Pangasius markets in doldrums, but short supply should spur price rises: Undercurrent News

Hopes are largely pinned on export market improvements in the second half of the year but if that does happen, supply may well be unable to meet demand

Neil Ramsden: Undercurrent News

Vietnamese pangasius exporters’ hopes are pinned on an improvement in international demand in the second half of 2023 — but if that does come about, there may not be the supply to meet it, sources told Undercurrent News.

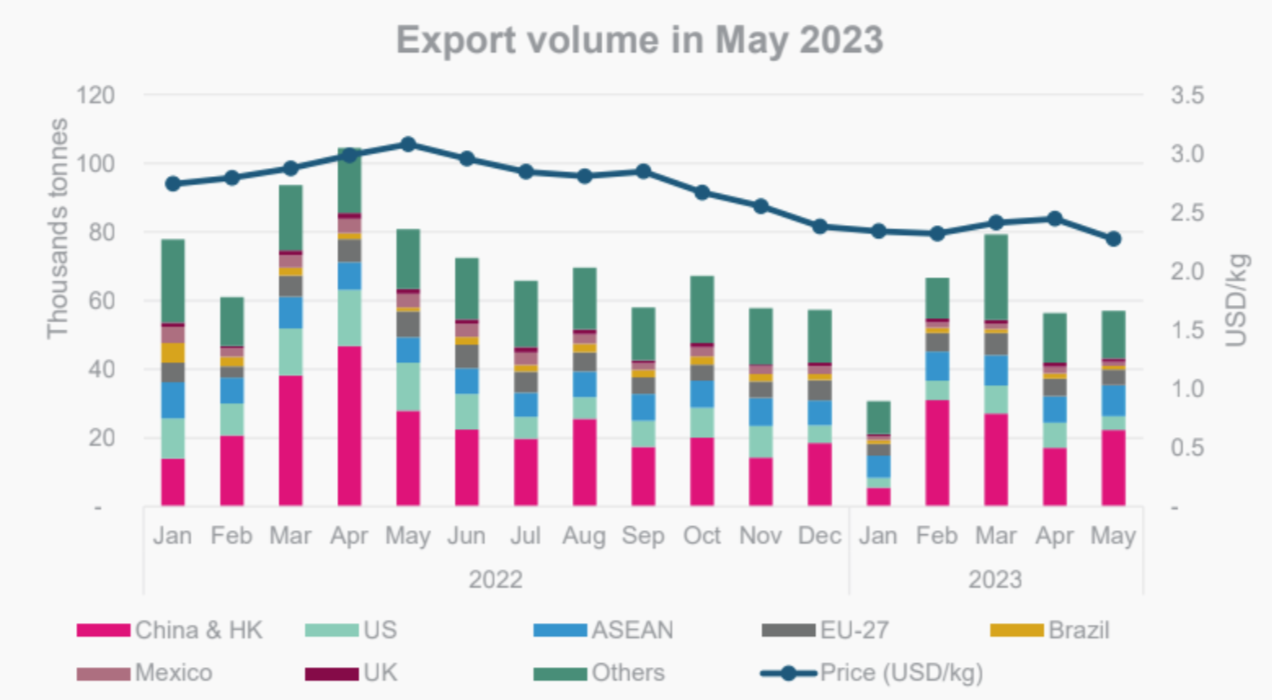

In the first five months of 2023, according to the Vietnam Association of Seafood Exporters and Producers (VASEP), total seafood sales from the Southeast Asian nation have plunged 28% to$3.37 billion. Pangasius sales have dipped 41% to $690 million.

