Vietnam could be waiting until 2024 for pangasius demand to fully pick up: Undercurrent News

Vietnam’s vannamei and black tiger shrimp exports leaped y-o-y in January, though this was more down to Tet occurring in January 2023; sources predict a tough and volatile H1 2024

Neil Ramsden: UnderCurrent News

Neil Ramsden: UnderCurrent News

Vietnam’s vannamei and black tiger shrimp exports leaped year-on-year for January 2024, though this was more down to its Lunar New Year celebration (Tet) occurring in February this year, rather than January, as it did in 2023.

Meanwhile, sources told Undercurrent News they expect a difficult and volatile first half of 2024, at least, for the sector.

According to a Ho Chi Minh City-based consultancy compiling trade data for Undercurrent, the average export price across all product specifications to all markets for vannamei dipped in January, while the indicator for black tiger rose slightly. More on January at the subheading below.

The shrimp sector is facing a number of headwinds as 2024 begins, and the situation could worsen. At the turn of the year, demand in key markets slumped, Vietnamese prices were still uncompetitive when compared to rivals India and Ecuador, and the US could yet add countervailing duties to the existing anti-dumping duties on Vietnamese shrimp products.

“The shrimp industry [in Vietnam] is going to be a bit volatile this year,” said Undercurrent’s contact at the consultancy. “There’s a lot of potential for people to switch over to shrimp from Ecuador and India, which has been happening already.”

He reported seeing first-hand that some small customers had already switched, adding this was a worry as it indicated the potential for other, larger importers to do the same.

“It’s difficult to really say with any confidence what’s going to happen; I think the first quarter is very unknown. I would expect things to pick up a little bit in Q2 and then see what happens after that,” he said.

“Also, now you’ve got the Red Sea crisis, so the cost of shipping’s going up massively with these container ships going around the Cape of Good Hope instead of through the [Suez] Canal. That’s an extra two weeks of transport time, and what that equates to in cost, I can imagine, is quite a lot.”

Jean-Charles Diener, director of inspection and consulting services company OFCO Group, agreed.

“The shipping costs are hitting the whole sector, prices especially, but I think maybe it hits cheaper products like pangasius more. That said, I think the most affected market is for reprocessing in Vietnam – – to ship raw material in and then ship the same finished product out, you are talking about multiples of what the cost was before.”

As Undercurrent reported last year from Vietfish in Ho Chi Minh City, a big part of what makes Vietnamese shrimp uncompetitive is the production cost per individual animal that survives to harvest.

The source with the consultancy doesn’t see that issue easing for Vietnam this year.

“The big problem with shrimp here is that farms use such high stocking densities to counteract the mortality from the disease outbreaks that it actually just makes things worse,” he said. “They think if they stock more, then they get more out in the end. But it just makes the water quality worse, and the disease risks higher. That’s the big difference between Vietnam and Ecuador — Ecuador is very low-scale [in intensity]. They only stock a few shrimp per square meter, when in Vietnam, it’s like 150 to 200 per square meter.”

It remains a very reactive business, he said. In 2023, India halted exports of rice, and Vietnamese shrimp farmers, struggling to make a profit with the crustacean, turned to that crop instead. It happens also with fruit; farmers are fast to switch away from shrimp to, for example, durian, if the demand is there.

Diener echoed this, pointing out that Vietnam’s big advantage is black tiger shrimp.

“With black tiger, we compete with only two other countries. I think increasing the proportion of black tiger would really help,” he said, though said there were no imminent signs of this.

Ecuador’s continued strong development in shrimp production is bad news for Vietnam, he said, and that could get worse as Ecuador moves into value-added shrimp products — one area where Vietnam does hold an advantage.

OFCO facilitates exports around the world, and Diener said that while plenty of customers buying frozen shrimp blocks, “simple products,” had switched to Ecuador, the volumes of cooked shrimp goods have not changed much at all.

Siam Canadian’s sales manager for shrimp in Vietnam, Oanh Tuong, also told Undercurrent that 2024 would be another tough year for the shrimp industry, primarily down to competition, made worse by the specter of countervailing duties on sales to the US.

