US shrimp import freefall continues with no apparent stop for months: Undercurrent News

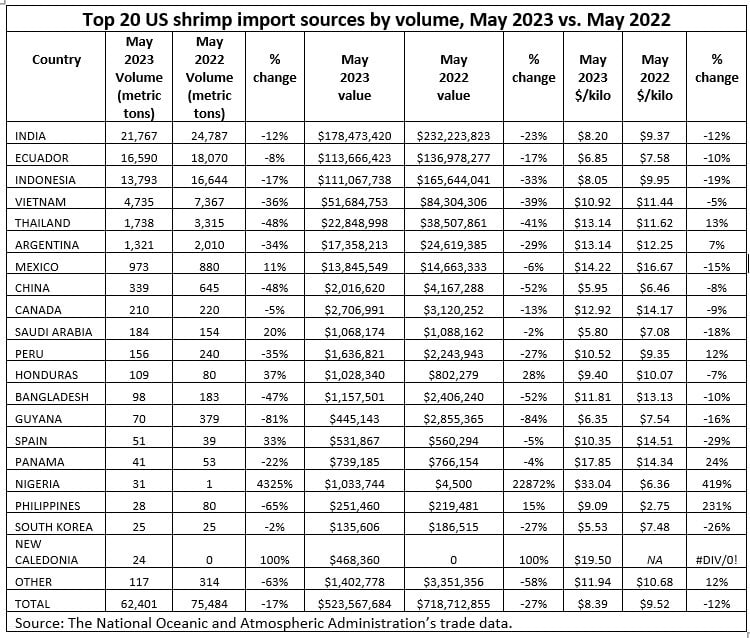

The US imported 62,401t of shrimp worth $523.6m in May 2023, 17% less volume and 12% less value than in May 2022, marking the 11th straight month of year-on-year declines

Jason Huffman, Daniel Hilliard and María Feijóo: Undercurrent News

The US shrimp import collapse is continuing with sector experts not seeing a break for at least another three months.

The US imported 62,401 metric tons of shrimp worth $523.6 million in May 2023, 17% less volume and 12% less value than in May 2022, marking the 11th straight month of year-on-year declines, reveals the latest update by the National Oceanic and Atmospheric Administration of its seafood trade data.

The average price in May was $8.39 per kilogram, 12% below the price that was being paid a year earlier but 2% above the average price reported in April.

The shrimp that came to the US was from as many as 35 different countries, including a few unusual spots, but Undercurrent News picked the top 20 to focus on, 14 of which sent the US less shrimp than a year earlier.

