Week 24 farm-gate shrimp prices continue to fall in Vietnam, Indonesia: Undercurrent News

Prices also dipped in Ecuador and India, according to price data tracked by Undercurrent News

Louis Harkell and Dan Gibson : UnderCurrent News

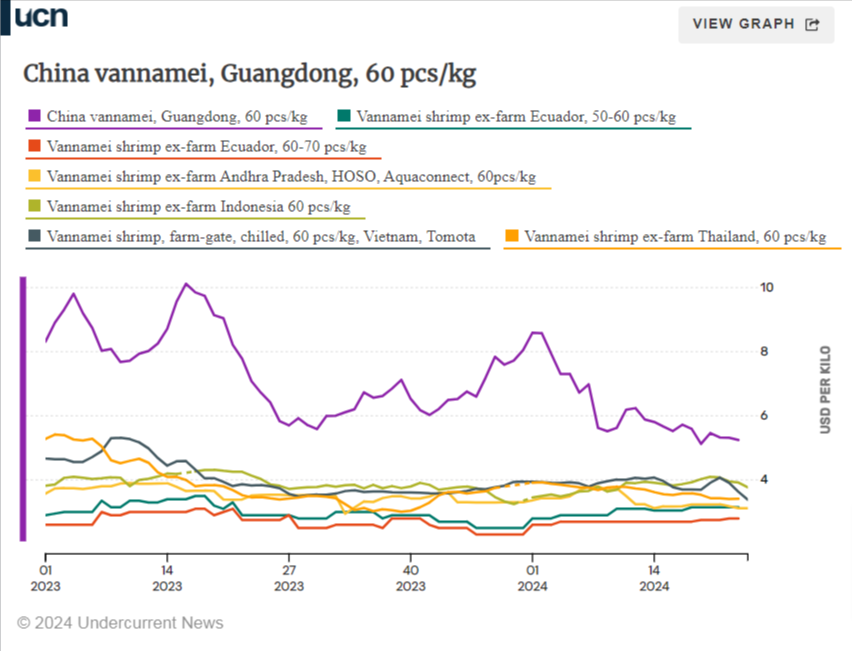

Farm-gate prices for vannamei shrimp continued to fall sharply in Indonesia in week 24 (May 27-June 2) amid high freight rates and US anti-dumping duties, while they remained flat in India and Ecuador, according to price data tracked by Undercurrent News.

The prices are at farm-gate level and reported weekly in major producing countries, in local currencies converted into US dollars. For Ecuador, the sizes used are 50/60 and 60/70, and the currency is dollars anyway.

