shown encouraging signs of price recovery. However, an oversupply in the global market could be pushing prices down now,” an Ecuadorian source told Undercurrent. “Prices continue mostly flat, I’d say, though. It’s still too early to draw any conclusions.”

The source noted while current conditions appear stable, market dynamics could shift quickly. “If there’s a surge in buying now, it definitely could mean a slowdown in coming weeks, but we’ll have to wait until the next harvest as well.”

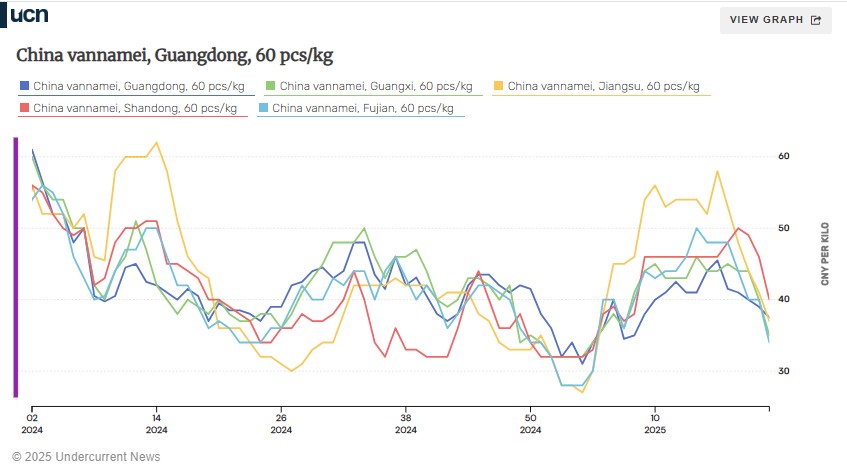

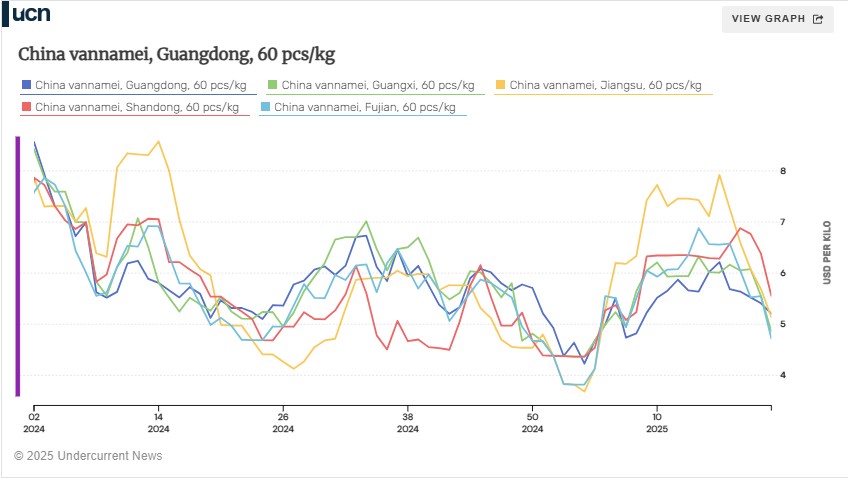

Chinese farmed shrimp prices continued their sharp downward trajectory in week 21,with the most dramatic drops in Guangxi, where 60-count vannamei prices plummeted CNY 5 to CNY 35/kg, and Shandong, which fell CNY 6 to CNY 40/kg.

“Shrimp prices continue to fall across China in week 21, with large price drops in Guangxi, Fujian and Shandong. The price of 60 count is now generally lower than CNY40/kg, which is a dividing line that most farmers would feel pessimistic about,” a market source told Undercurrent.

Haid, China’s largest shrimp feed producer, said that the local farmed shrimp market has formed a “stampede,” and greenhouse harvesting is expected to peak on June 20.Industry insiders attribute the pressure to “the harvesting of greenhouses and the lack of holiday consumption as a driving force.”

The early and steep price declines reflect the growing impact of greenhouse cultivation, which allows producers to cultivate shrimp in colder temperatures and is smoothing out traditional seasonal patterns. Tongwei, China’s second-largest shrimp feed manufacturer, has warned that prices have entered a downward trend and are expected to fall further.