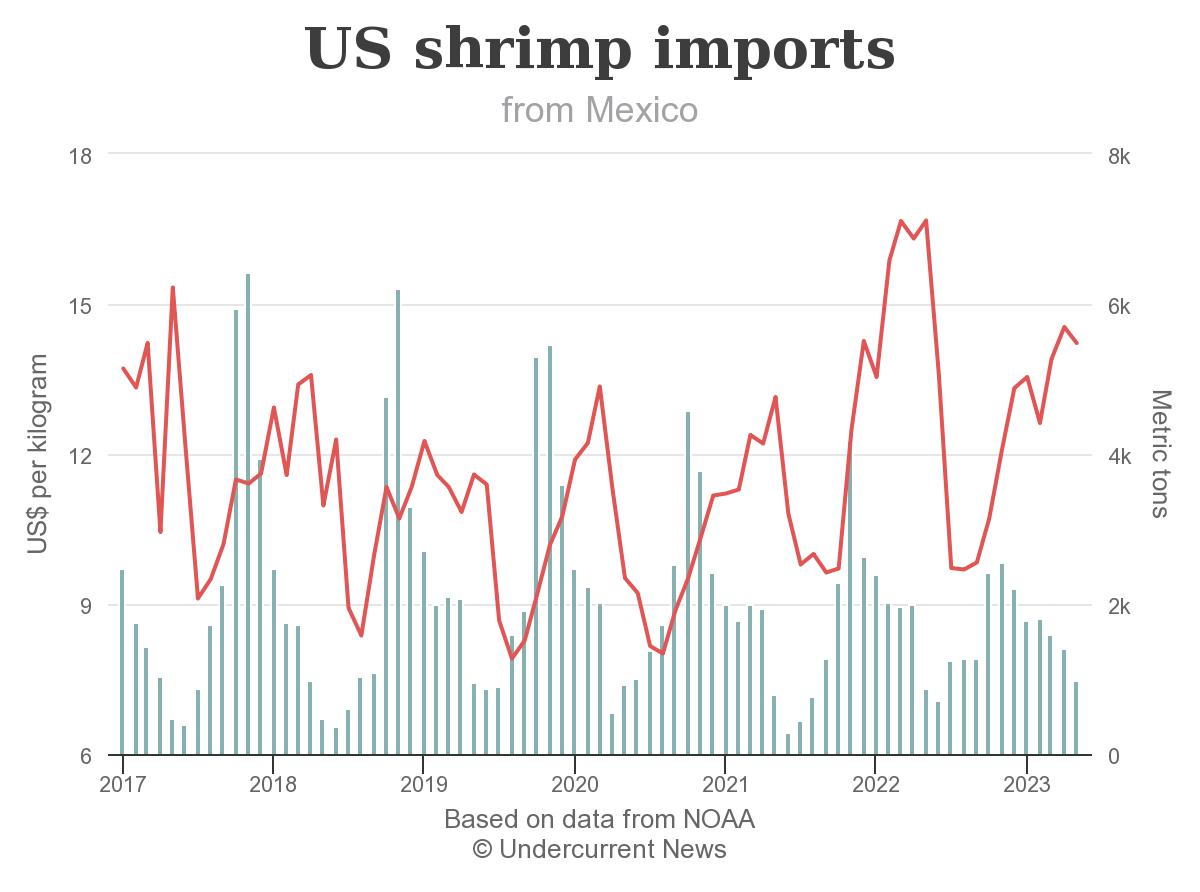

The six exceptions that saw their US imports rise included some unlikely source countries, like Saudi Arabia (20% more volume), Honduras (37% more volume), Spain (33% more volume),New Caledonia (100% more volume) and Nigeria (4,325% more volume). Mexico also saw a big jump in the amount of shrimp it sent the US — up 11%.

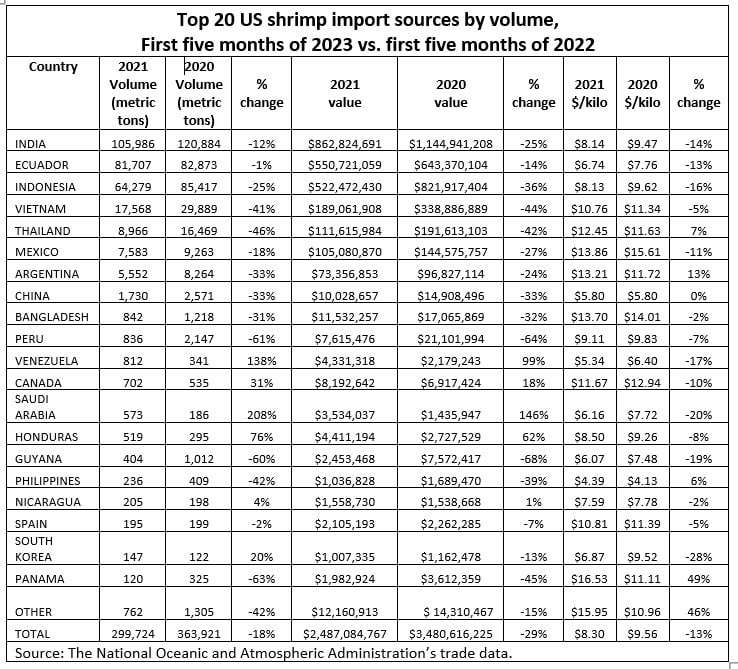

May seems to have followed a similar pattern as the rest of 2023, however. Over the first five months of 2023, the US imported 299,724t of shrimp worth $2.5 billion, 18% less volume and 29% less value than the first five months of 2022.