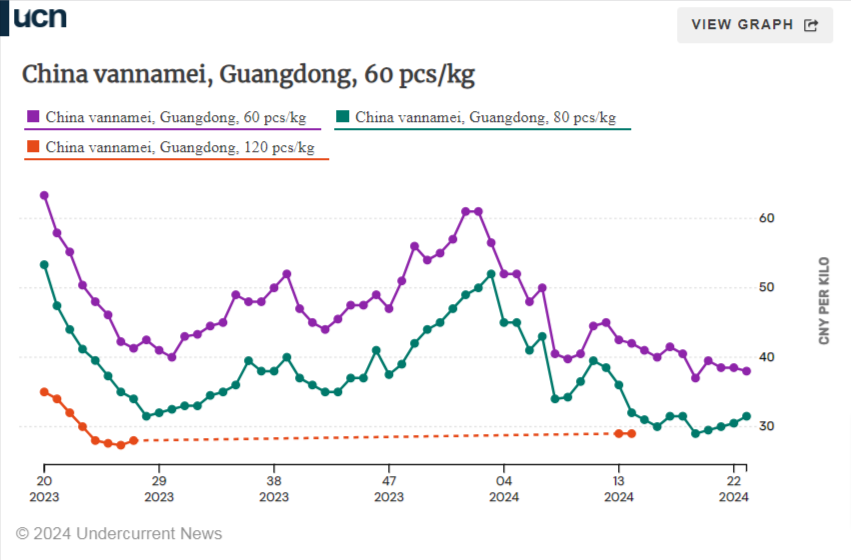

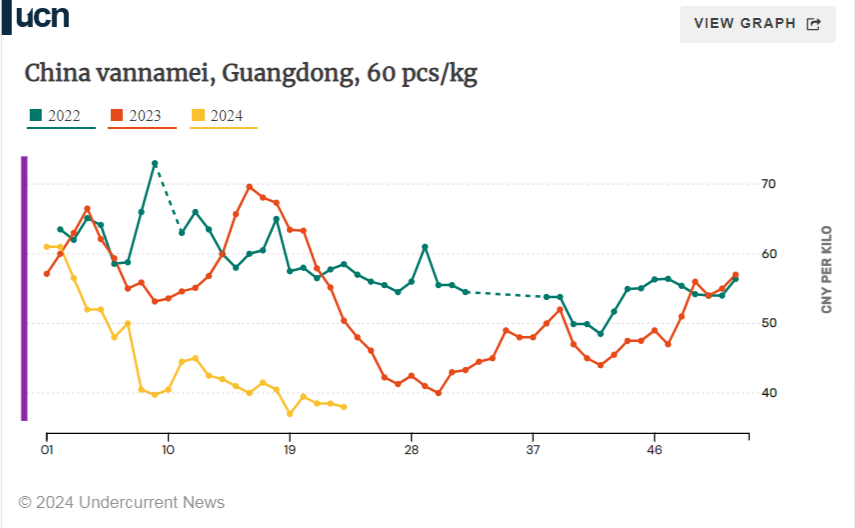

China

In China, amid a seasonal peak in production, prices for live, 60-count per kilogram shrimp slipped back further in week 23 to CNY 30 per kilogram ($4.14/kg) in Guangdong province. For smaller shrimp, 80- counts, prices rose slightly to CNY 31.50/kg. Similar price levels are reported in Jiangsu, Fujian and Hainan provinces.

Amid the flatlining prices, Chinese industry media reports many producers are operating at a loss. However, low prices look set to continue through to the end of the summer months with even higher production volumes expected in June and July.