Indian prices hold steady

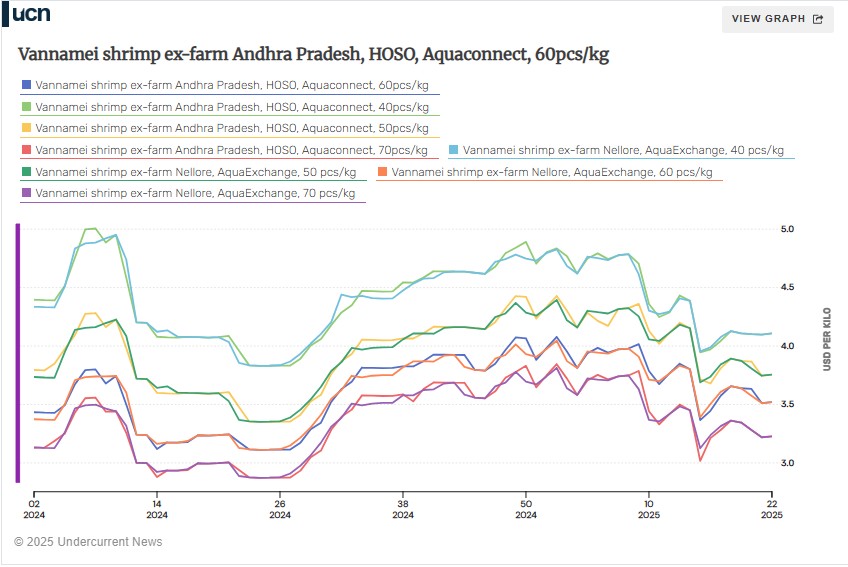

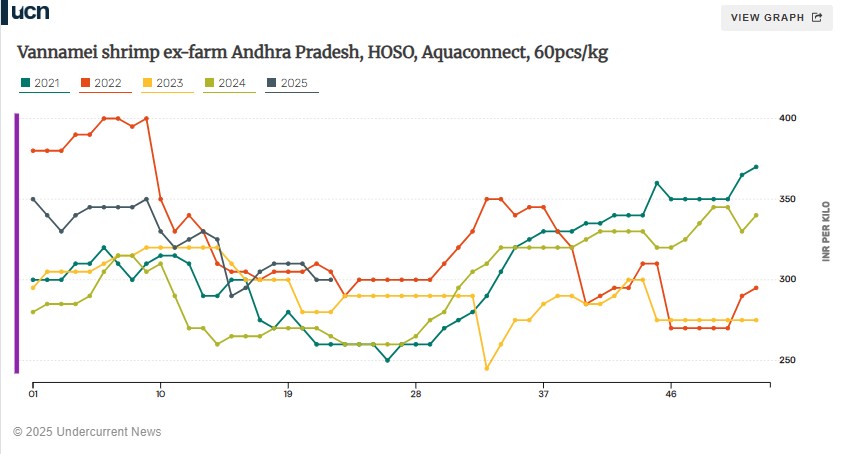

Indian shrimp prices remained stable in week 22 despite increasing production in Andhra Pradesh and ongoing concerns over the US shipment cutoff ahead of the July tariff deadline.

Vannamei shrimp prices in Andhra Pradesh held steady across all size categories, with60-count maintaining INR 300/kg ($3.50/kg) for the second consecutive week, according to Aqua connect data. Prices in Nellore showed similar stability, with 60-count also unchanged at INR 300.

“The ambiguity of tariffs after July 8 is a factor,” a source with a major Indian processor told Undercurrent. This comes as Indian and Southeast Asian seafood processors had been racing to ship products before the unofficial deadline.

Industry experts previously told Undercurrent that May 15-20 was the range for final shipments to arrive at US ports before July 9, depending on destination. Shipping from India typically takes 36-38 days to the US West Coast and 40-50 days to East Coast ports.