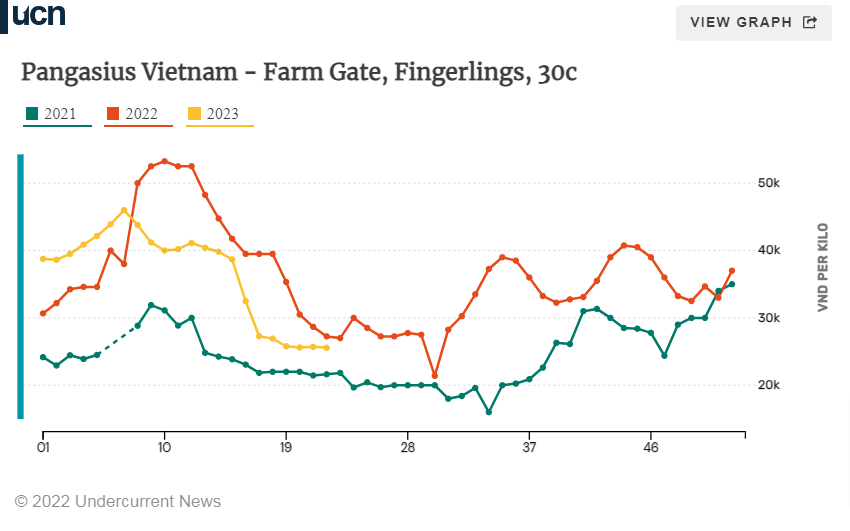

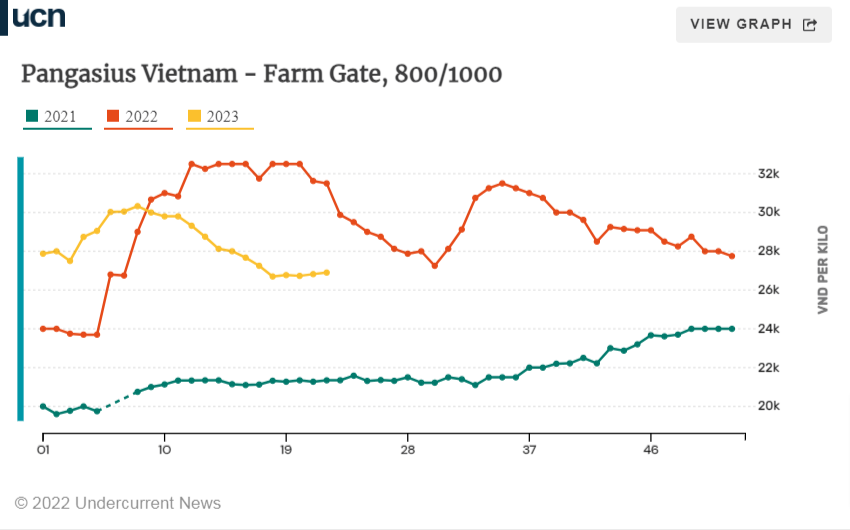

As previously reported by Undercurrent, Vietnam’s production of pangasius fingerlings was poor early in 2023. That pushed up the cost for farmers to re-stock their ponds, and in the months that followed, demand has sunk quite dramatically, meaning there has still been little incentive to re-stock.

“Fingerling prices were between VND 40,000 and VND 50,000 [per kilogram] early in 2023, so people were very reluctant to stock at that time, and that went on a little bit longer than we thought it would,” said a source in the country working on analyzing data for Undercurrent.

“Even in April, they were still VND 38,000/kg, which is still very high. Prices have come down in May, but we’d assume there’s not been a huge amount of stocking in the first quarter.”

That’s likely to mean a shortage of pangasius raw material for processing in five-to-seven months, he said, before — around three months after that — “the market will be inundated again.”

“It’s the same cycle again, where people don’t stock because production costs are higher than sales costs, and then the prices drop again, and then everybody starts to stock, but then that causes the market price to drop. We’re still stuck in that vicious circle.”

Le Thi Thuy Trang, sales manager with Siam Canadian Group’s Vietnamese office, confirmed that the firm expected supply to be interrupted.

“We are in very hot weather because of El Nino. With this weather, farmers are afraid of fish dying, so they are delaying rotating the new crop,” she said early in June. “Plus, with the slow market, farmers are leaving the ponds empty to wait for prices to trend up. To my thinking, new crops starting late will affect the supply for the next four-to-six months.”

More recently, fingerling prices have become far more enticing for farmers, the first source said. The usual season for fingerling production was delayed somewhat by unusual weather patterns, but now availability is much higher, and stocking will likely rebound.

Prices still low for now

Hence, the industry largely hinges on a lift in demand from key export markets China, the EU and the US.

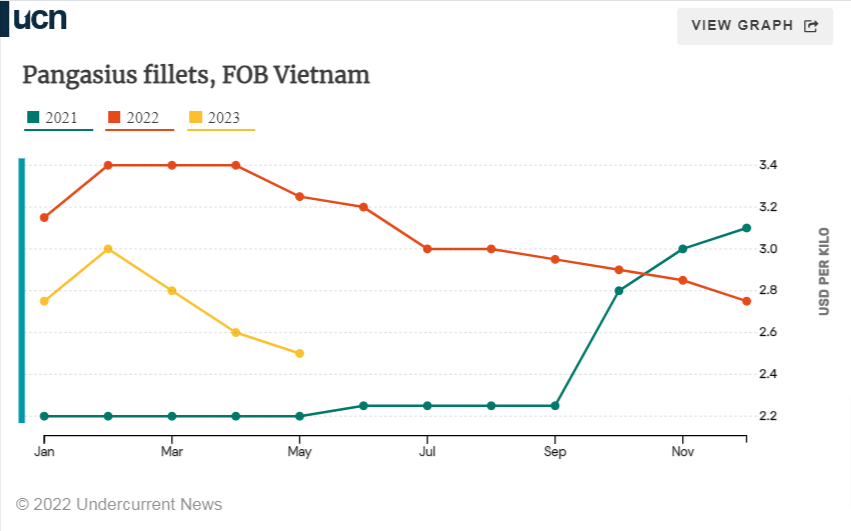

“This year is really tough, not only for the pangasius market but also for all seafood businesses. The market is very slow,” said Trang. “According to a report by VASEP, shipments of pangasius dropped a lot; under the pressure of orders, pangasius packers are willing to lower their prices[for export],” she said.