“Exporters and packers are working on documentation to prepare for the US anti-dumping and countervailing duties. It is another battle for the Vietnam shrimp industry. Surely, it has serious impacts if they are brought in. Vietnam shrimp will face stronger competition with more costs added on,” she said.

Diener echoed that, simply adding, “We don’t need that. It will be very hard if we have that. I just hope we’ll not get them.”

“The Red Sea crisis will lead to higher costs in transportation, which means the cost of products will be higher. It also causes unstable worldwide logistics and supplies,” Tuong added.

However, she said there were some “good signals that the market is warming up. Importers started asking for new offers for new year purchases. Prices are going to move up because of higher transportation costs and materials.”

January stats swayed by Tet

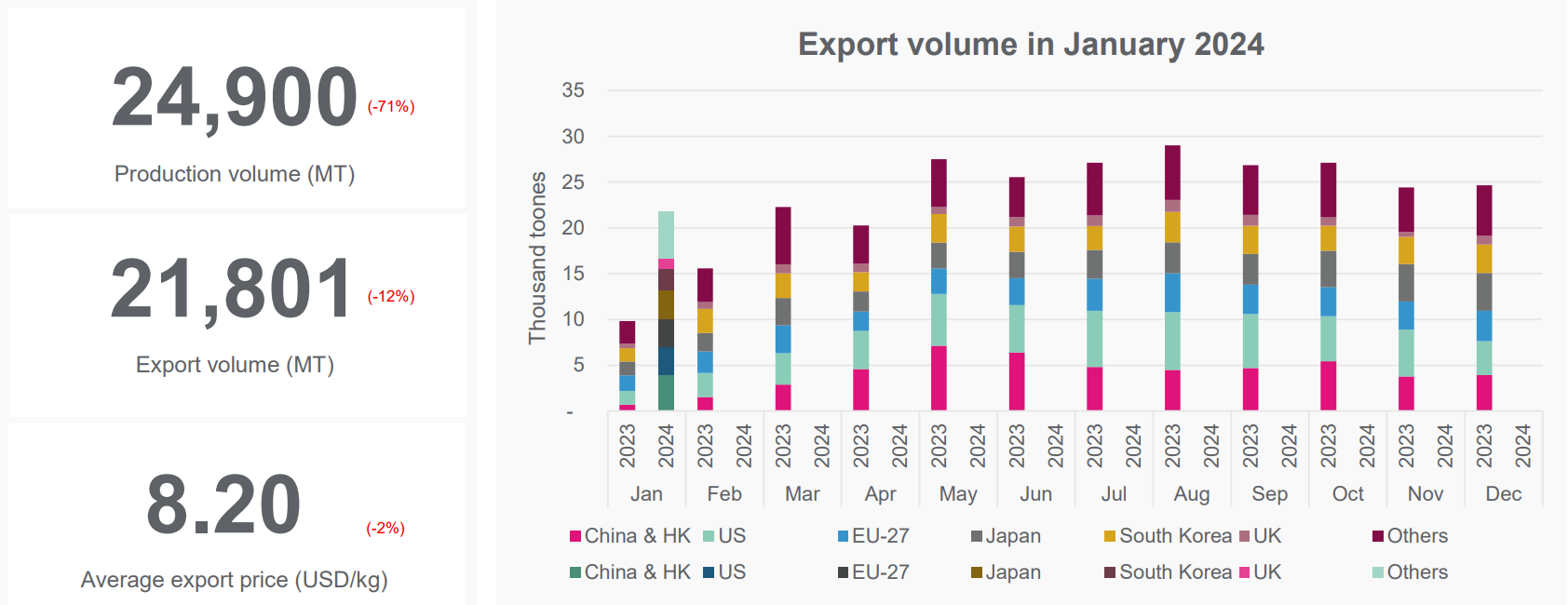

In January 2024, Vietnamese vannamei exports decreased 12% month-on-month to 21,801 metric tons, though that was up 122% over January 2023 as a result of Tet arriving in January 2023 and February 2024.

“Exports to China and Hong Kong went flat this month with a slight rise of 1%. Exports to the UK also rose by 14%. Meanwhile, other main markets recorded a reduction in import volume comprising the US (-17%), the EU (-10%), Japan (-21%) and Korea (-26%),” the consultancy wrote.

