Siam Canadian: US shrimp demand to recover this summer, with caution: Undercurrent News

With retail and distributor inventories effectively bottoming out, Siam Canadian is expecting a wholesale improvement in demand for shrimp within the next two to three months

Dan Gibson: Undercurrent News

BANGKOK, Thailand — It’s been a long, tough 12 months for suppliers of Asian shrimp to the US, a market that became so oversaturated with vannamei shrimp of all shapes and sizes in late 2022that commodity prices have done little but tumble ever since.

The good news, according to Jim Gulkin, CEO of Thai-based seafood trading firm Siam Canadian, is that there are signs of demand returning, the scale of which will shape global shrimp markets for the rest of the year.

“What I’m hearing is that the cold storages are actively looking for new accounts now,” he told Undercurrent News at his company’s head office in Bangkok, Thailand. “That’s what I’ve been told from several sources. And it is common knowledge that the inventories have dropped significantly, and it only makes sense; if imports have dropped significantly for nine to 10 months in a row, then inventories are dropping too.”

Global shrimp prices have been on a rollercoaster ride in the last three years, soaring in late 2021 as the return of foodservice complimented growing retail demand among housebound, lockdown consumers — before overwhelming supply left inventories full to bursting last year, while Los Angeles port experienced its legendary log-jam.

“It was a mess because there was just so much product in the country,” explained Gulkin. “And then, the interest in retail dropped off. Foodservice picked up significantly, obviously, as restaurants reopened, but not enough to make up for the shortfall in retail.”

Retailers, he said, haven’t made too much of an effort to get the shrimp supply glut through their systems and were unwilling to drop prices or promote their excess product in order to protect their margins.

“But now we’re getting to the tipping point where importers are going to start to buy again,” he continued. “So things are going to start to pick up within the next few months. Could be as early as June, could be as late as July or August; but it’s going to happen because people haven’t stopped eating shrimp — it’s actually cheaper than before the inflation issues started.”

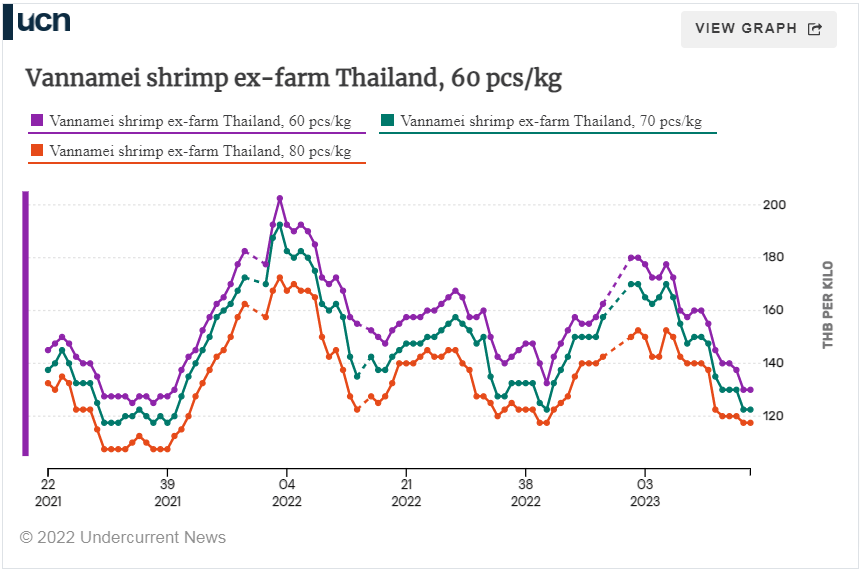

In fact, medium-sized 60-count Thai shrimp has fallen to roughly THB 130 ($3.80) per kilogram by week 18 (May 1-7), the lowest level in nearly two years, according to the latest data from Talay Thai shrimp auction market (see below).

It’s a similar story for smaller 70-count and 80-count animals, each selling at exceptionally low averages of THB 122/kg and THB 117/kg.

Given the situation, a sharp improvement in US demand would be warmly welcomed by processors and farmers across Southern and Southeast Asia.

“But it’s going to be a typical situation where everybody’s going to be jumping on the bandwagon at the same time, a herd mentality. One retailer starts and decides they’re going to order, a few others follow, the importers start to order, wholesalers, foodservice distributors start, they say ‘we need to replenish stock,’ and then the prices will move up.”

“They’re not going to move up massively, and it’s not going to be like 2021, but prices will move off the bottom.”

It’s an improvement likely to affect most, if not all, categories of shrimp product, as Gulkin believes the current inventory shortage in the US “is pretty well systemic.”

“The US will be actively buying cooked, tail-on product, shrimp rings, easy peel, peeled tail-on, peeled tail-off, the whole range of shrimp products,” he said.

“For the headless shell-on blocks [from Asia], not much. The bulk of the old headless shell-on blocks will be coming from Ecuador.”

Where Ecuador is concerned, the Latin American country has still not yet moved into value-added shrimp production as much as first feared, nor are they likely to soon, according to Gulkin.

“A number of companies in Ecuador have moved in this direction, but they haven’t caught up with Asia yet. So it will be some time before they can, and I don’t think they have the labor pool and abilities to do that. It’s more difficult than people imagine,” he said.

“And if China comes back in full steam in terms of imports, then yes, there will be less interest from Ecuador to move towards value-added. If you can sell a head-on shrimp at a very good profit, it’s much easier and much faster than having to cook it.”

Don’t expect repeat of 2021

A word of warning, however, before any traders get too carried away — it’s likely that US retail buyers will be considerably more conservative than they were during the pandemic when consumption was booming.

“I don’t think they’re going to go crazy like they did, so I don’t think there’s going to be massive orders placed. The lesson learned after 2021 is that people will be taking a more conservative approach to it — a lot of companies have gotten burnt on higher value items like crab and scallops and things that have dropped massively, losing their shirts on it.”

“But with shrimp, prices have moved down, but not like that,” Gulkin said. “So people are going to wait until there’s nothing [in the inventory] and then start ordering. I was expecting that things would already be moving now in May, but not much yet, it seems.”

Similarly, low spot prices have thrown up another problem seemingly shared by most major Asian shrimp producers: a lack of supply.

“Farmers certainly back off when raw material prices get too low. It’s happened here, and it’s going to happen in Vietnam as well, Indonesia not so much.

“So I think that the bigger problem towards the end of the year is going to be lower production out of India, lower production out of Vietnam, lower production out of Thailand. And I think when orders are placed, there’s going to be some difficulty at a certain point to meet them.”