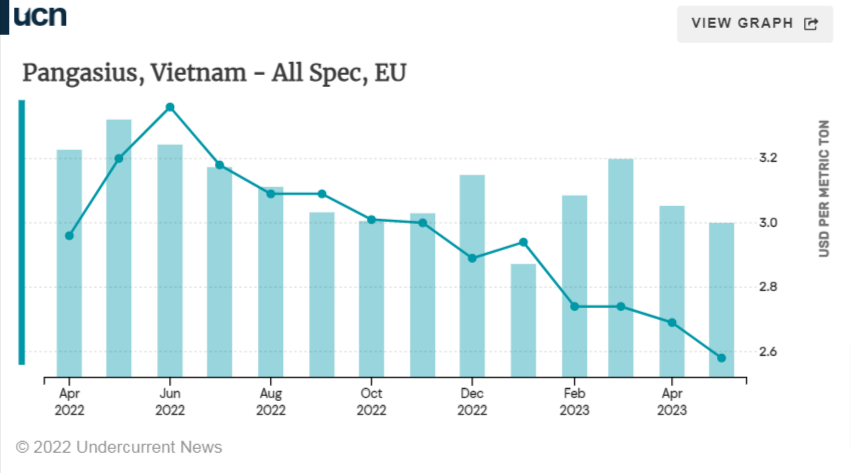

As June began, prices for product being shipped to the EU were between $2.10 and $2.20 per kilogram, delivered cost and freight, 80% net product weight, she estimated.

The price for 100% net weight shipments is $2.50-$2.60/kg.

Another source — a purchaser with a large European importer — gave Undercurrent a similar quote of $2.40-$2.65/kg for 100% net weight, delivered freight on board.

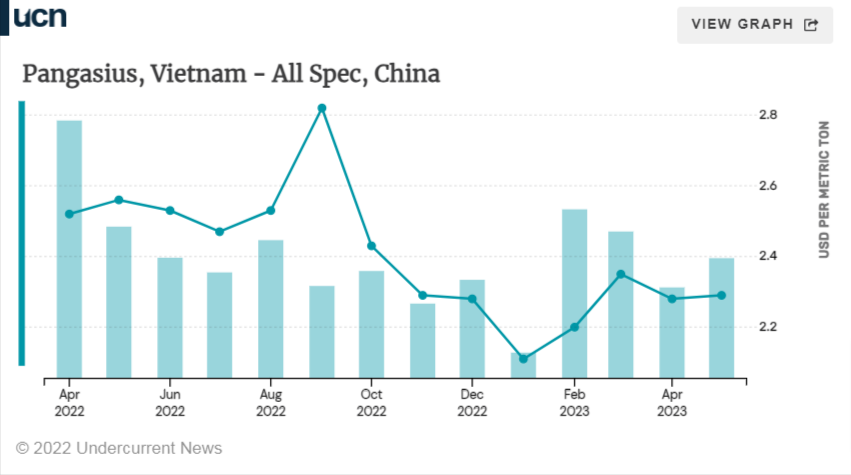

“The prices have come down a bit [over the last couple of months] because of lower demand from both China, the US and EU, all three main markets,” he said. “There’s some variation in the offered prices due to different strategies from factories.”

The aforementioned source with a consultancy based in Vietnam added that he had heard talk of high inventories in key markets, too.

“There’s a big lack of demand for most markets — I think it’s only really the UK where the demand has increased a bit — but also, I keep hearing that there are big stockpiles, warehouses full of frozen pangasius all over the place. A lot of people are actually saying that. It’s possibly going to keep affecting demand over the next couple of months,” he said.

Siam Canadian’s Trang told Undercurrent that inventories in Vietnam, at least, were not too big, as packers had been limiting their stock levels due to tight cash flow.

These packers have been cutting the amount of pangasius they buy from third-party farmers in recent months, the source with the consultancy added.

“The big companies contract a lot of their supply out to others, while also having their own production. At the moment, because the demand’s so low, they’re not actually buying from any of these contract firms and are just using their internal supply. Which is quite rare, actually, and that’s happening all over the place.”

Global demand for pangasius should begin to pick up again as inventories are used up, he said.

“It will pick up in a couple of months once the stockpiles start to dwindle and people start harvesting again. It’s a bit unusual this time of year, but it’s not surprising, especially with what’s going on in the world with inflation, Ukraine and Russia, and so on. Everyone’s tightening their belts, but there’s been some positive financial news coming out, so maybe things will start to look up in the next couple of months.”