Undercurrent’s source at the consultancy pointed out that while export volumes haven’t changed too much between 2022 and now but, “it’s all shifted to China, so it’s all low-cost commodity.”

“It has been revealed that the number of new orders for the first quarter of 2024 is still limited.

Consumption from major markets like the US, the EU, China, Hong Kong and others is not strong, while shrimp sources from main producers like Ecuador, India and Vietnam are still abundant.”

The average export price across all products sold to all markets eased 2% m-o-m to $8.20 per kilogram.

“For the US market, the increasing freight rates (due to the Red Sea crisis) affect the price of new orders and the expected delivery schedule. The exporters and their partners are also waiting for updates on anti-subsidy taxes, so they are not in a hurry to sign new orders for large volumes.”

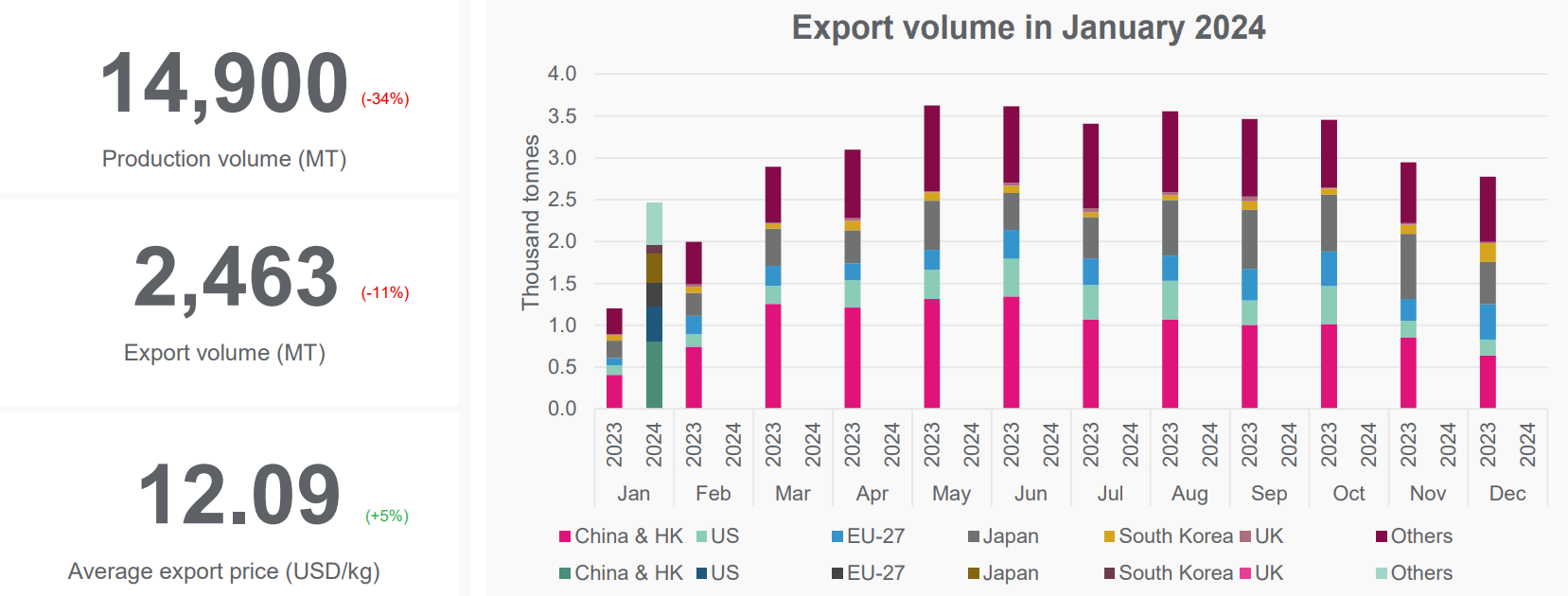

The export volume of black tiger shrimp, meanwhile, was down 11% in January, at 2,436t. That was up 105% y-o-y.

