Vietnam’s pangasius firms could be hit worse than shrimp by US tariff, despite lower level : Undercurrent News

The main markets for Vietnamese pangasius are slow and stable, which is largely being seen as a good thing after a tough 2023; sources are calm on a possible shortage of raw material

Neil Ramsden : Undercurrent News

The Vietnamese seafood sector looks to be one of the worst-hit by the new US reciprocal trade tariffs that were announced on many of the most important suppliers on April 2.

Vietnam will be hit with a tariff of 46% — judged by the US to be half the rate it charges in turn — and for shrimp, that comes on top of a 25.76% anti-dumping rate and a 2.84% countervailing duty tariff, meaning a total tariff of 74.6%.

And yet, Jean-Charles Diener, director of OFCO Group — a French inspection and consulting firm based in Vietnam — told Undercurrent News he feared more for the pangasius sector.

“If these tariffs take effect on April 9 and include seafood, this will heavily impact the pangasius and shrimp industries,” he said. “It’s hard to believe the US would impose a46% tariff on seafood from Vietnam, but if it happens, the repercussions on the pangasius industry could be huge.”

Shrimp companies, too, would be significantly impacted, but it is a more resilient industry, he believes.

“It’s crucial to consider that the US market is essential for the stability of pangasius. The growth of pangasius [in Vietnam] since 2000 has been largely driven by the US market and its similarity to American catfish. The American lobby for catfish is very strong, and while they oppose pangasius imports, this competition helps support both pangasius and American catfish in the US market. Both products are very similar,” he claimed.

The US may be the second-largest market for pangasius exports, but it is crucial for stability, he stressed. “China is the biggest market, but it often brings more chaos than stability to the industry.”

“If pangasius really faces a 46% tariff, I believe prices will drop, and within a few weeks or months, the market will become more confused than ever. Farmers might significantly reduce farming, leading to a shortage of raw materials by the end of the year. This is not in anyone’s interest because while some importers might appreciate lower prices, this will create a lot of confusion in the market in the medium term.”

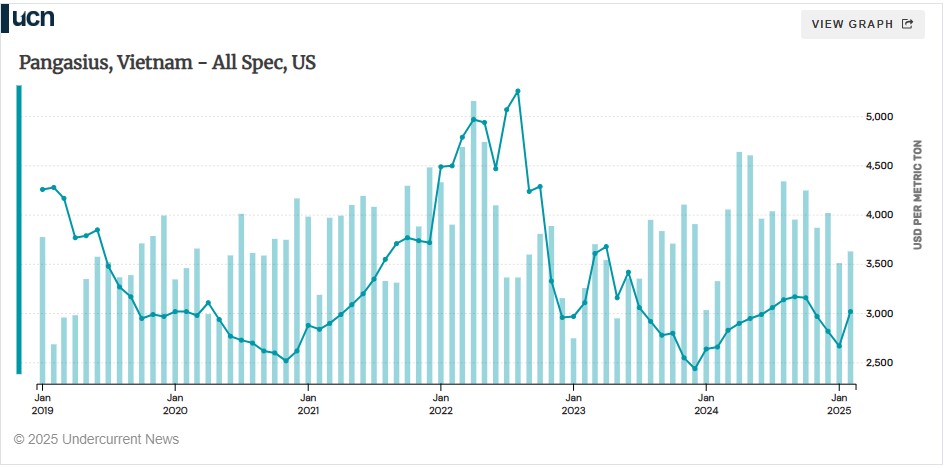

The chart below, from Undercurrent’s prices portal, shows Vietnamese customs data for all specifications of pangasius product shipped to the US, and the average export price across them.