Trang, too, hoped that August and September would see the market “warm up for year-end purchases.”

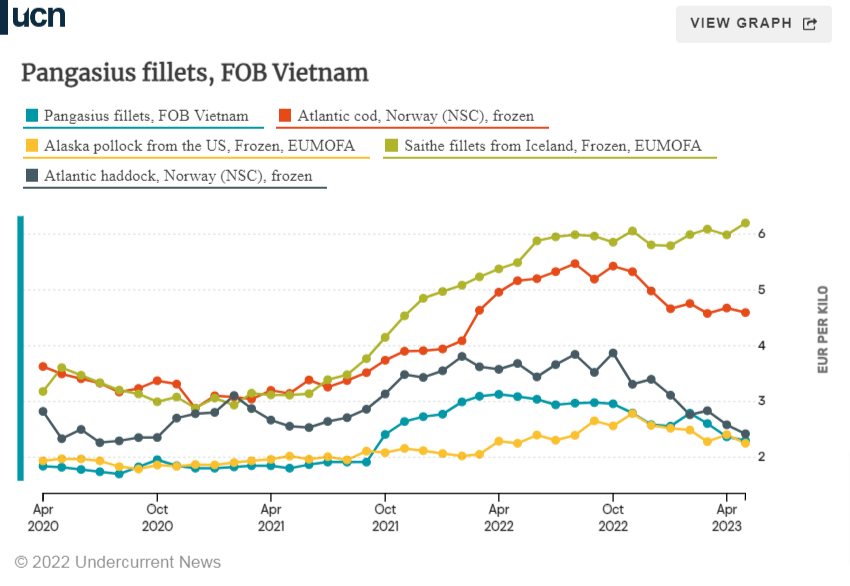

“I think in the summertime, demand will be better — all the main markets will prepare for Christmas and New Year holidays.” Pangasius prices remain highly competitive next to other whitefish and could gain market share, she suggested.

That said, the Ho Chi Minh-based consultant suggested the pangasius industry could have some concerns over how competitive it is these days.

“The cost of some other whitefish is really starting to come down now. That’s really what started the whole pangasius industry, the cod crash in the North Atlantic, and then people started switching to whatever they could, which turned out to be pangasius, and now the fisheries are bouncing back, and the price is coming down.”

“So I think that will have maybe quite a long-term impact on the industry. Maybe in a few years, there will be a big change for this [pangasius] industry.”

The US view

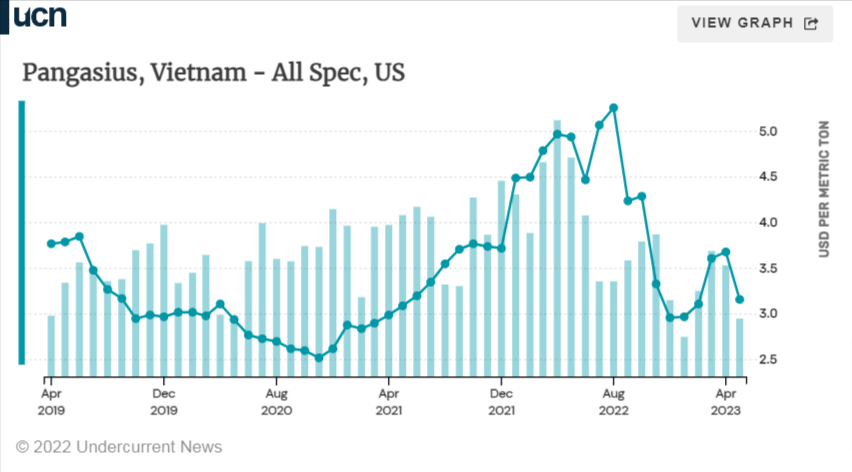

The US market had been one of the more positive for Vietnamese pangasius since January from a price point of view, though volumes have been down dramatically year-on-year.

May data shows a downturn in the export prices from Vietnam to the US, back to the lows seen at the turn of the year. However, an argument could be made that price levels have just normalized to where they were before the coronavirus pandemic hit Vietnam hard, from April 2021 onwards.

“The US buyer has been placing orders but continues to be conservative with purchases, and most of the contracts placed are for fixed programs,” Seattle Shrimp and Seafood’s senior director of sales, Bob Noster, told Undercurrent.

“If the demand doesn’t increase soon, we can expect [Vietnamese] packers to discount prices further in the hopes they can trigger a reaction,” he suggested.

In the meantime, packers have “moderate demand” and have, therefore, “continued to pull from their own or contracted ponds to fulfill pending orders,” he said about June.

“New price offers have decreased a bit compared to the previous month, mainly due to reduced ocean freight costs and less demand. Demand from China is down and is not expected to change over the next 30 days, while Europe has been buying for their retail sector, but the volume is still considered slow.”