“There is a considerable increase in export volume to the US (+112%) and China and Hong Kong (+28%). Nevertheless, exports to other main markets decreased, including the EU (-34%), Japan (-29%), Korea (-57%) and the UK (-71%).”

“Shrimp trading is relatively quiet this month since it was the off-peak season for black tiger exports, especially in the EU, UK, Japan and Korea. The demand in the EU and UK markets has decreased after the Christmas and New Year holidays. Japan and Korea also did not show many positive signs.”

Exports to the US, China and Hong Kong increased in January as Vietnamese enterprises tried to fulfill export orders to these markets before the Lunar New Year, the consultancy added.

The average export price for all specifications of black tiger products to all markets was up 5% m-o-m at $12.09/kg.

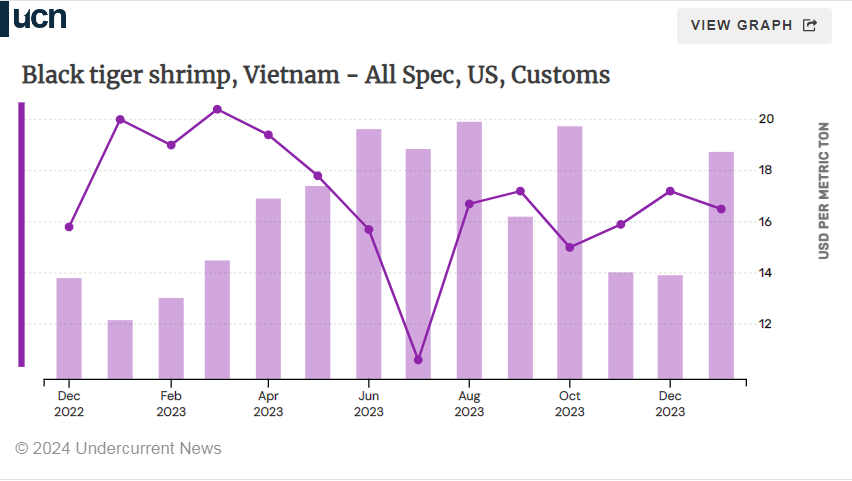

US imports fall again, but prices rise

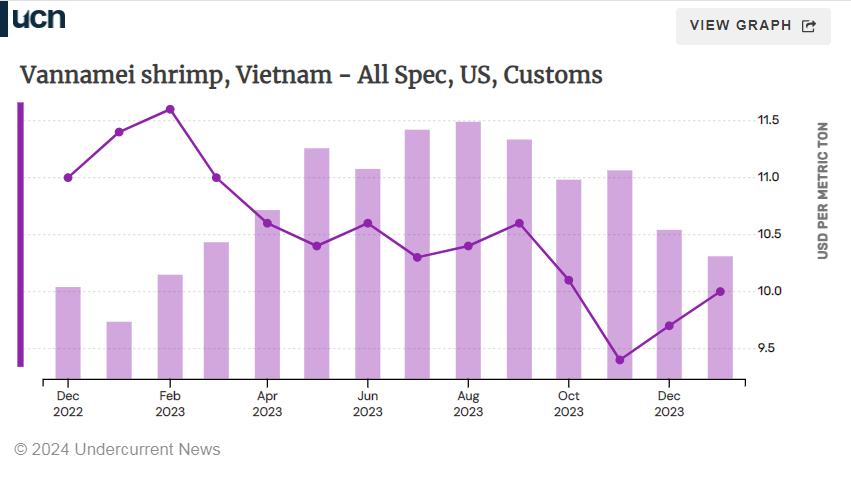

As mentioned above, the export price of Vietnamese vannamei shipped to the US was up 3% in January to $10.00/kg.

However, volumes fell m-o-m to 3,088t, the lowest since February 2023.

