TARIFFS DEAL BIG DISADVANTAGE TO SEAFOOD IN PROTEINS’ BATTLE FOR US CONSUMER DOLLARS : Undercurrent News

Trump’s global tariffs have an unequal impact on seafood, disadvantaging it against other proteins, such as chicken, pork and turkey — By Cliff White and Tom Seaman | April 10, 2025 17:11 BST

The United States is a net exporter of chicken and turkey, and its imports and exports of pork are about even. That’s bad math for the seafood industry in tariff-happy US president Donald Trump’s second term.

The US imports a huge percentage of the seafood it consumes. So, thanks to the generalized 10% tariff he hit nearly 200 countries with on April 2, seafood is about to become even more expensive in the US than its protein rivals, which already dwarf it on consumption rates, warn a group of seven global seafood executives interviewed recently by Undercurrent News.

Equally damaging, they also might exacerbate seafood’s reputation as less affordable compared to other proteins, they said.

Count the National Fisheries Institute (NFI), the US’ largest seafood-related trade group, as among those with deep concerns.

“Seafood already faces all sorts of barriers to consumption on the preparation and access sides of the equation,” NFI chief strategy officer Gavin Gibbons told Undercurrent

Even in spite of the 90-day delay he ordered Wednesday (April 9) on higher, country-specific tariffs, the 10% tariffs remain in place for all except for Canada, Mexico and a group of other countries that now send the US little seafood, including Russia.

Undercurrent did the math.

The US imported 3.2 million metric tons of seafood worth $25.8 billion in 2024, while exporting 1.2m metric tons worth $5.0bn — amore than 5-1 ratio. After subtracting the $7.6bn in combined annual import values generated by Canada and Mexico, and after adding the combined 125% tariffs applied to Chinese products, that means the US is potentially looking at more than $3.7bn in combined seafood-related tariffs.

And that doesn’t include the 25% tariff applied to most Chinese seafood products during the first Trump term.

How exactly the tariffs will impact protein prices in the US, and subsequently US consumption, remains to be seen, primarily because the US’ primary trading partners for beef, chicken, pork and turkey are also Canada and Mexico, which Trump has threatened repeatedly with 25% tariffs on food and other items, but which currently still trade most goods tariff-free due to the US-Mexico-Canada Agreement.

Regardless, though it’s too soon to have concrete data confirming a drop in US seafood consumption, consumers are reacting negatively to the budding trade war, said Anne-Marie Roerink, the founder and president of 210 Analytics, a Florida-based market research firm.

“From a consumer point of view, we’re definitely seeing some unease over the tariffs and their potential impact on prices and availability of goods,” she said.

Andy Harig, vice president of tax, trade, sustainability and policy development at FMI-The Food Industry Association, agreed seafood will likely get more expensive due to Trump’s tariffs.

“About 70-80% of the US seafood food supply is imported, and that is not a number that the US domestic industry can plug,” Harig told Today. “So you’re going to see that the cost of the seafood department go up.”

Glenn Sakata, a seafood wholesaler at Marine International Products, in Hayward, California, said he’s already seeing seafood prices rise, making sushi-lovers’ favorite indulgence an even bigger splurge.

“The price of sushi will definitely be more expensive,” Sakata told the Associated Press. “Sadly, yes, there will be a big impact.”

Even before Trump’s ignition of a global trade war earlier this month with his reciprocal tariffs, seafood had been struggling to gain market share versus other proteins in the US food market.

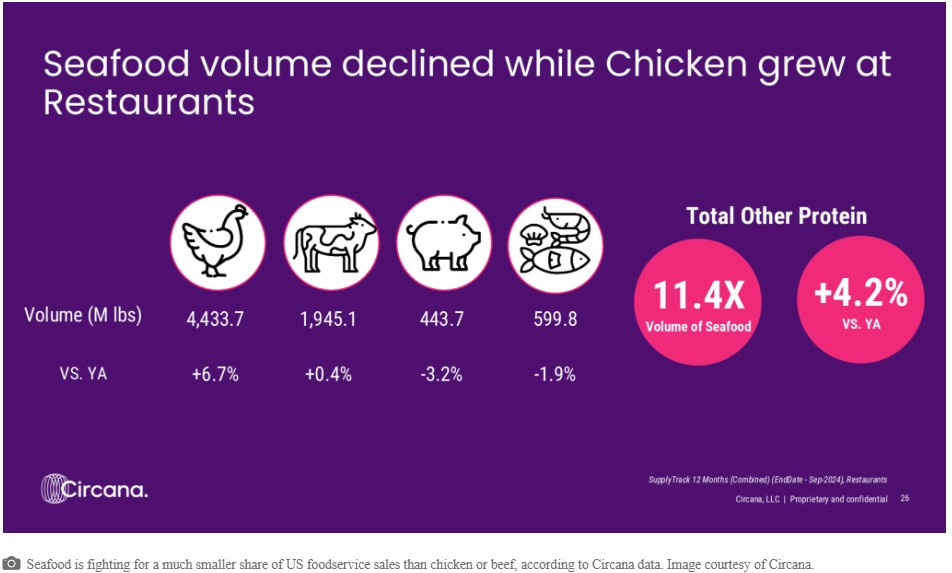

Chicken was already nearly ubiquitous in US restaurants, and US chicken consumption grew last year by 6.7% year-over-year, while seafood consumption declined 1.9% over the same period, Undercurrent reported in January.