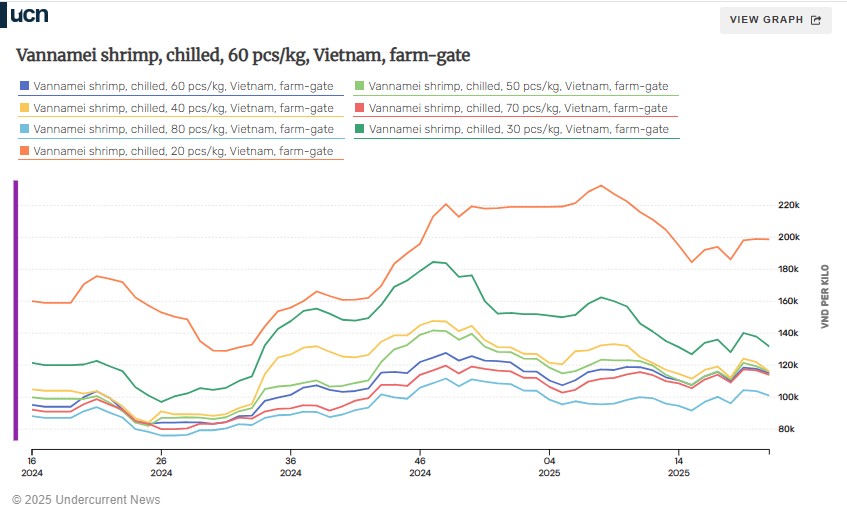

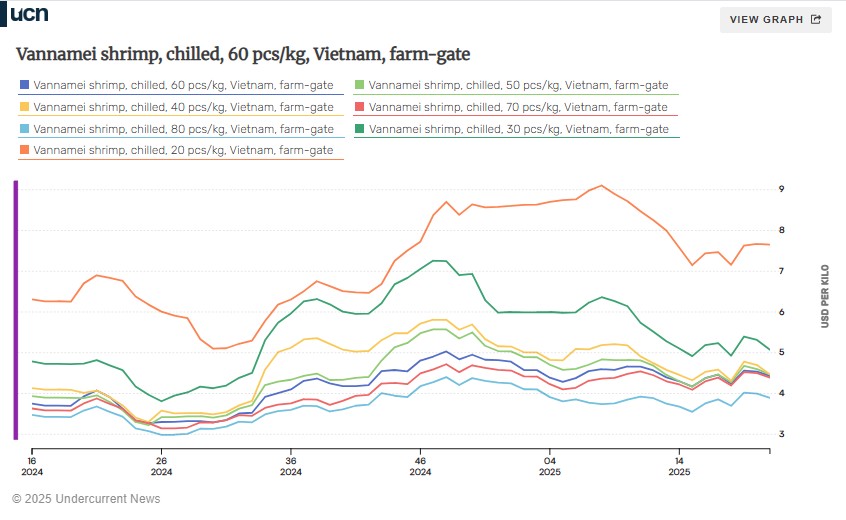

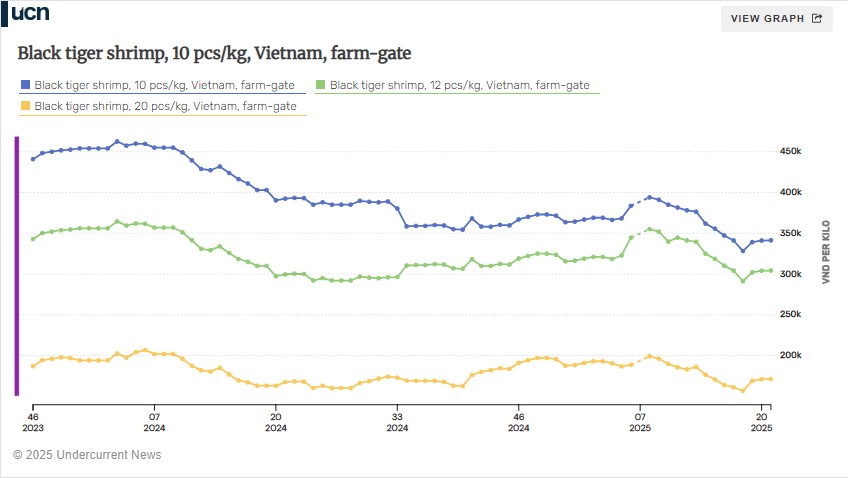

Vietnamese shrimp prices eased in week 21 following a period of sustained firmness, with 60-count vannamei dropping to VND 115,000 ($4.43)/kg from VND 119,000 the previous week.