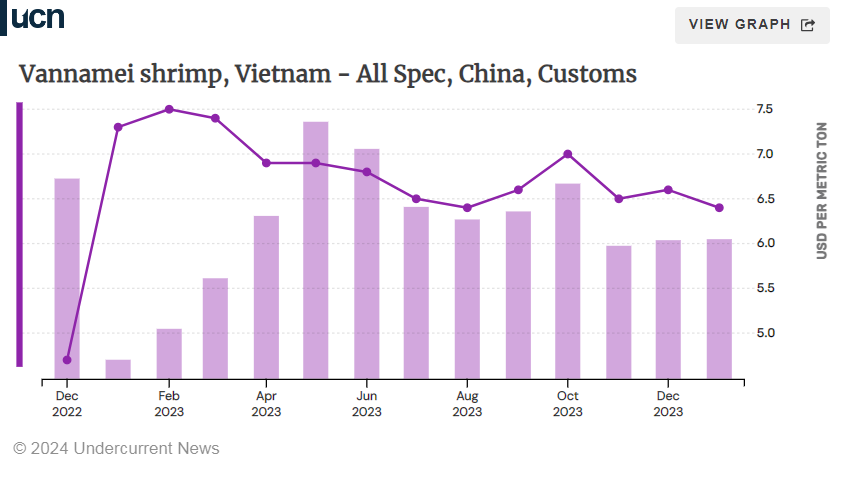

China’s imports have remained stable for the past three months and were 3,941t in January. Prices dipped 3% to $6.40/kg, back to the lowest levels they reached in 2023.

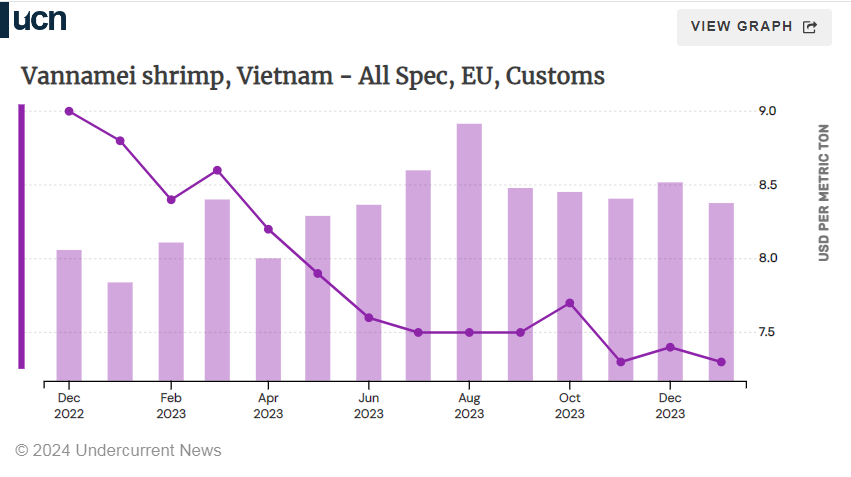

The EU’s imports, as mentioned, slipped 10% to 2,980t, with the average price at $7.30/kg. That’s back at the lowest since Undercurrent’s data began — at least at the beginning of 2015.

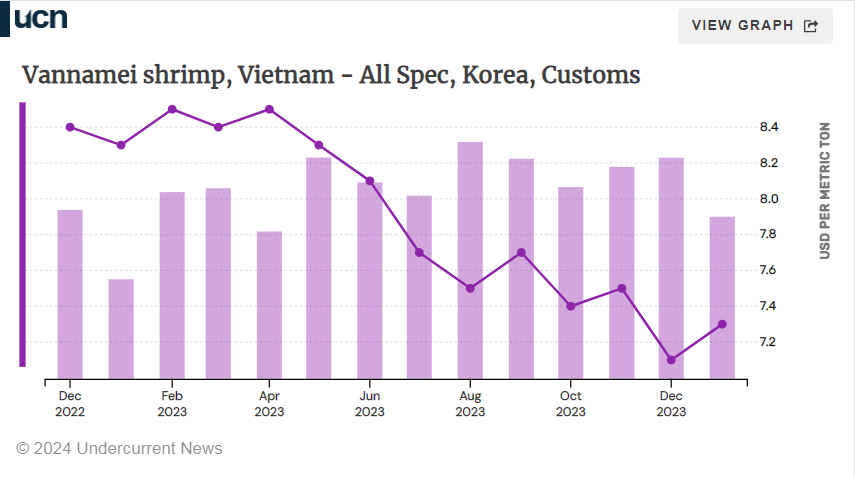

In Korea, volumes in January may have fallen to 2,302t, but the average price level lifted 2.7% to $7.30/kg.

