Pangasius markets ‘very slow, ’ but balance better than pre-Tet price dive: Undercurrent News

The main markets for Vietnamese pangasius are slow and stable, which is largely being seen as a good thing after a tough 2023; sources are calm on a possible shortage of raw material

Neil Ramsden : UnderCurrent News

A “very slow” and stable market for Vietnamese pangasius is seen as a step up from a tough 2023 and start to 2024 by Undercurrent News sources.

“The market is very slow, and China is pushing the price down, but only very slowly,” Jean-Charles Diener, director of Vietnamese shipment inspection and consulting firm OFCO Group, told Undercurrent.

“It’s not like a few months ago, before [the Vietnamese holiday] Tet [Feb. 10], when prices were going down; now we are used to this situation, people accept it, it is slow but stable.”

The market has gone from being overstocked to having a good balance, he said.

“Before, we had overstock, and the market collapsed. Now the market is very slow — demand and supply are not very strong, so it matches. Farmers reduced their pond stocking, but demand is low, so there’s no shortage for the market.”

“Of course, if China starts to buy like crazy, we’ll have a lack of product, but I don’t see that coming. The market being slow is not a negative, I think — now the farmers are not so scared, and the factories are not so scared. But there is no strong demand coming in any market.”

A “clear market price” is making it more comfortable for buyers to make purchases compared with a few months ago, he said, adding that price was roughly $2.10 per kilogram for 100% net weight “regular fillet” shipped out of Ho Chi Minh City, Vietnam.

“It’s cheap — buyers feel the price can’t go down too much because there’s not enough supply for the price to collapse. But they also don’t think that the price will increase crazy, so it’s quite stable.”

Thuy Trang Le, sales manager with trading firm Siam Canadian’s Vietnam office, confirmed the market had been “quiet and stable” for a while, putting prices at $2.70/kg for 100% net weight fillets meeting EU requirements for import.

That’s been the price level for some time, according to sources, with EU demand having never really recovered from the price spike during the COVID-19 pandemic.

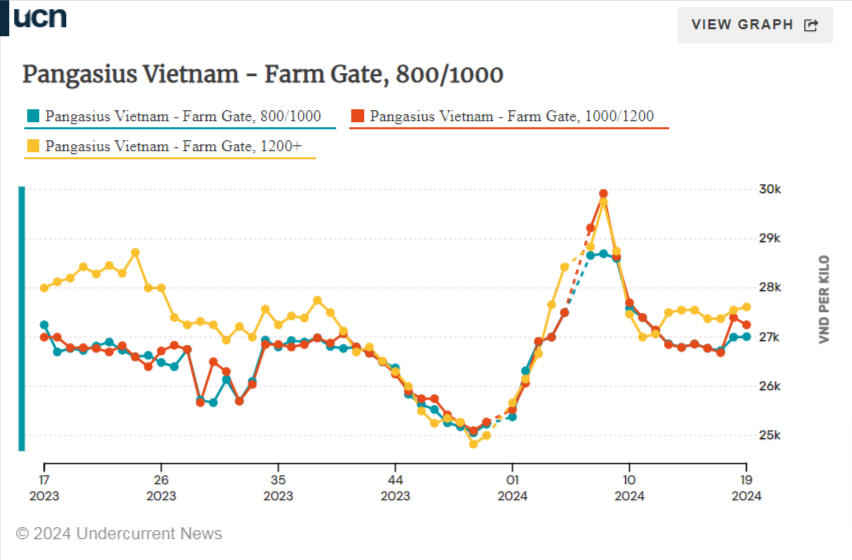

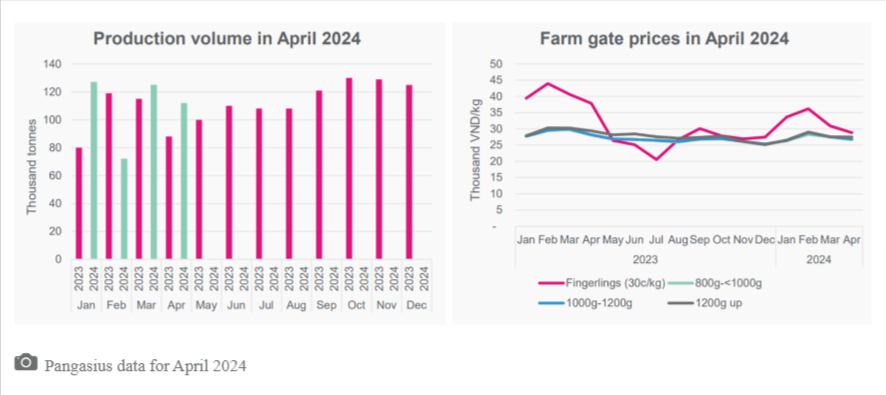

She said raw material prices had been stable since week 14 at around VND 28,500-VND 29,000/kg due to the quiet market, though “the price of the smallest sizes, four-ounce [fillets], are higher than other sizes as farmers don’t want to sell, they want to stock the fish to earn better prices.”

That’s not quite shown in the farm-gate prices provided to Undercurrent by a Ho Chi Minh-based consultancy, as shown below, though it does show the smaller sizes being on a par with larger fish until quite recently.

“At the time being, hot weather, drought and saltwater intrusion due to El Nino are serious, farmers are worried the fish will die, and they don’t want to start a crop,” Trang added. “This weather will cause a shortage of raw material in August and September, which is the main time for year-end shipments and usually pushes prices higher.”

