US shrimp import pricing ‘pop’ expected after inevitable rebound: Undercurrent News

‘As prices decline and the price of shrimp gets closer to chicken, demand will pop’ — Sea Lion International vice president Donelson Berger

Daniel Hilliard: Undercurrent News

It’s unclear when US shrimp import pricing will finally push off bottom, but the rebound is likely to be significant when it happens, market sources say.

“I would estimate that when purchasing starts, we would be looking at an increase of 7-12% in the near term,” Jim Gulkin, CEO of Thai-based seafood trading firm Siam Canadian Group, told Undercurrent News.

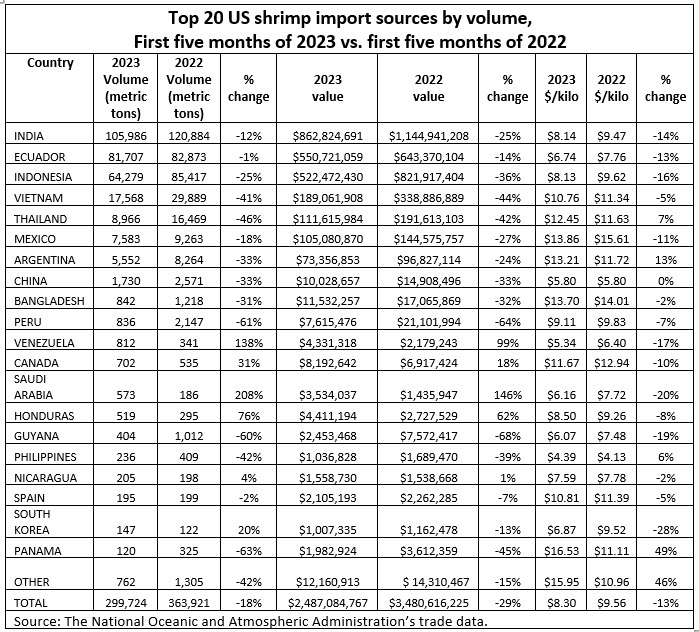

The current trench in shrimp pricing was predicted earlier in the year to end by August. Now, with imports tanking for 11 straight months , it looks like autumn is a more reasonable timeframe. The US imported 62,401 metric tons of shrimp worth $523.6 million in May 2023 — the most recent month for which data is available — amounting to 17% less volume and 12% less value than in May 2022.

“I don’t think we are looking at year-end before purchasing from origin starts again,” Gulkin added. “We have to keep in mind that inventories are aging, a lot having been imported in ’22, so at a certain point, older product has to be moved out one way or the other and then at least to some degree it will have to be replaced — lousy market or not.”

In the latest pricing update from Urner Barry, ex-warehouse prices for shell-on, headless frozen blocks of 16-20 count farmed Asian white shrimp were selling for $4.15-4.25 per pound, while 41-50 count blocks were at $3.35-3.45/lb.

Shrimp prices were thought to have bottomed in May, but at least some buyers are still hoping to snag a last-minute deal before the inevitable rebound, market sources add. The average price in May from all supplying countries and all shrimp products, according to import data, was $8.39 per kilogram ($3.81/lb), 12% below the price that was being paid a year earlier but 2% above the average price reported in April.

“The spin into Q3 and Q4 is that the market has to pick up — there is no question it will, but the magnitude is still in question,” said Urner Barry analyst Angel Rubio. “A 2% increase month-to month doesn’t really mean much because there could be less head-on shrimp relative to peeled, cooked or other value-added products. But the 12% year-over-year is an excellent point to remember and to keep mentioning.”

Sea Lion International vice president Donelson Berger added that the double-digit y-o-y import dip of about 17% in May could be hiding a demand loss of up to 30%.

“While demand is usually the driving factor for the shrimp markets, it is supply that will have the most impact,” he said. “Imports will continue to decline. My guess is that 2023 will see about 670,000t of total imports, the same level as 2017.”

Berger added that a sustained period of low prices only makes a “pop” more likely, as retailers capitalize on the opportunity and inflation-weary buyers look for alternatives.

“As prices decline and the price of shrimp gets closer to chicken, demand will pop,” he said. “It is quite likely that we will see numerous retail ads for shrimp under $5.00/lb in Q4 of this year. That is the shot in the arm we all need.”