It’s practically a given that US import volumes will continue to fall through October, barring some large late-summer buying spree, said Jim Gulkin, CEO of Thai-based seafood trading firm Siam Canadian.

Gulkin said that current cost and freight pricing from both Asian and South American countries is “by and large below production cost, so as soon as importers, as well as retailers and other end-users, start purchasing in significant volumes, origin prices will move up immediately.”

When they might begin buying, though, remains the big question.

“Almost a year of well below average imports should mean that inventories are getting low, but buyers are being very cautious and seem to be trying to beat the system by waiting until they believe prices are at their very bottom so, surprisingly, they’re not moving yet,” he said.

“As pricing is already below production cost, we are already pretty much on the bottom price-wise or extremely close to it,” he added. “So if any retailer, wholesaler or other end-user anticipates that they will need any product between September and January-February ’24, they should make their move now because once the buying starts prices are going to move up and it will be a long time (I’m talking a year or longer) before we see these low prices again.”

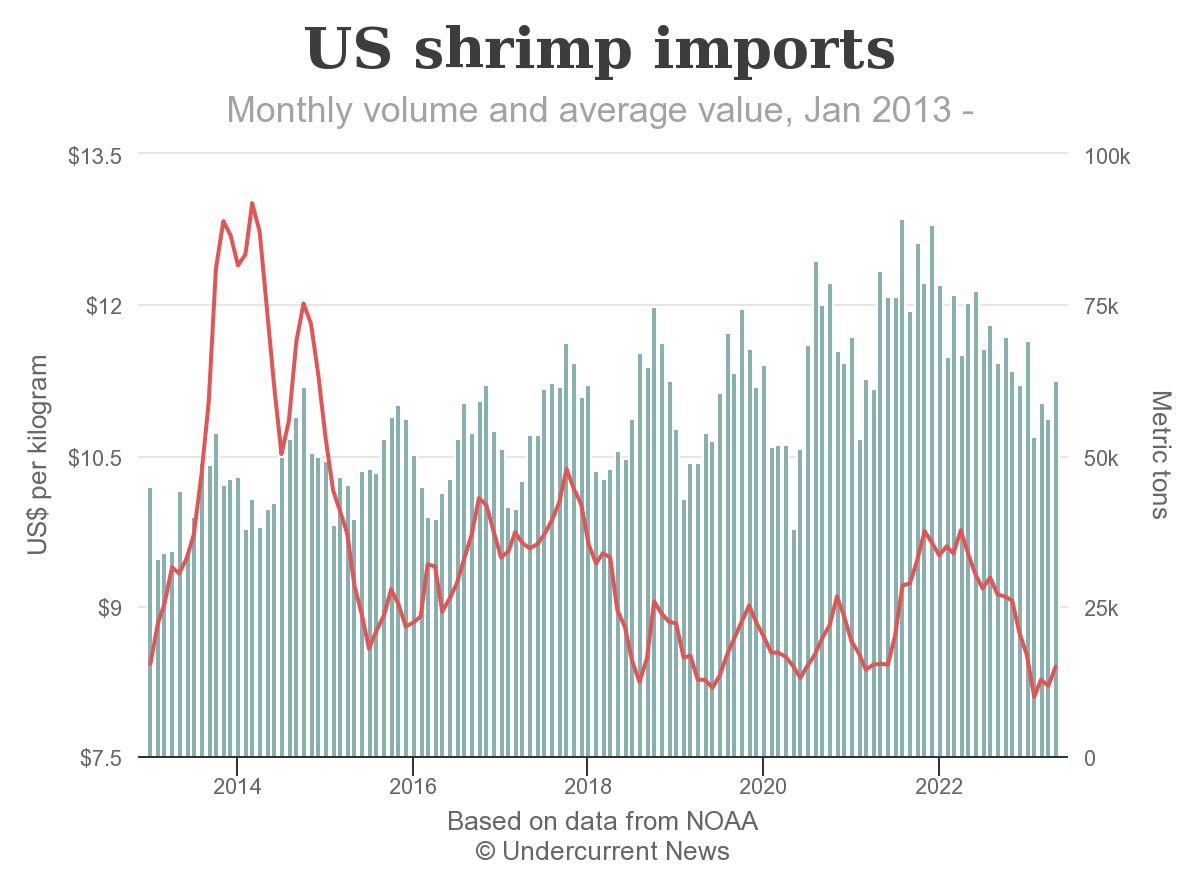

An X, Y chart shows the decline, month to month, since August 2021 when the US imported85,442t of shrimp, the highest mark over the past 10 years.

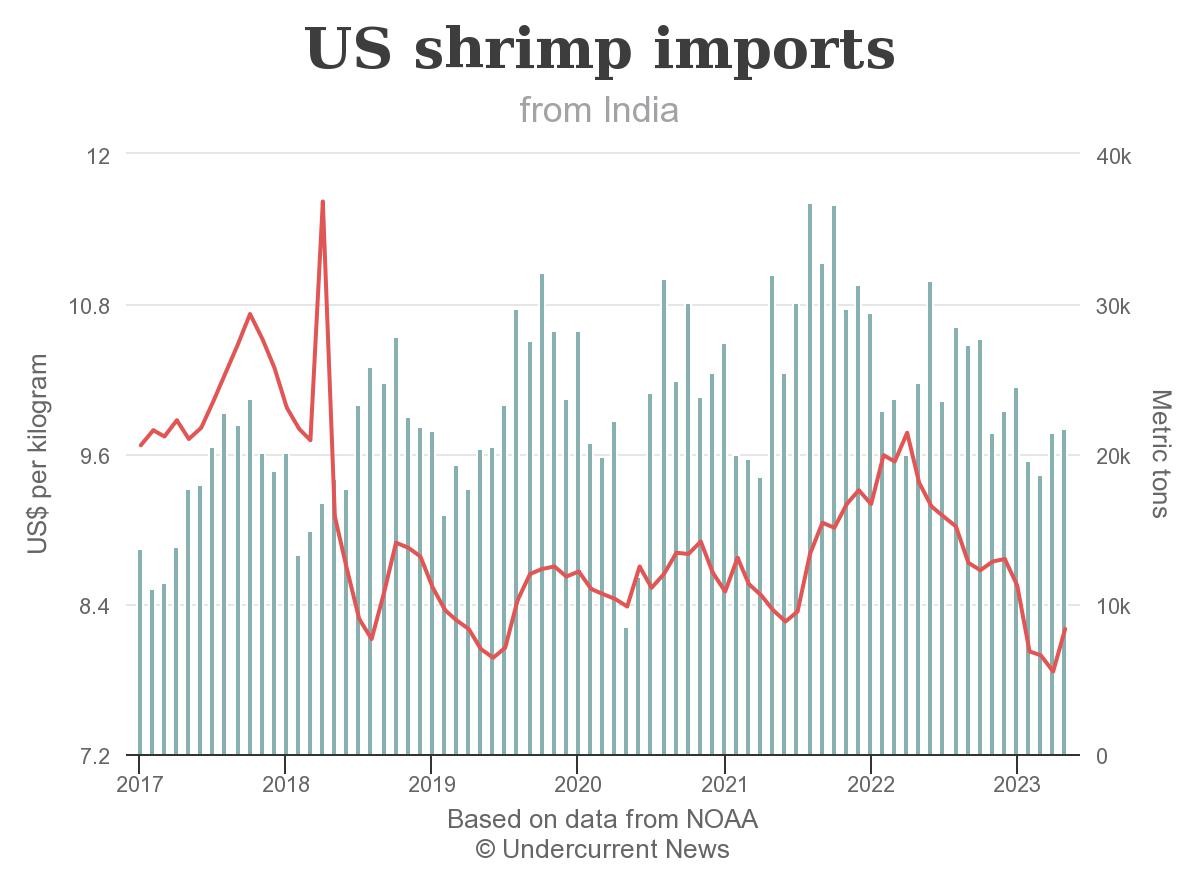

Further production decline ahead for India

India continued its position as the US’ dominant source of shrimp in May, sending it 21,767tworth $178.5m, which gave it 35% of the volume market share and 34% of the value market share. It commanded an average price of $8.20/kg in May, 12% less than the average $9.37/kg it saw a year earlier.