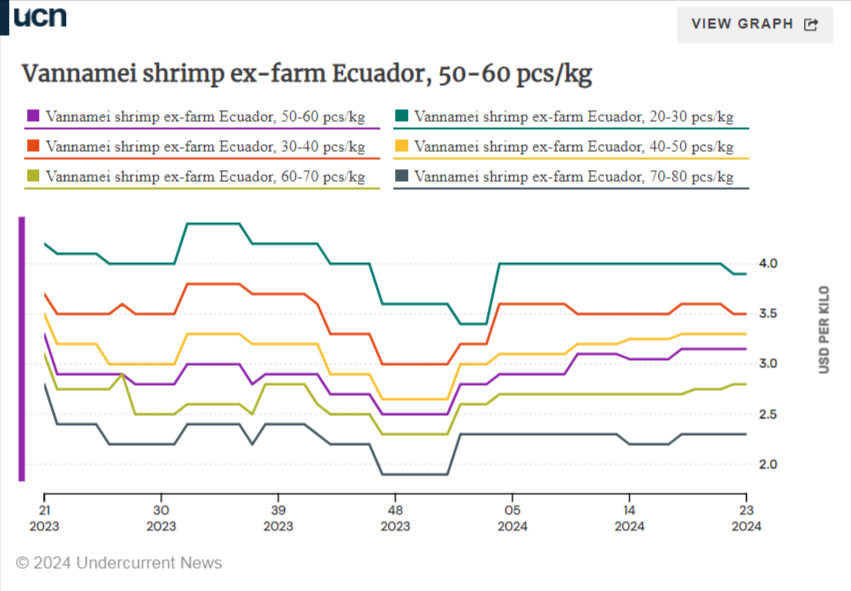

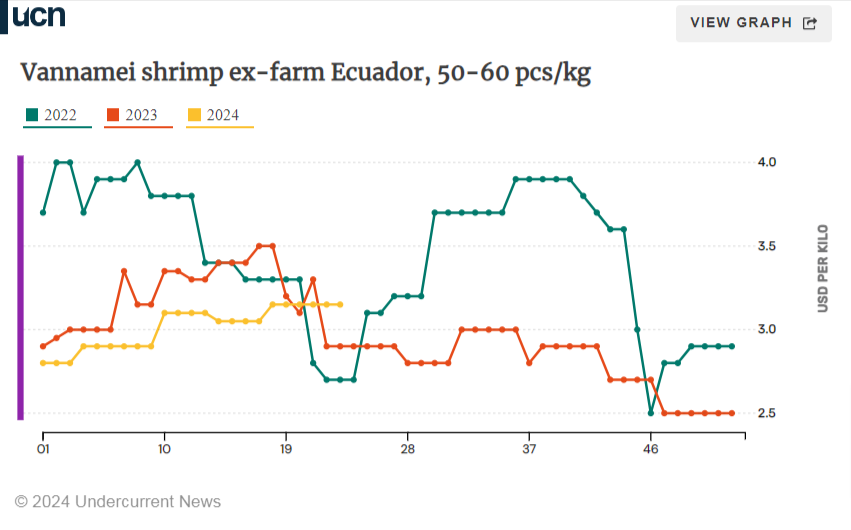

Ecuador

In Ecuador, the world’s largest shrimp exporter, average ex-farm prices for head-on, shell-on (HOSO) shrimp remained flat at $3.90/kg for 20/30 counts and $3.50/kg for 30/40 counts. The prices for 40/50,50/60, 60/70, 70/80 and 80/100-count shrimp, however, continued mostly flat week-on-week.

Ecuador’s shrimp exports unexpectedly hit a record 111,684 metric tons after shipments fell in the first quarter. The jump followed strong April harvests, as reported by Undercurrent.

However, trade flows were snagged by US countervailing duty rates. In April, the US imported just 9,881t of frozen warmwater shrimp from Ecuador, less than half (45%) of the 21,754t imported the month before, based on National Oceanic and Atmospheric Administration data

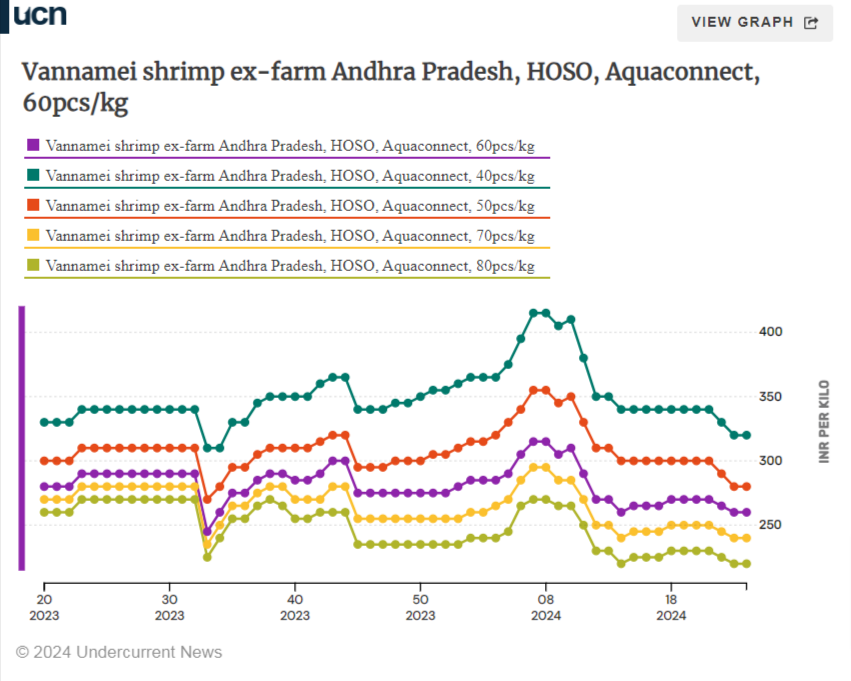

India

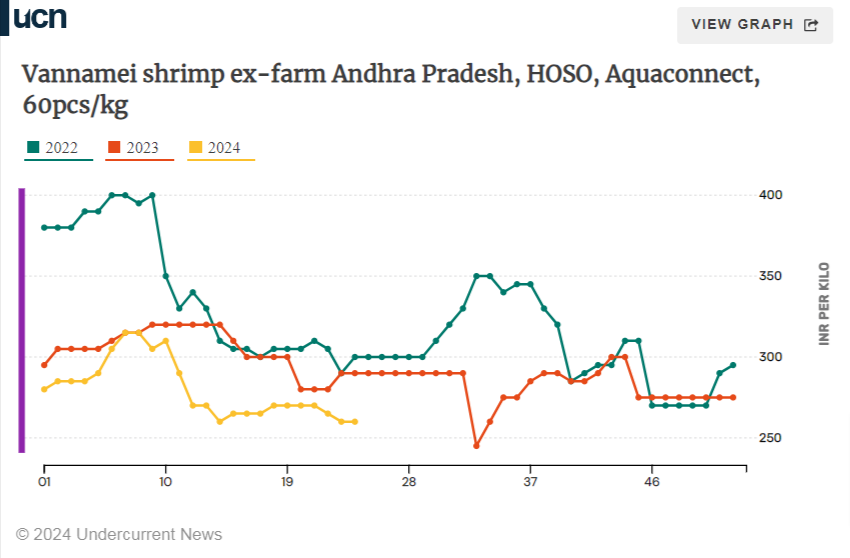

In week 24, prices slipped back across all sizes in India, the top supplier nation to the US.