The decline comes as production conditions have improved across the country. “White leg shrimp production has strengthened over the past two weeks, thanks to higher survival and faster growth rates. Early this week, farm-gate prices softened across all sizes,” a Ho Chi Minh-based consultancy told Undercurrent.

Despite the recent softening, Vietnamese shrimp continues to out perform regional competitors. “Vietnam prices are up, and that’s two factors: they have very strong markets in Europe, and two, they’re having raw material issues,” Gulkin told Undercurrent.

At $4.43/kg for 60-count, Vietnamese prices remain approximately $1 higher than equivalent sizes from India’s Andhra Pradesh, reflecting the country’s focus on premium market segments and diversified export destinations.

The current pricing also reflects strong year-over-year growth, with 60-count levels up from $4.07/kg in the same week last year and significantly above the $3.81/kg recorded in 2023.

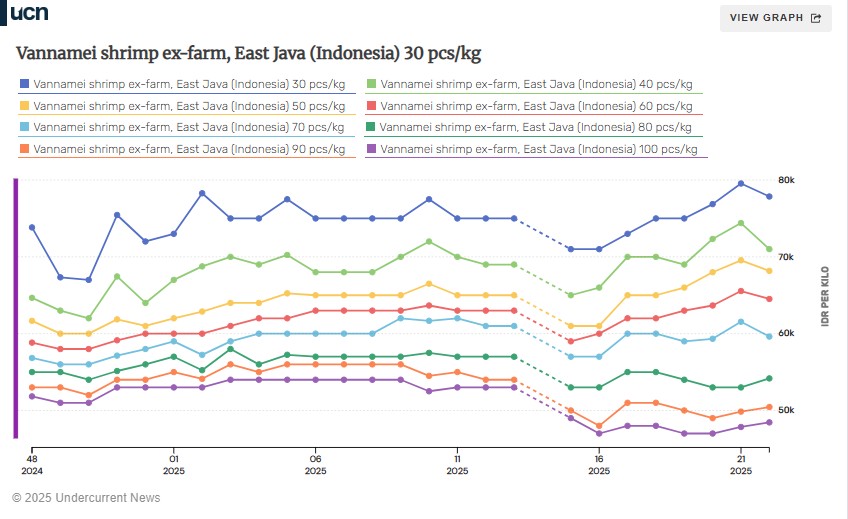

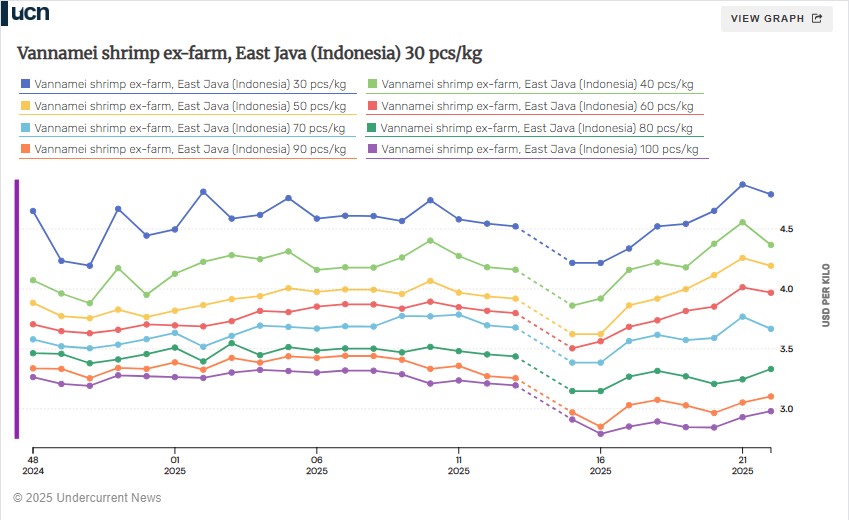

Indonesian shrimp prices declined in week 22, particularly for larger sizes, suggesting the critical shipping window for US-bound exports may have closed.