India continues to lose ground, however, sending the US just 105,986t worth $862.8m during the first five months of the year, 12% less volume and 25% less value than the first five months of 2022.

The US is not the only market seeing less Indian shrimp. India exported 719,357t of shrimp between April 2022 and March 2023, the most recently completed financial year for the sector, which is 2% less than the 734,375t exported during the 2021-2022 fiscal year, according to the latest Shrimp Insights blog from Willem van der Pijl.

India’s raw vannamei exports amounted to 560,778t (4% down from 2021-2022) and was responsible for most of the decline. Value-added shrimp amounted to 67,232t, 10% up from2021-2022, and black tiger amounted to 25,750t, 90% up from 2021-2022.

India production will continue to drop. An indication of this was van der Pijl’s later report that broodstock imports by India fell hard during the first five months of 2023. They were down y-o-y by more than 50% in December, 44% in January, 24% in February and 38% in March before rising 8% in April and dropping by 42% in May.

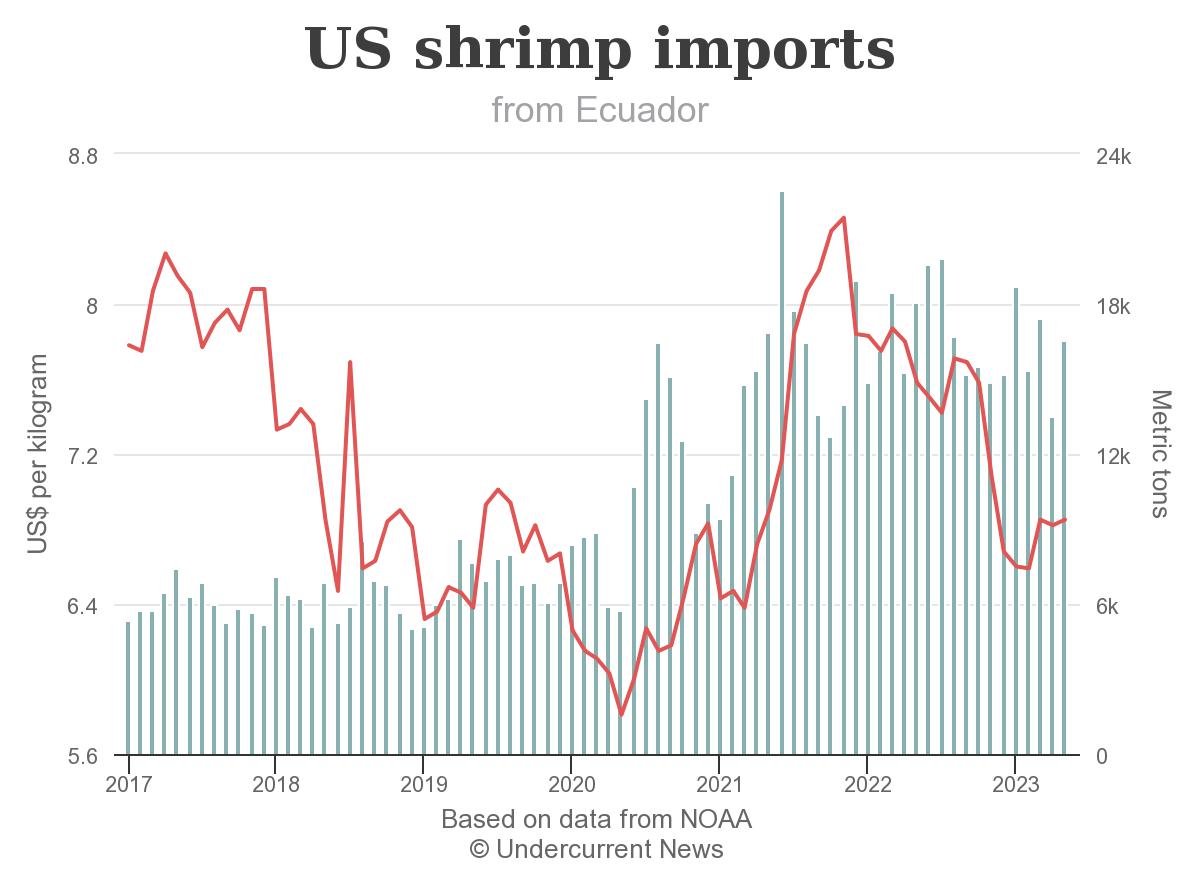

Ecuador still cranking

Ecuador, meanwhile, continued to hold its position as the US’ second-largest shrimp source in May, sending it 16,590t worth $113.7m, giving it a 27% share of the US volume market and a 22% share of the US value market. However, that was 8% less volume and 17% less value than in May 2022.

Ecuador continues to be one of the cheapest sources of shrimp for the US, with imports selling for an average $6.85/kg in May, down 10% from the $7.58/kg price it commanded in May 2022.

Over the first five months of the year, Ecuador sent the US 81,707t of shrimp worth $550.7m, just 1% less volume but 14% less value than the first five months of 2022.

As reported earlier, Ecuador’s shrimp farming sector has been rocked by a series of calamities – an earthquake, El Nino flooding, banditry, and a slowdown in Chinese demand among them.

Still, however, the country continues to produce. The latest Ecuadorian trade data shows the Latin American country exported above 100,000t of shrimp in May, the third time the country has surpassed the milestone, as reported by Undercurrent.

According to Ecuador’s national chamber of aquaculture, or CNA, Ecuador shipped 107,419t of shrimp in May, up 13% compared with May of 2022 and a new monthly record. It means the country’s January-May exports stood at 496,739t, up 19% year-on-year. The value of exports in May was $574m, down by 6% y-o-y, while exports for the January-May period were worth $2.71bn, flat with the same period last year.