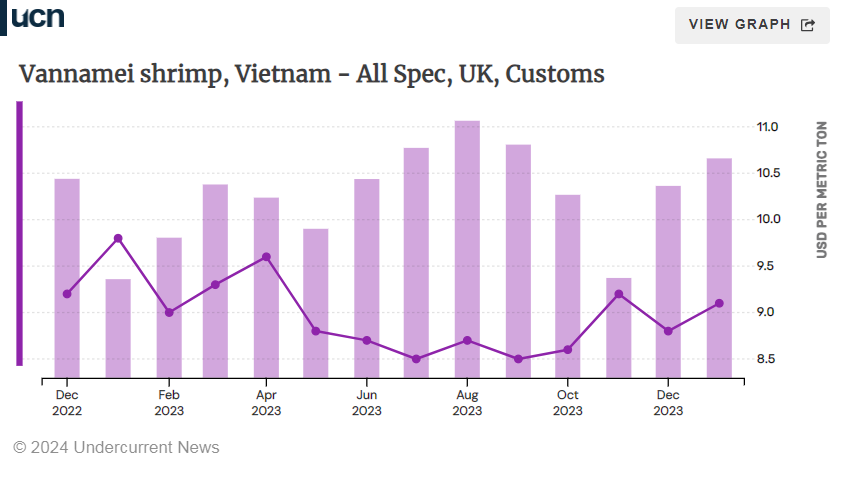

And for the UK, prices climbed 3.3% m-o-m to $9.10/kg, while volumes rose to 1,115t — the highest since September.

EU, Japan black tiger purchases drop

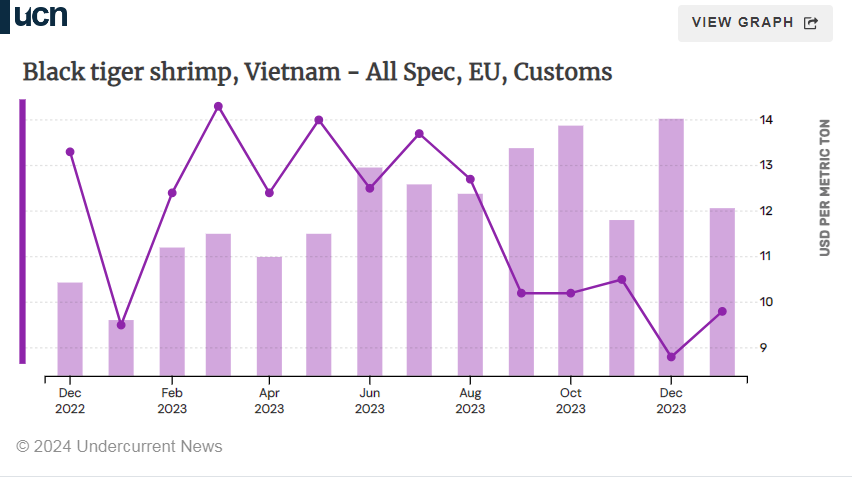

The EU’s black tiger shrimp imports leaped in December to 421t — the most it had bought in one month since October 2022 — but dropped again to 278t in January.

December’s rush may have been prompted by the fact that prices were down 16.2% m-o-m. January saw prices come back by 10.2% to $9.80/kg