Beef sales in US restaurants increased 0.4% in 2024, and the total volume sold was more than triple seafood sales, according to Circana data. Only pork fared worse than seafood, dropping 3.2% with lower sales than seafood.

Len Steiner, founder and principal of the retail and foodservice consultancy Steiner Consulting Group, warned in his 2025 economic outlook webinar for the Meat Institute that a trade war will impact the pricing of all proteins, and could actually make chicken, pork, turkey and even beef — despite the fact that the US is a net importer — cheaper for US consumers compared to seafood.

“It could mean a decrease in demand for the products, and a subsequent reduction in prices,” he said, WATT Poultry reported.

Bloom: Consumers forced to choose

In contrast, very few seafood executives believe seafood prices will decrease as a result of the tariffs.

“If the tariffs go into effect as currently written and structured, there is no doubt that business will be impacted. We will be looking at prices where consumers will be forced to make different protein choices due to economic concerns. Domestic seafood production can nowhere satisfy demand for many species, so seafood consumption will naturally be negatively impacted,” Eric Bloom, president of Eastern Fish Company, told Undercurrent.

Bloom’s company, based in Teaneck, New Jersey, and owned by Japanese conglomerate Marubeni, had around $400 million in seafood sales in 2023, mostly shrimp and crab.

Jeff Stern, co-president of Central Seaway Company (CenSea), which was acquired by Indian e-commerce firm Captain Fresh last year, is also worried US seafood consumption might drop as a result of the tariffs.

“It is too early to fully assess what will happen as a result of this, but yes, it could affect consumption. Markets don’t like higher prices and uncertainty – seafood [will become]more expensive as compared to other proteins by the tariffs,” he said.

Mike Shimchick, the owner of Stellar Pacific Seafoods, which trades Alaskan and Canadian seafood, said US consumers will not keep buying seafood if prices go any higher.

“The margins in our industry are already tough, especially with the processors with labor and material costs elevated over the past three years. Consumers won’t pay for these tariff-influenced increases,” he told Undercurrent.

Jim Gulkin, the CEO and founder of Siam Canadian Group, said he’s worried about how US consumers will react to the tariffs.

“Margins in the seafood business are far too low for anybody along the supply chain, whether processor, exporter, importer etc., to be able to absorb the price increases due to the tariffs on Asian exporters. It will take some time for the market to adjust to higher prices and consumers will not react well. Consumption in the US will likely drop,” he said.

Stephanie Pazzaglia, outreach and development manager at Elkridge, Maryland-based seafood wholesaler JJ McDonnell, isn’t sure how the tariffs will impact her firm’s business.

“The tariffs are a tough topic. [It’s] uncertain how the industry will adapt and react. At JJ, we are working to navigate how it will affect the products and species we are importing from the various countries,” she said.

Undercurrent heard from many others, too.

Jose Antonio Camposano, executive president of Ecuador’s National Chamber of Aquaculture (CNA), is concerned about US consumption changing as a result of the tariffs.

“Inflation affects consumer behavior. There is a chance that shrimp could be replaced by other proteins,” he told Undercurrent

Andreassen: Farmers will pay

Johan Andreassen, who built up Villa Organic farms in Norway and also co-founded land-based US project Atlantic Sapphire in Florida, was a solitary voice of calm regarding the impact tariffs will have on seafood prices and consumption in the US.

US tariffs on salmon from all supply sources other than Canada will increase costs to the consumer, but not as much as people might assume, he posted on LinkedIn.

“There’s a lot of noise in the market. It’s creating uncertainty, for sure. But I still believe it’s unlikely that what was announced [April2] will end up being the long-term reality. And even if it does stick, the actual impact on consumer prices is going to be less dramatic than many assume,” wrote Andreassen.

“A 10% tariff at the import level doesn’t mean prices go up 10% on a restaurant menu,” he said. “If a salmon dish sells for $25 and the raw salmon portion costs $3.50, a 10% increase on the fish only adds $0.35. Even if the restaurant adjusts to maintain its food cost ratio, the menu price only needs to go up by about 5%. In many cases, it won’t go up at all.

“Retail is the same,” he added. “A 10% increase at the wholesale level might translate into a 5-8% increase at the shelf, depending on how margins are managed. It’s a real impact, but it’s not a 1:1 shock.”

The end consumer is unlikely to be the one to take the hit here, he added.

“A lot of the cost may end up falling on the farmers – who, historically, have enjoyed high profit margins and are still likely to make money even with tariffs in place.”