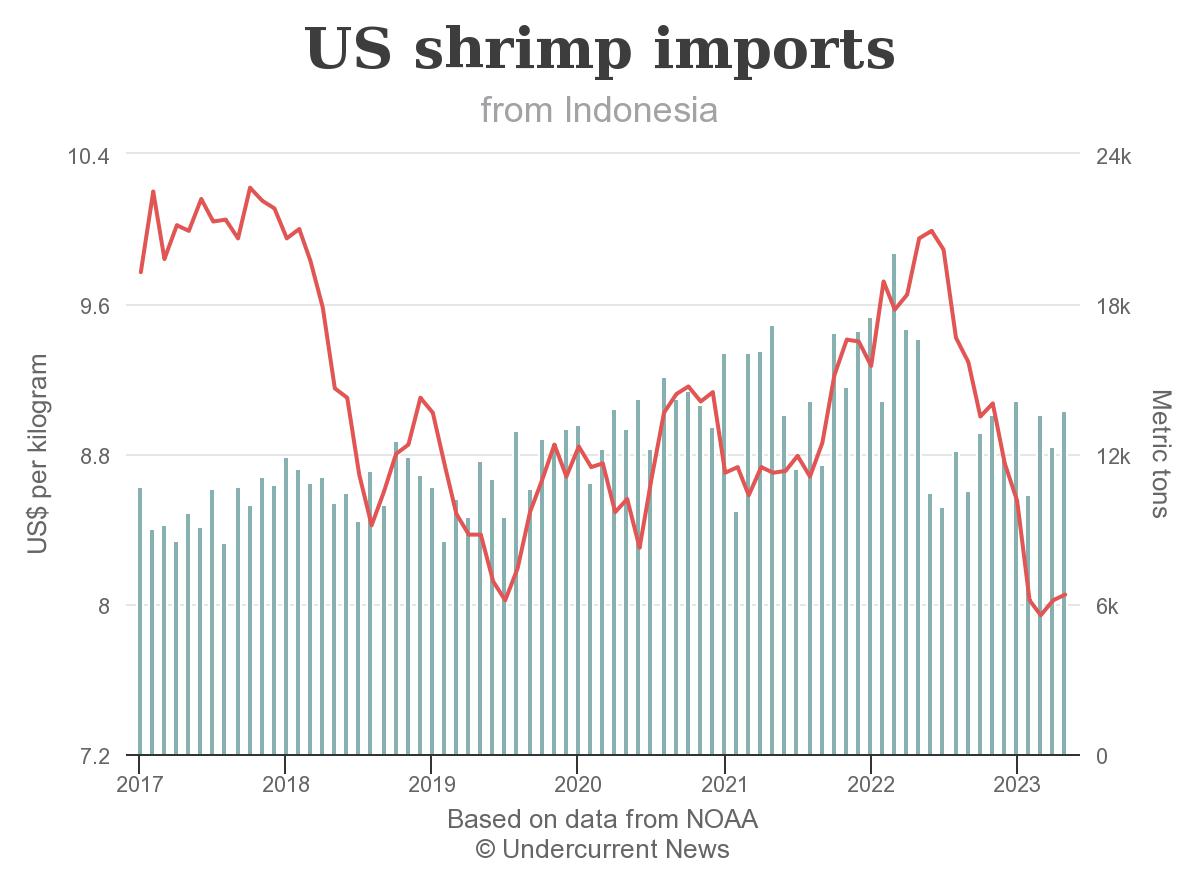

Indonesia losing ground, too

Indonesia also continued to maintain its position as the US’ third-largest source of shrimp in May, sending it 13,793t worth $111.1m, though that was 17% less volume and 33% less value than a year earlier.

Over the first five months, Indonesia has seen even steeper declines. The US imported 64,279t of Indonesian shrimp worth $522.5m between January and May 2023, which was 25% less volume and 36% less value.

Indonesia, which counts on the US for about 68% of its shrimp sales, saw its overall exports drop to 87,638t during the first half of the year, down 19% from the first half of 2022, according to Shrimp Insights. It was the lowest six-month volume for Indonesia since the first half of 2019, when it exported 76,596t.