As mentioned above, Diener was only worried about a real shortage of raw material if demand suddenly picks up — a sentiment that was echoed by Undercurrent’s consultant and Nguyen Ngo Vi Tam, CEO of Vietnam’s largest pangasius exporter Vinh Hoan Corporation.

“Early this year, raw material prices went up, and then the market turned out to be slow and steady,” noted Tam. “The raw material price in the market was then adjusted but did not plummet. It has been steady, slightly up and down just a bit in the last four-to-six weeks and at a quite healthy and normal level for farmers.”

This has been down to a steady raw material supply, not too high, and some improvement in export markets, especially the US and China, she said.

“Raw material supply has not been too much and has been quite under control in terms of both volume and price; we anticipate that it could cause a more serious shortage if the fillet markets get stronger and stronger over the months,” she said, adding that Vinh Hoan does expect to see a continued recovery from key export markets over the next three months.

The consultant source accepted that raw material supply could run a little short come September, but also felt that was a fairly normal occurrence for the time of year.

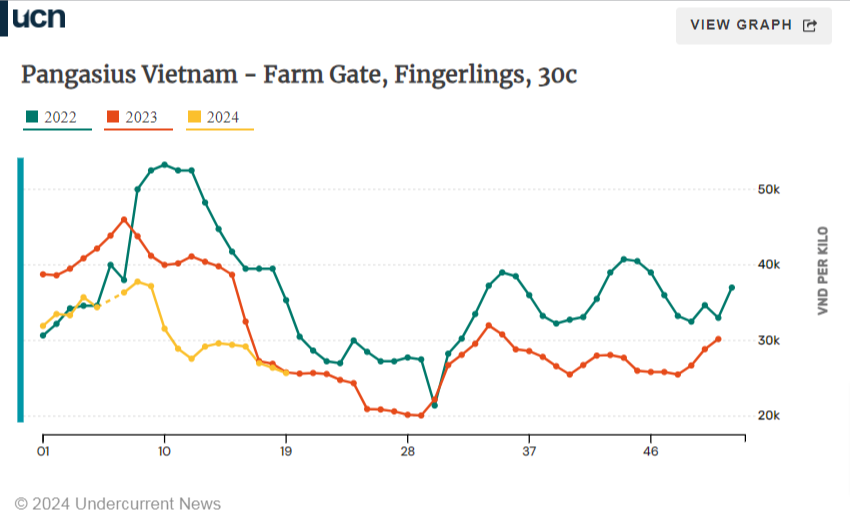

“In February, March, the fingerling price usually runs higher, so farmers quite often hold off stocking for the first quarter of the year,” he said. “A couple of months later, that tends to go back to normal again, and maybe you get an oversupply again because they started stocking again when the fingerling price came down.”

This source, like Trang, noted the worse weather conditions than usual; “it’s been odd for a few months, and only in the last few days has it started raining,” he said on May 23.

“That’s pushed the season back a little bit, it’s been incredibly hot, so there’s a shortage of water. Combine that with the [farm-gate] prices, and nobody’s really been stocking. That’s where the talk of a shortage comes from, I think, but it’s not too unusual.”

Demand still on the upturn?

He and Vinh Hoan’s Tam both said they expect to see the export markets continue to pick up as 2024 progresses, given a nudge by the lack of Russian fish now making its way to the US and European markets (or at higher duties) and the resulting high prices for cod and haddock.

As reported by Undercurrent, Vietnamese customs data showed another decent month in April in terms of small signs of demand recovery, with export volumes of 77,325 metric tons up 21% month on-month and 37% year-on-year.

Prices to China are down at their lowest in roughly three years, but for the US market, they have been climbing gently since December 2023.

The initial data for May 2024 suggests that demand continued to improve a little, he added; “it’s not massively increased, but it’s certainly not declining.”

Vietnam’s Association of Seafood Exporters and Producers, or VASEP, has welcomed the news that the US is beginning to talk about recognizing Vietnam as a market economy. It believes this could be a great advantage for Vietnamese businesses, especially in administrative reviews of anti-dumping taxes on shrimp and pangasius and anti-subsidy investigations. In addition, other barriers and regulations may also be reviewed in a more relaxed and favorable manner.

While Vietnam’s pangasius sales to the EU were down 7% y-o-y at some $70 million in the first five months of 2024, VASEP believes Vietnamese firms can capitalize on the EU-Vietnam Free Trade Agreement to take advantage of the continued economic difficulties there.

VASEP forecasts that pangasius exports can climb 10% in Q3 with fuel and logistics costs cooling, though that may have been before freight rates shot back up late in May.

On May 26, the Financial Times reported that the cost of international shipping has soared as businesses prepare to ship goods for the festive season far earlier than usual, “in a sign of the far-reaching effects of disruption from attacks in the Red Sea.”

The average cost of shipping a 40-foot container between the Far East and northern Europe at short notice, the figure that is most sensitive to market prices, hit $4,343 late in May, roughly three times higher than the same time in 2023, it said.

Melissa Woodhouse, vice president of US importer Western Edge Seafood, told Undercurrent that “although shipping has become more prompt recently, the steady rise in vessel costs is likely to drive prices even higher from Q3 2024 through early Q1 2025.”

She said the US had seen the supply of raw materials for 3-5oz and 5- 7oz fillets become constrained, leading to a “7-8% increase in prices over the past month.”

“It seems raw material supply for smaller sizes should rebound by Q4,” she added.