Benchmark 30-count vannamei in East Java fell to IDR 77,857/kg, while 40-countdropped more significantly to IDR 71,000/kg. The declines were most pronounced in medium to large categories, with 50-count falling to IDR 67,857/kg.

Indonesia’s 30-day shipping time to US West Coast ports had given processors a later cutoff than their Indian counterparts, with industry sources previously indicating June 1as the critical deadline to reach US ports before higher tariffs potentially take effect.

“It’s processors doing last-minute shopping before the window closes on June 1 to enjoy the pause period,” one industry source last week told Undercurrent.

Prices decline amid market adjustment

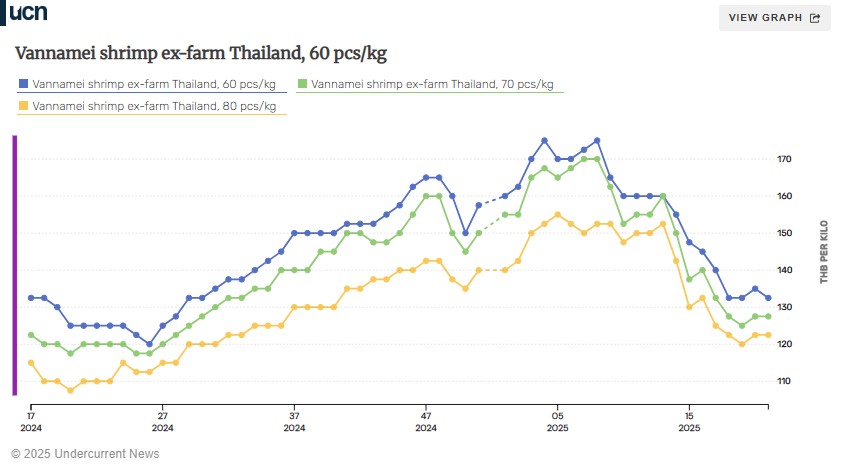

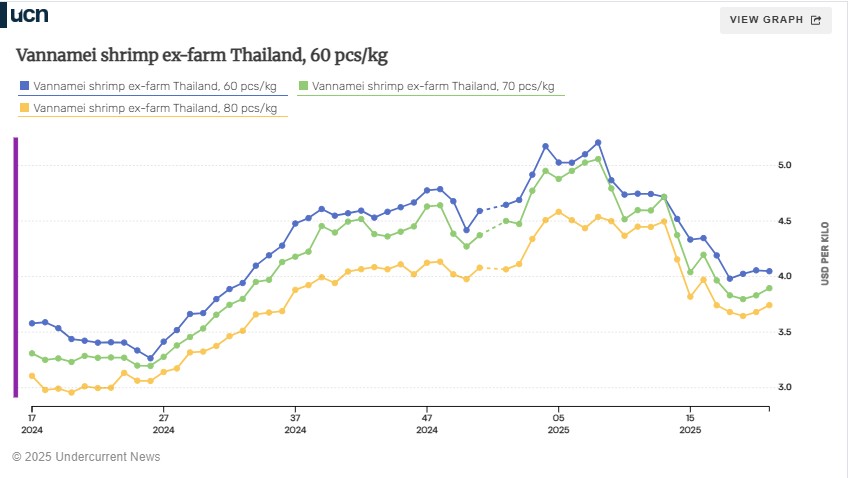

Thai shrimp prices showed mixed movement in week 21, with 60-count vannamei declining to THB 132.5 ($3.70)/kg from THB 135/kg the previous week, while other sizes remained stable.

Medium-sized 70-count held steady at THB 127.5/kg, and smaller 80-count maintained THB 122.5/kg, according to Undercurrent sources.

The decline reflects broader regional trends as markets adjust to the post-shipping deadline environment. “Thailand prices are down,” Gulkin of Siam Canadian, told Undercurrent, noting the impact of reduced export activity following the closure of the US shipping window.

The modest decline in the benchmark 60-count size contrasts with the previous week’s gains across all categories (see below).