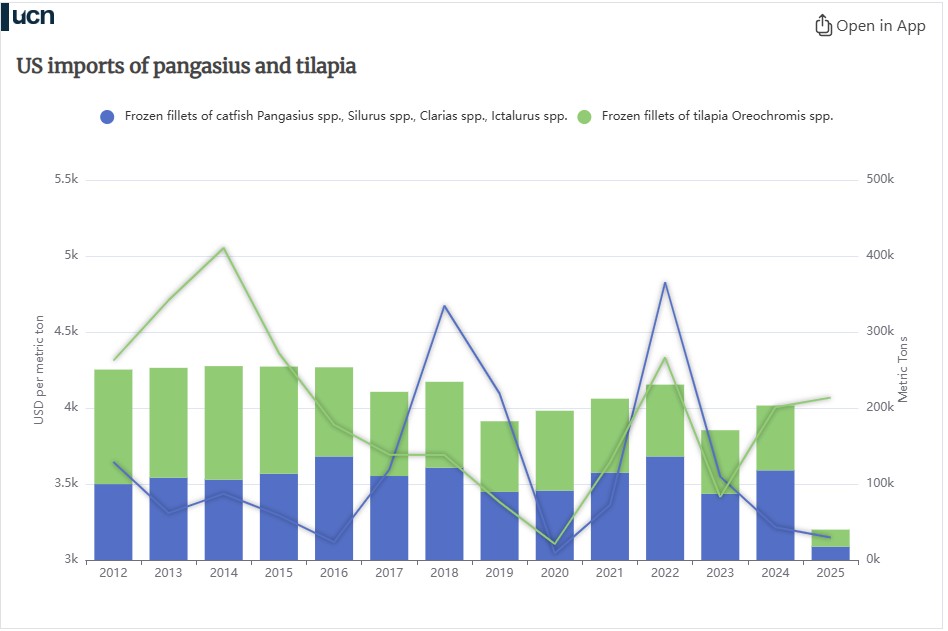

Vietnamese pangasius competes in the US with tilapia and American catfish. These tariffs (34%) might also affect tilapia from China, which could boost American catfish, even though the production cycle in the US is much longer compared to pangasius in Vietnam (eight-to-10 months for pangasius versus 18 to 36 months for American catfish), he said.

Chinese sales of tilapia products now face a combined 79% tariff on sales to the US, though, so that may prove an opportunity for Vietnam.