In the main farming state of Andhra Pradesh, prices for 60-count HOSO shrimp fell to INR 265/kg ($3.18/kg); INR 290/kg for 50- counts; and INR 330/kg for 40-counts, according to the latest data from provider Aquaconnect. For smaller sizes, prices slipped to INR 245/kg for 70-counts and INR 225/kg for 80-counts.

Prices for smallest-sized shrimp — 100-count per kilogram — remain significantly lower than year-ago levels, down 13% compared with the same week of 2023. However, prices for larger sizes remain stable year-on-year.

According to Sheraz Anwar, director of exporter Abad Group, general supply on the market has improved in the last month.

“[However], packers are not willing to pay higher prices as export markets are not picking up,” he told Undercurrent.

Another source with a major shrimp packer, who preferred to remain anonymous, told Undercurrent that he does not believe the drop will last.

“It’s only for a couple of weeks now that we saw some reduction, and we think in a month or so they will start going higher,” he said. “Some extra harvests are happening, but the season is almost over — maybe another four to six weeks.”

Indonesia

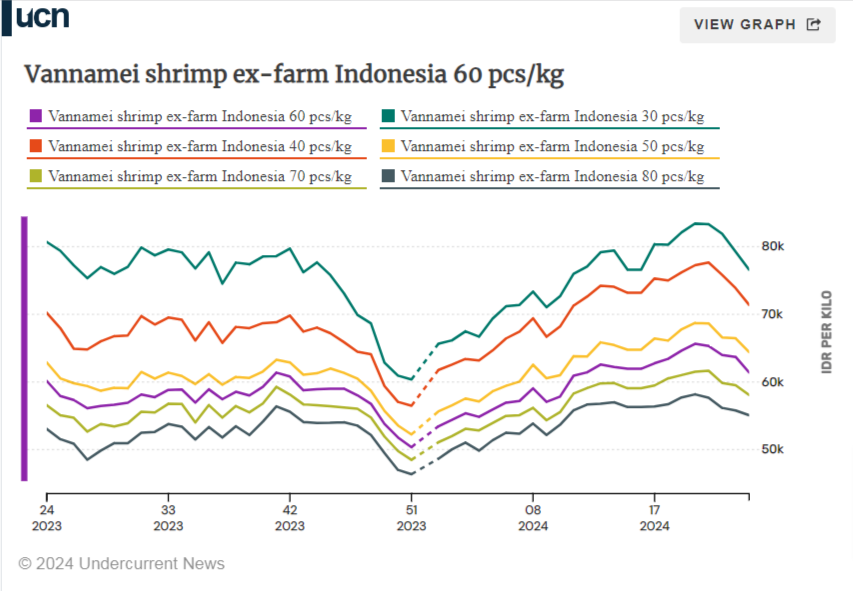

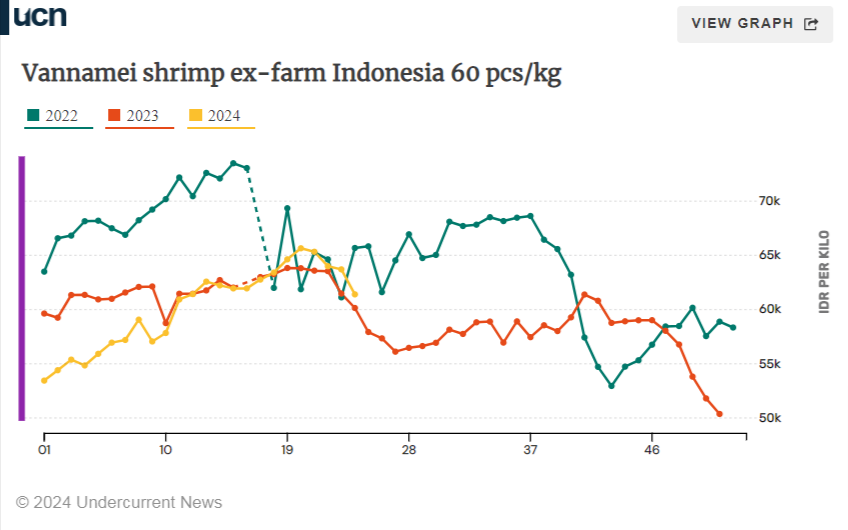

Meanwhile, Indonesian shrimp prices are also dropping further across all sizes in week 24.