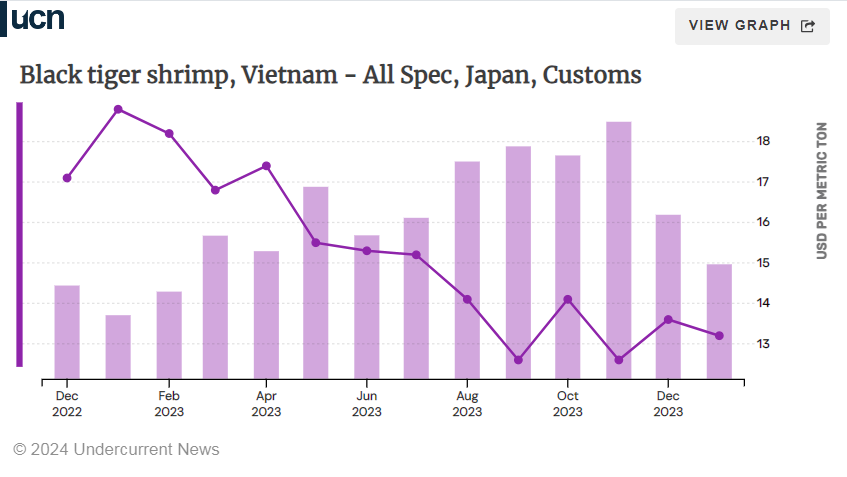

After a strong November when Japanese imports reached 781t — its highest purchases since 2020 — they dropped off again in December. January saw another fall in volumes to 358t, and prices eased 2.9% to $13.20/kg.

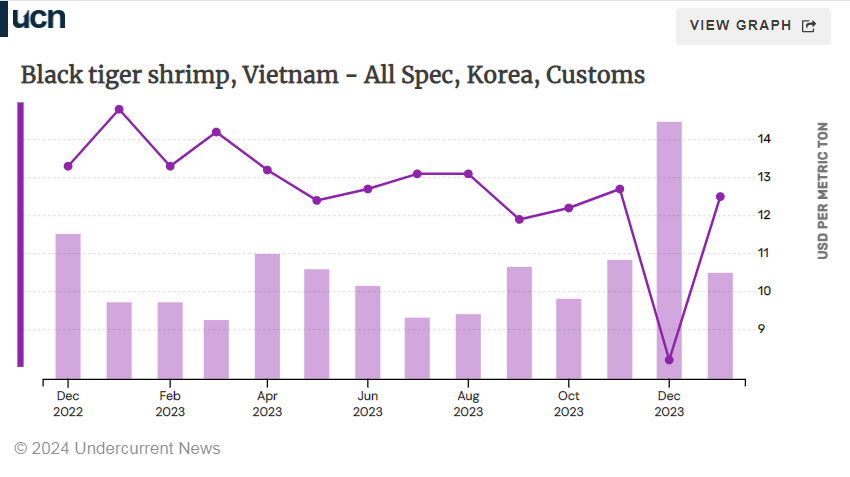

South Korea’s black tiger imports hit 223t, its highest monthly amount since 2018, in December, but they fell back as prices fell 35.4% to $8.20/kg.to just 95t in January. Prices bounced back from a dramatic low in December to $12.50/kg in January.

The US and China saw increased imports in January.

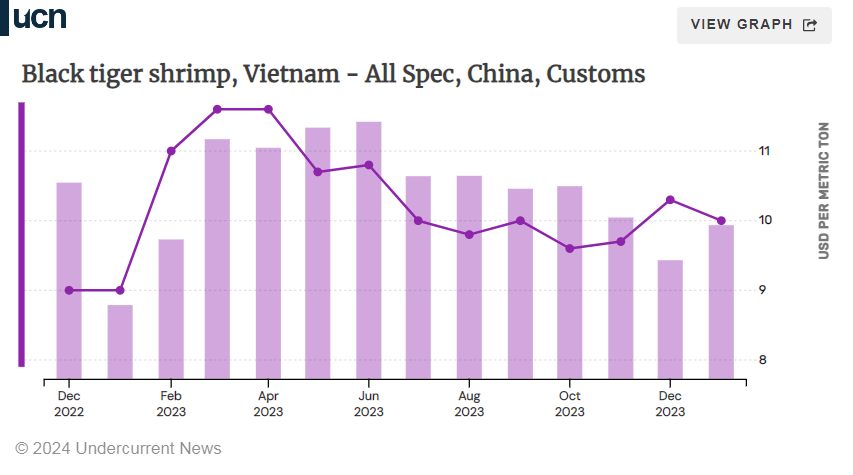

China’s import rise was only slight, from 637t to 816t. Prices eased 2.9% to $10.00/kg.

But the US saw a hefty increase in import volumes for January, rising to 410t.

The average price slipped 4.1% to $16.50/kg.