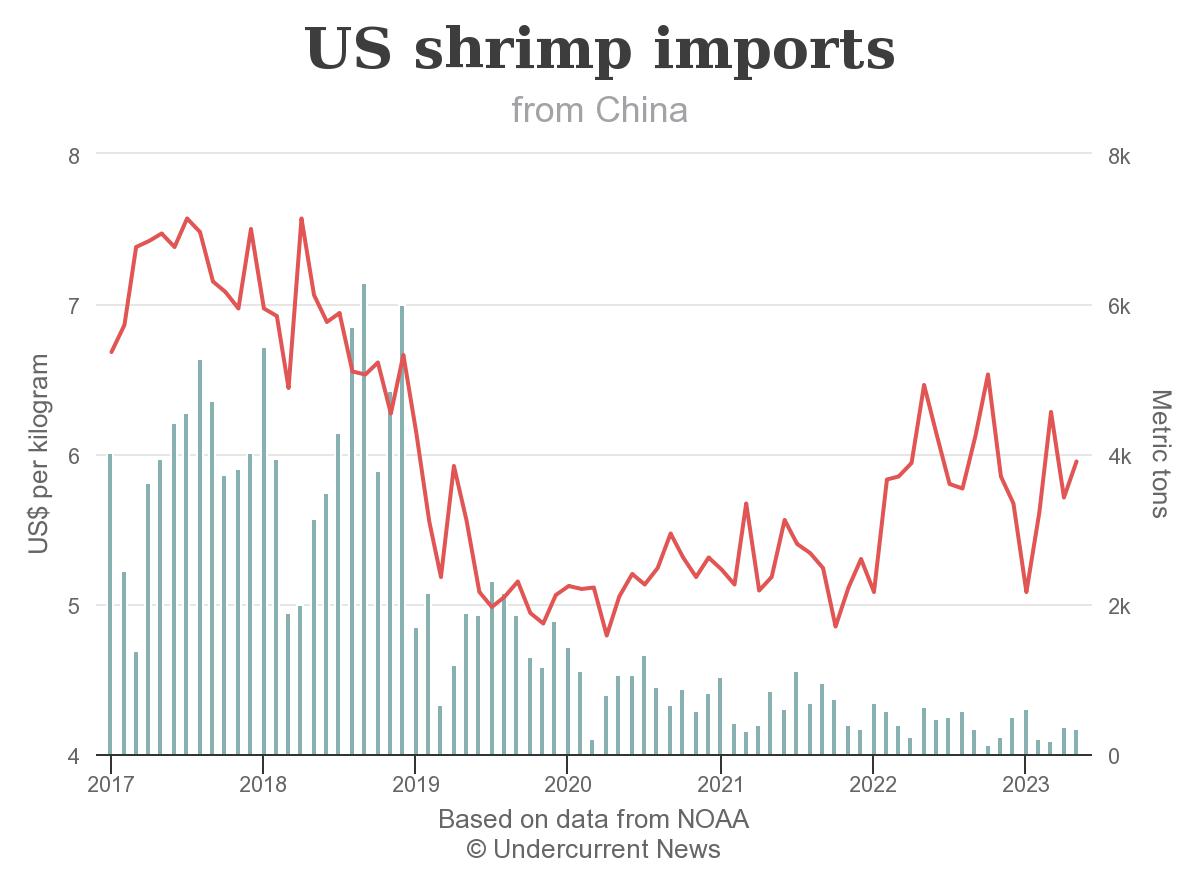

China continues to lose ground as a source of shrimp for the US as well, sending it just 339t worth $2.0m in May, 48% less volume and 52% less value y-o-y. The average price was $5.95/kg, 8% less than in May 2022.

China was once one of the US’ leading sources of shrimp, but its trade war with the US has it now ranked eighth behind Vietnam, Thailand, Mexico and Argentina. The US imported 1,730t of shrimp from China worth $10.0m in the first five months of 2023, 33% less volume and value than the first five months of 2022, also while paying as much as $2.5m in tariffs.

As noted earlier, Mexico was one of the relative bright spots among US shrimp sources in May, sending it 973t, 11% more y-o-y. But Mexican shrimp saw its price drop to $14.22/kg in May,15% below the price paid a year earlier, and — as a result — its imports were worth only$13.8m, 6% less than in May 2022.

The good and bad news about red shrimp

One source country that always commands a look because of the popularity of its famous “red shrimp” in restaurants is Argentina. Too bad for the South American country that it sent the US just 5,552t worth $73.4m in the first five months of 2023,33% less volume and 24% less value.

On the bright side, Argentina shrimp commanded an average $13.21/kg during the first five months, 13% more than during the first five months of 2022.

Red shrimp continues to be Argentina’s most valuable seafood export item, accounting for 34,388t in overall exports worth $239.1m during the first quarter of 2023, up by 32%in volume and 28% in value from the first quarter of 2022, as reported by

Undercurrent. For comparison purposes, consider that Argentina’s fisheries sector exported a total of129,131t of seafood worldwide worth $471.0m during the first quarter.

Sources warn that the Argentinian shrimp market is facing a challenging situation due to weak demand putting downward pressure on prices, while hyperinflation is making operation costs rise.

“There is lots of vannamei stock and low prices. We cannot compete,” one source, whore quested anonymity, recently told Undercurrent. “We will see if Asia activates a bit in August. It does not seem to be a question of price but rather of low consumption,” he said.