Analysis: Here are five big takeaways from Trump’s tariff bombshell : Intrafish

The impact was as bad as the seafood industry feared.

Get it while you can: it’s possible seafood from some countries will be priced out of the US market.( Photo: Shutterstock)

Drew Cherry and John Fiorillo : Intrafish

Published 4 April 2025, 06:06

The tariffs range from a low of 10 percent to as high as 40 percent, depending on the trade imbalance between each country and the United States.

The move threw the global economy into a tailspin and, once again, pushed the seafood supply chain into chaos.

While the full impact of these tariffs won’t be known for months to come, it’s safe to say that global trade will likely never look the same.

Many losers, but one big one

Shrimp clearly fared the worst from Wednesday’s news, in large part because many major suppliers already had trade hurdles in the United States.

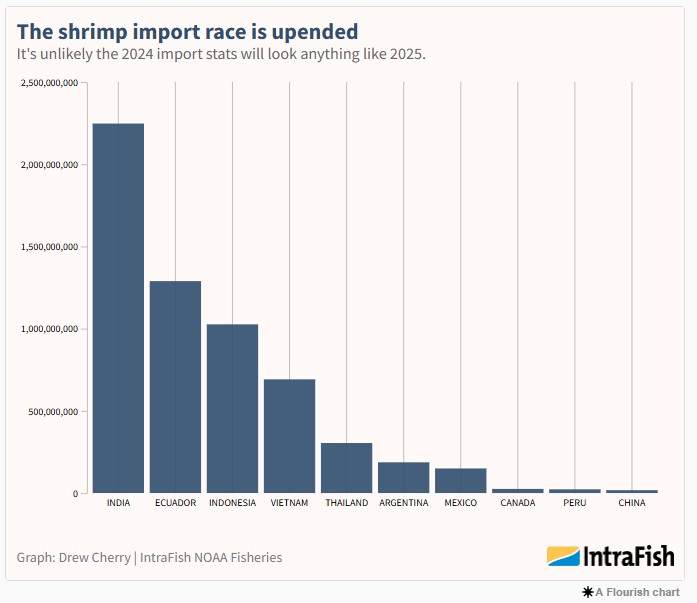

Willem van der Pijl, owner of market analyst Shrimp Insights, released analysis showing effective rates for shrimp imports into the US by country, including antidumping and countervailing duties. It’s beyond ugly. The top exporter of shrimp to the US market, India, will face 34.26 percent combined duties and tariffs at the US border.

Other major suppliers have it worse. Vietnam shrimp exports will face 74.6 percent duties and tariffs; Thailand will face 36 percent and Indonesia will face 35.9 percent.

Even Ecuador, theoretically one of the “winners” in the new round of tariffs, will face 13.78 percent duties.

One to watch will be Mexico, which will be exempt from US duties because of its trade agreement with the United States. Mexico exported 13,866 metric tons of shrimp to the US market last year. Of that, around 8,624 metric tons was farmed, worth $76 million (€69 million).

Sure, it’s the 7th largest exporter, but for context, its export volumes to the US are around 20 times lower than India’s. So its lower rate only takes it so far.

Norway took the bullet on salmon

Norway fared the worst in the salmon sector. Exports from that country to the United States will face a 15 percent tariff, making it the hardest hit of any of the salmon-producing countries.

The rate puts Norway at a disadvantage over top rival Chile’s salmon exports to the US market, which will now face a 10 percent tariff. Salmon suppliers in the UK, the Faroe Islands, Iceland, New Zealand and Australia will all also face 10 percent rates.

Canada, meanwhile, came out the winner, when just 24 hours earlier it faced potentially 25 percent duties on its exports to the US.

Trump said Wednesday goods covered under the pre-existing USMCA trade agreement — including seafood — would not face any additional tariffs.

Pangasius: A low-cost favorite no longer

At the new rates on Vietnam, pangasius will no longer be the low-cost whitefish favorite it has been.

The majority of the fish comes from Vietnam, which now faces a 46 percent tariff.

If the newly announced rates were applied evenly across last year’s imports, the per kilogram price of pangasius would have been over $4.20 (€3.85), as opposed to the actual value of $2.88 (€2.63) per kilo.

It’s hard to imagine consumers paying that when they can get other alternatives of same or better quality either domestically or from other countries.

Which species might fill the gap is anybody’s guess, but the tariffs will certainly open up new avenues for America’s very own low-cost whitefish: Alaska pollock.

The domestic consumption of Alaska pollock in the United States hit record levels in 2024, reaching 115,260 metric tons. That’s a 27.2 percent increase since 2022.

By comparison, imports of pangasius in 2024 reached just over 112,000 metric tons.

Alaska is looking for any market demand that can push up prices, and with the huge volumes of fish it produces, it may have an opening.

Trade flow shake-ups, with a big beneficiary

Given that the majority of US seafood is (and will remain) imported, no doubt suppliers will be looking for ways to get around Trump’s tariffs.

The pre-existing tariffs on China had a massive effect on its key exports to the US market (shrimp and tilapia in particular), but it also forced importers to scramble for new places to purchase fish processed at cheaper rates.

Vietnam has increasingly risen up as a potential re-processor for the West, including the United States. That is now in question. The free trade status of Mexico may give it a reprocessing edge, but as of now there is not near the infrastructure needed.

More than anything, though, the tariffs — even if they are short-lived — will force seafood companies in the United States to invest more in automation.

There is a positive to all of the changing trade flows — if you live in China. The world’s second-largest economy is eager to secure a flow of goods, particularly protein, and will be eager to fill the void let

The biggest loser of all

Though, as we mentioned above, shrimp imports will be the hardest hit, the group that will fare the worst are the people buying all this seafood. Fish, already perceived as an expensive protein, is poised to get much more expensive.

US retail sales of seafood were already struggling headed into this year, and there is no doubt that tariffs on its favorite fish and shellfish will only make things worse.

Lisa Wallenda Picard, president of the National Fisheries Institute, which represents the North American seafood sector, said the tariffs will raise the cost of seafood, “making the healthiest animal protein on the planet less available and more expensive.”

Jim Gulkin, the managing director of global seafood trader Siam Canadian, summed up the impacts nicely.

“Seafood is a business with very small margins,” he said. “No processor, exporter or importer

has the wherewithal to absorb 25 percent or higher tariffs. The tariffs will have to be passed onto the consumer and consumption will drop markedly as a result of the substantially higher prices.”

The last thing consumers want right now is higher seafood prices, and the easiest move to make will be a simple one: buy chicken instead.