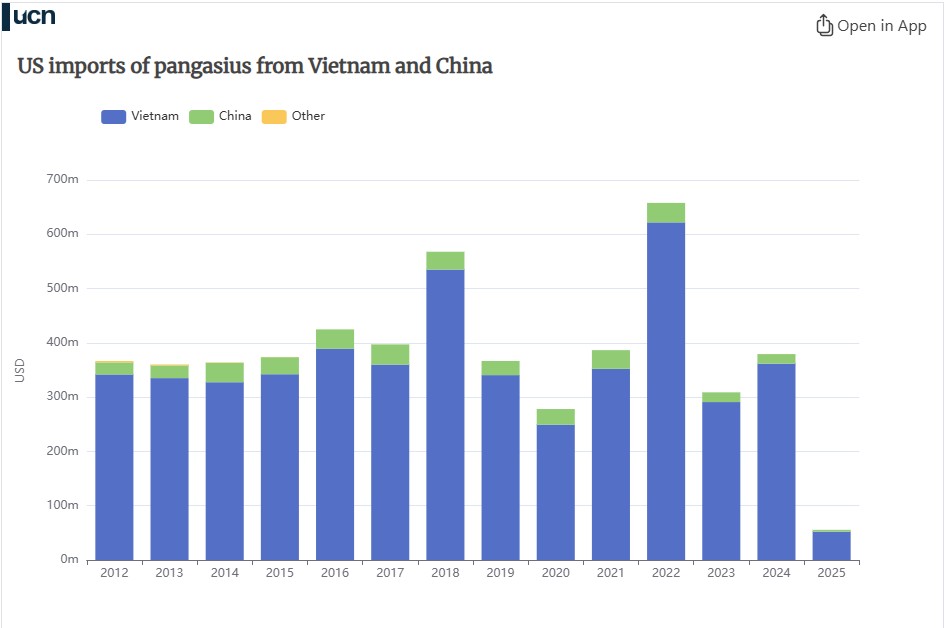

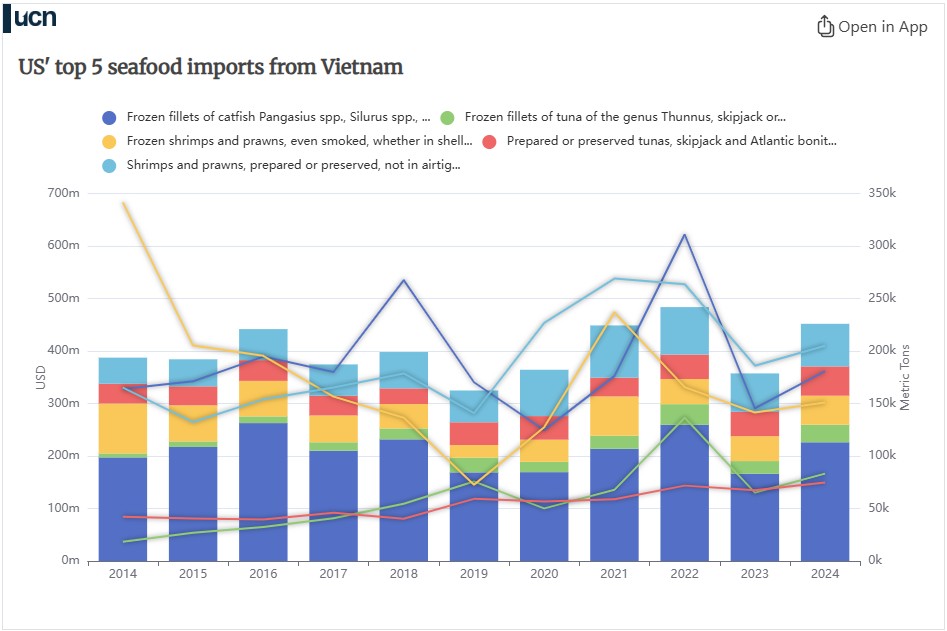

The Vietnamese Association of Seafood Exporters and Producers (VASEP) says total pangasius sales value in 2024 surpassed $2 billion and that the US made up exports worth $345 million.

VASEP has urged the government to consider cutting tariffs on imports of seafood from the US to 0% — the move Ecuador made ahead of the tariffs announcement, which seemingly paid off, with Ecuador receiving a 10% rate.

Some of Vietnam’s biggest seafood firms rely on US

Vietnam’s largest exporter of pangasius, Vinh Hoan Corp., saw 54% of its total 2023overseas revenue of $307.8m come from sales to the US — that was a total that was down year-on-year, and a decrease to the US in particular.

Vinh Hoan’s sales to the US were up 33% in 2024, reaching $153.5m, according to VASEP estimates issued ahead of the company’s annual report release. The year before, 54% of its exports had gone to the US.

The domestic Vietnamese market was the second-largest at VND 3.5 trillion ($136.1m)in 2024, up 25.6% y-o-y — a potential bright spot if the company needs to diversify further.

Sales to Europe reached an estimated $82.5m in 2024.

Vinh Hoan has informed shareholders that the new US tariffs could result in profit after tax falling by as much as 30% in 2025. CEO Tam Nguyen said: “Based on our preliminary assessment, we estimate that the announced 46% reciprocal tariff may negatively impact 2025 net profit after tax by 15% to 30%. However, the situation remains fluid, and the actual impact may vary depending on how the tariff is implemented and other factors beyond our control.”

Its share price has fallen around 13% since news of the tariffs broke, to VND 54,500($2.11).

Nam Viet Corp. (Navico), the second-largest pangasius exporter in the country, saw a drop of 13.3% to VND 14,300.

