High inventories, cost-of-living crisis challenge US shrimp market: Intrafish

Low prices, high inventories and tight warehouse space are just some of parts of a conundrum facing those with shrimp to sell.

John Evans: Intrafish

The US shrimp market is struggling to shrug off the global cost-of-living crisis despite prices at rock-bottom levels.

Seafood consumption in the US has slowed over the past six months with consumer confidence ebbing, mostly as a result of inflation, although unlike some seafood items, shrimp prices have been softening, according to Jim Gulkin, managing director of Thailand-based exporter Siam Canadian.

“Shrimp demand has been slower than normal for this time of year. There is a still a problem in the US market of excess, higher-priced inventory and current weaker pricing from Asian and South American origins,” Gulkin told IntraFish.

These were themes echoed by an importer of Indian shrimp, who said with shrimp prices at such low levels, those holding inventory may be tempted push product into the market.

“Shrimp prices are low, there can’t be any better time to promote shrimp,” the importer said, noting that it is difficult to explain why sales are slower than usual, especially in the foodservice sector.

Both market sources said much of the inventory will be worked through during the holiday season, helping to firm up the market as it moves into the New Year, but that remains to be seen.

Importers are also faced with the difficult choice of trying to buy lower-priced shrimp when inventories are full, while the tightness of warehouse space in the United States is a pressing issue.

The downside of purchasing lower-priced shrimp in anticipation of higher prices is the potential impact on company balance sheets.

“Probably a lot of importers would start taking losses,” the importer of Indian shrimp said, calculating that prices have fallen by about 18 percent since August, depending on size and product form.

The United States was Ecuador’s first export market 40 years ago, and is today the largest supplier of shrimp to the country, thanks in part to a stunning run of production growth this year.

Despite tougher trading conditions, shrimp shipments from Ecuador were 7 percent higher in the first 10 months of this year compared with a year earlier at just under 356 million pounds.

At the same time, Ecuadorian shrimp producers are pushing ahead with investments aimed at serving the US value-added market and say they will be ready once the economy picks up.

“We are planning to be at the Boston seafood show (in March) and try to actually grow our offer there and try to be a little more active on promotions,” Jose Antonio Camposano, president of shrimp producers’ trade body Camara Nacional de Aquacultura (CNA), told IntraFish.

In the US market orders specifically for Lent and Easter can sometimes be placed in November.

However, the most concentrated sales period of the year is thanksgiving through the Super Bowl when the majority of orders for that period are typically placed before August, Gulkin explained.

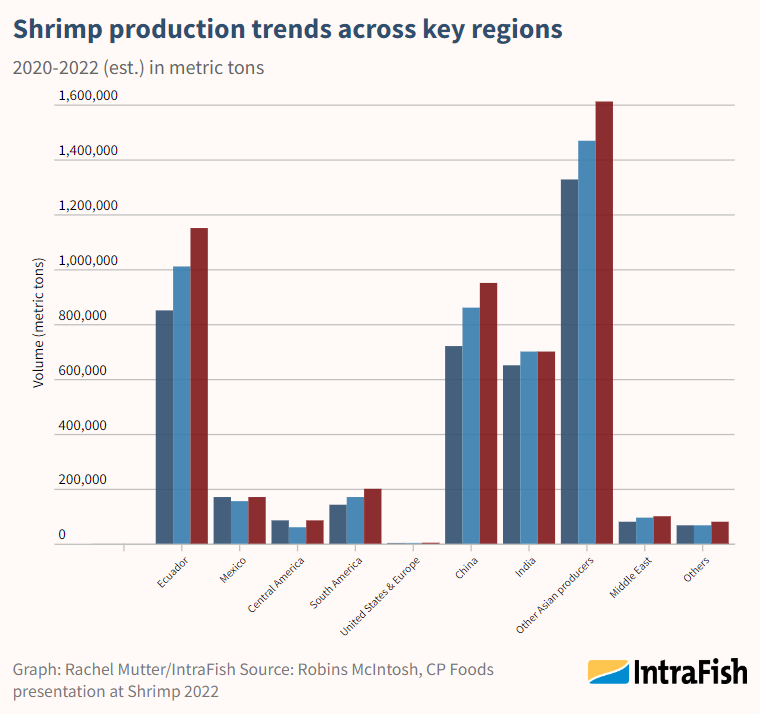

Shrimp production globally has trended up over the past year, and Rabobank forecasts production will jump 7 percent next year to reach 6 million metric tons for the first time ever.

While the overall trend is an expansion in demand, question marks hang over recessions in the US and Europe, as well as China, where Xi Jinping’s “zero-COVID” policy has weighed on consumer spending and wreaked havoc with both imports and exports of seafood.