According to the data received as part of a partnership with the Indonesian firm Jala Tech, average vannamei farm-gate prices across the country fell again to IDR 76,200/kg for 30-counts and IDR 70,800/kg for 40-count shrimp.

Prices for 50-, 60- and 70-counts also dropped to IDR 63,900/kg, IDR 60,900/kg and IDR 57,700/kg, as did prices for 80-, 90- and 100- counts to IDR 54,800/kg, IDR 51,900/kg and IDR 49,700/kg.

“Indonesia raw material prices have moved down as packers there try to push prices down in the wake of new anti-dumping duties,” said Jim Gulkin, managing director of Siam Canadian Group.

Vietnam

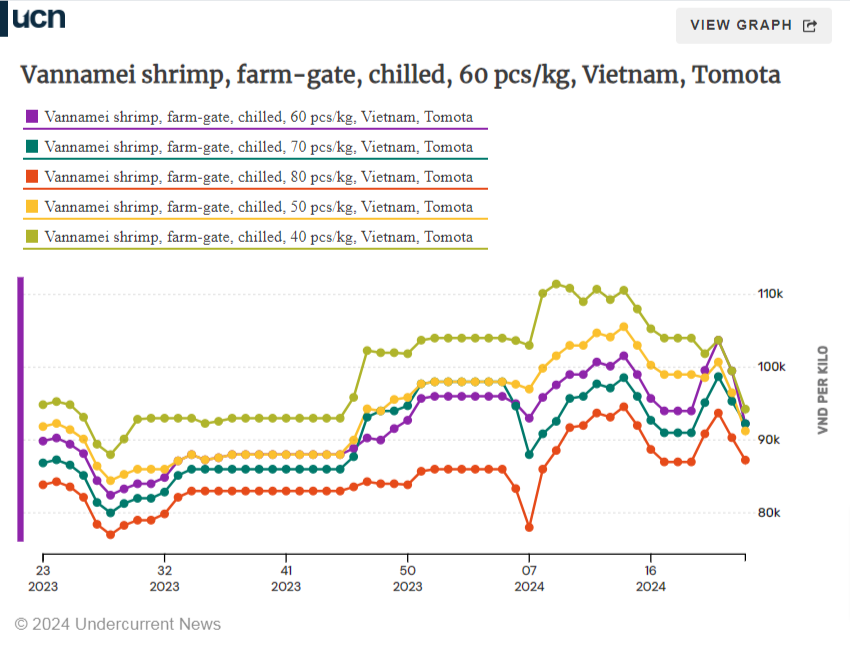

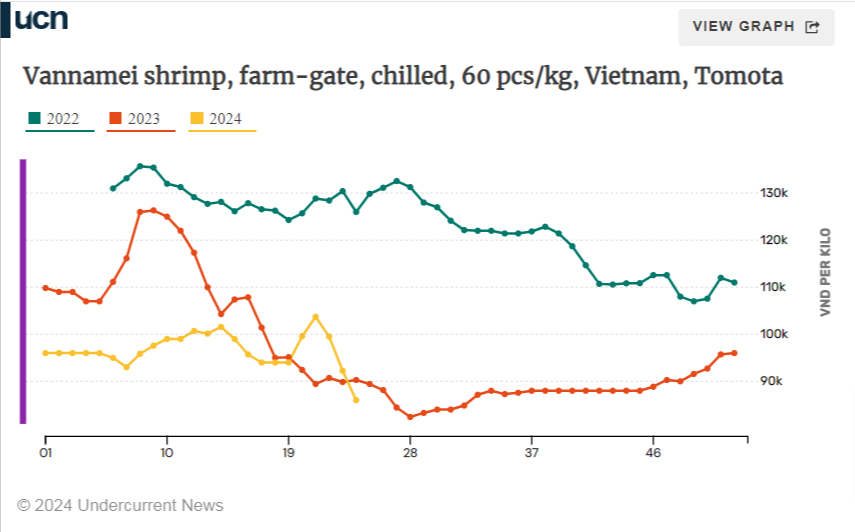

Following in the wake of Indonesia prices, those in Vietnam are also following a downward trend.