International Development and Investment Corporation, which commonly goes by IDI, is another company that may be in a tight spot if tariffs on Vietnam stand.

In January 2025, it began construction on a plant worth almost VND 700bn (around$27m as of April 7) that has been set up to focus on sales to the US market. A much-improved anti-dumping rate was expected to be a boon to it this year.

Since April 2, its share prices have dropped 13.6% to VND 6,440.

Camimex Group, another pangasius exporter, is another to have seen decreases in the days following the US announcement; on April 4, its share prices were VND 6,960, down13.4% from market close on April 2.

Cuu Long Fish is down 5.3% at VND 9,490.

Shrimp market in immediate disarray

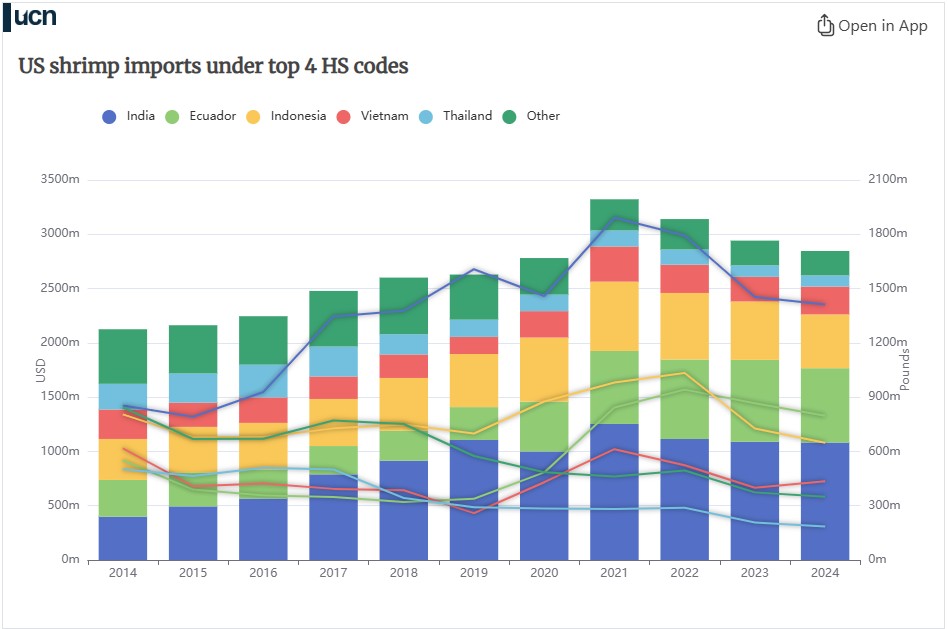

The US is also a key market for Vietnamese shrimp, shipping almost 70,000t worth nearly $725m in 2024, according to data available at Undercurrent‘s trade portal.

In 2024, the US imported 19% of all the shrimp exported from Vietnam (and 17% of the total pangasius exports).

The Vietnamese office of global trading business Siam Canadian Group told Undercurrent the market for exporters was chaotic and that shipments had been put on hold pending negotiations or further clarity.

“In the short term, sales to the US will be dropped. Factories may switch to other destinations to balance their market share. However, the other destinations are not able to cover the exported volume of the US. Many people think that price will drop significantly

due to the US tariff problem, but we have to wait and see until everything is clear.”

Undercurrent reported on April 4 that this was true across India and Southeast Asia, with shrimp suppliers holding off on shipping pending US orders, hoping to re-negotiate deals and include at least part of the added cost in their charges.

Shrimp exporters’ shares have reflected the negative outlook, with the largest exporter, Minh Phu Seafood, seeing them fall 26% to VND 9,700.

Thuan Phuoc Seafoods has slipped 12.5% to VND 8,400, and Sao Ta Foods (commonly known as Fimex Vn) is down 13.4% at VND 40,800.