Farm-gate prices for chilled vannamei shrimp have fallen sharply in the past couple of weeks, down to VND 92,300/kg ($3.63/kg), a drop of over VND 10,000/kg in two weeks. Prices fell by similar amounts across all sizes.

Industry sources report a slowdown in purchases by shrimp processors, who are still getting through orders for the second quarter of the year. Supply chains are also gummed up by a hike in freight rates and lack of containers, as tensions in the Red Sea force container ships to re-route around Africa.

“It is difficult to deliver goods and negotiate new contracts. This will probably lead to a reduction in the demand for raw shrimp,” said a source last week.

Thailand

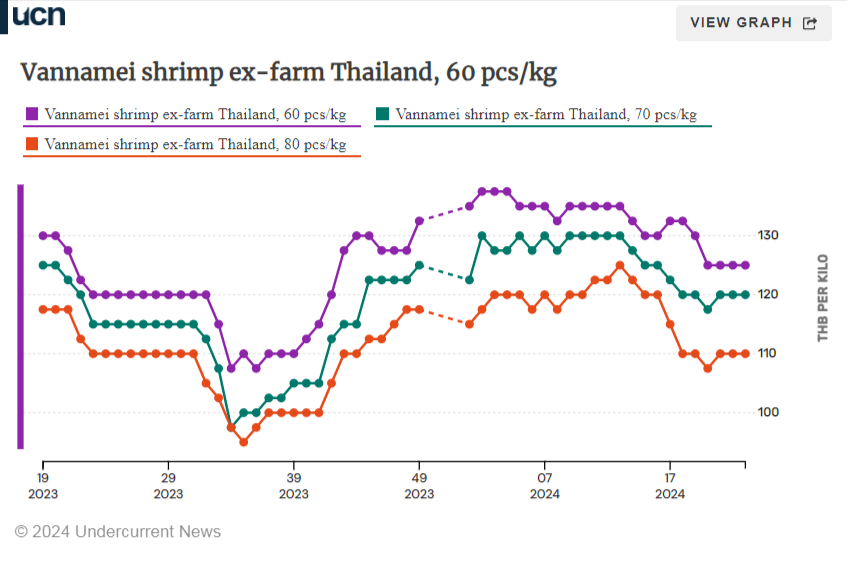

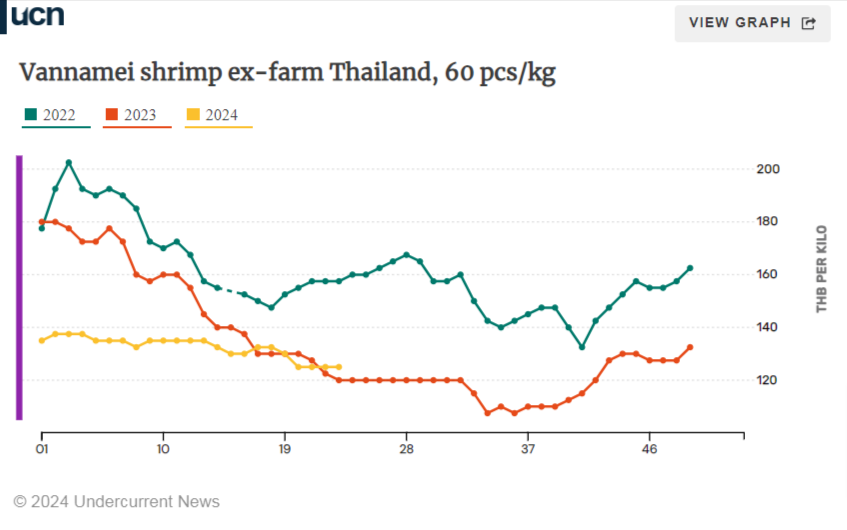

Finally, ex-farm prices for head-on, shell-on vannamei shrimp in Thailand were flat during week 22, having risen on 70- and 80-count in week 21.

Week 22 prices for 70- and 80-count shrimp were THB 120/kg and THB 110/kg, with 80-count stable at THB 125/kg, data shows. In dollars, prices are $3.43/kg for 60-count, $3.29/kg for 70-count and $3.02/kg for 80-count.

“Thailand’s shrimp production is quite okay this year, but demand is low as it is still difficult to compete with other origins, so raw material prices are mostly stable,” said Gulkin.